Belarus’ leading supermarket chain Eurotorg (aka Euroopt) signed off on a RUB3.5bn ($52.7mn) syndicated loan facility agreement with a consortium of banks, the company said in a statement on August 28.

The syndicated loan consists of two tranches: a three-year RUB0.5bn and a five-year RUB3bn. The structure of the transaction makes it possible for additional lenders to join the facility.

Andrei Zubkou, CEO of Eurotorg, said: “We are pleased to announce that Eurotorg has closed its second successful Russian capital markets deal in 3Q19. This transaction marks an important step in diversification of our financing sources and optimising the company's debt profile. The proceeds will be used for refinancing purposes and will extend Eurotorg’s debt maturity profile.”

Gazprombank and MKB Bank acted as the mandated lead arrangers and lenders. Gazprombank also acted as documentation agent.

As bne IntelliNews reported Belarus is seeing the emergence of a middle class that is driving retail development. Eurotorg has set up as a modern organised retail supermarket chain to capitalise on the growth of the retail business.

Eurotorg reported strong 2018 results in April that will bolster its chance of getting a mooted IPO away this year after postponing an attempt last year. Zubkou, commenting on the company’s results, said: “2018 was a year of successful growth for Eurotorg. We set a new record for store openings, with 362 net new stores during the period, and continued to focus primarily on developing smaller-format stores in leased premises, in line with our capex-light expansion strategy." The company’s revenue was up by 15.3% y/y and reached BYN4.5bn ($2.1bn), while revenue in dollar terms was up 9.4% y/y and net retail sales were up 8.6% in dollar terms and equal to $2bn.

Ivan Dun, vice president and head of the syndicated and international financing department of Gazprombank, said: “This is the first syndicated loan for a private corporate borrower in Belarus, so signing the agreement is a landmark event both for the company and for the Belarusian market as a whole. The bank is already cooperating with Eurotorg and arranged the issue of the company's ruble bonds in July 2019. Attracting long-term unsecured financing underscores Eurotorg’s strong standing as a reputable, high-quality borrower with a robust strategy, efficient business model and significant potential for future growth.”

The outlook for Belarusian retail is good as the country emerges from several years of instability and the ministry of finance follows a policy of paying down debt and ensuring the stability of the currency. However, the economy remains exposed to external shocks, primarily in its energy relations with Russia which is changing the way it taxes oil exports via Belarus that will hurt the budget over the coming years. Just how painful these changes will be remains a matter of debate, but tax changes will be phased in and the government is in the process of restructuring the economy to cope with the changes.

The syndicated loan follows on from Eurotorg’s debut RUB-denominated bond offering on July 9. The company placed RUB5bn of five-year unsecured bonds with a coupon of 10.95% and will be listed on Moscow Exchange (MOEX).

Alexander Kaznacheev, deputy chairman of the management board of MKB Bank, said: “MKB Bank is actively working with companies from countries belonging to the Eurasian Economic Union, and offers various forms of financing based on the current needs of each client. In this case, a deal involving MKB will help the company to optimise its debt portfolio. The bank has been working with Eurotorg for a long time. Previously we provided the company with working capital loan, and acted as an organiser of the Company’s bonds issue. Eurotorg is currently one of the best borrowers in Belarus and a leader in the food retail segment. We are highly interested in continuing our cooperation.”

News

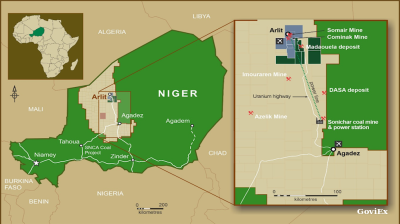

GoviEx, Niger extend arbitration pause on Madaouela uranium project valued at $376mn

Madaouela is among the world’s largest uranium resources, with measured and indicated resources of 100mn pounds of U₃O₈ and a post-tax net present value of $376mn at a uranium price of $80 per pound.

Brazil’s Supreme Court jails Bolsonaro for 27 years over coup plot

Brazil’s Supreme Court has sentenced former president Jair Bolsonaro to 27 years and three months in prison after convicting him of attempting to overturn the result of the country’s 2022 election.

Iran cleric says disputed islands belong to Tehran, not UAE

Iran's Friday prayer leader reaffirms claim to disputed UAE islands whilst warning against Hezbollah disarmament as threat to Islamic world security.

Kremlin puts Russia-Ukraine ceasefire talks on hold

\Negotiation channels between Russia and Ukraine remain formally open but the Kremlin has put talks on hold, as prospects for renewed diplomatic engagement appear remote. Presidential spokesman Dmitry Peskov said on September 12, Vedomosti reports.

_0_1757608964.jpg)