Brazil is taking a leading role in efforts to reduce the BRICS economic bloc's dependence on the US dollar, championing the use of national currencies in trade among member states.

The initiative, which aims to reshape how BRICS nations conduct international trade, is expected to gain momentum during Brazil's upcoming chairmanship of the group in 2025. But it faces complex challenges within the expanded bloc.

The Kazan summit next week will be the first to include new members Egypt, the United Arab Emirates, Ethiopia, Iran, and Saudi Arabia alongside founding members Brazil, Russia, India, China, and South Africa. This expansion has introduced new dynamics and potential obstacles to the de-dollarisation efforts.

Eduardo Paes Saboia, Brazil's Foreign Affairs Secretary for Asia and the Pacific, highlighted his country's stance, stating that the issue of reducing reliance on the US dollar "has already been considered at meetings of finance ministers and heads of central banks" of BRICS nations.

Brazilian President Luiz Inácio Lula da Silva has long been a vocal advocate for creating alternatives to the US dollar. At the 2023 BRICS summit in South Africa, Lula stressed the need to reduce vulnerabilities of member states tied to dollar dominance.

In a similar vein, former president Dilma Rousseff, chief of the Shanghai-based New Development Bank, revealed the lender intended to "use national currencies for investing in the private sector of the economies of member states."

The initiative aligns with recent statements from other BRICS officials. Russian Foreign Minister Sergey Lavrov bullishly said in September that a report on options for creating alternative payment platforms for settlements between member countries would be prepared for the Kazan summit.

However, Brazil's broader position is more nuanced. Sources within the government indicate that while the country supports exploring alternatives, implementation must be carefully considered. The approach is described as pragmatic, balancing ambition with economic realities, and walking a tightrope not to damage important ties with the West.

Meanwhile, BRICS faces internal divisions. India and China's ongoing border disputes have led to India rejecting the use of Chinese currency in bilateral transactions. Adding to this, Chinese banks have grown wary of providing yuan liquidity to their Russian counterparts since early 2024, reportedly scaling back assets in the country amid fears of US secondary sanctions stemming from Moscow's invasion of Ukraine.

The rifts extend to the bloc's hopeful members: Brazil’s own animosity against Venezuelan President Nicolas Maduro in the wake of his disputed re-election and Saudi Arabia's apparent reluctance to fully engage with BRICS, evidenced by its decision to send only its foreign minister to the Kazan summit, do not bode well for a smooth expansion this year.

As Brazil gears up to steer the BRICS agenda, its careful push for de-dollarisation is shaping up to be more than just an economic initiative. It represents a critical test of the country's diplomatic prowess and its ability to shape the future of global finance beyond the Global South.

News

Fuel prices in Kyrgyzstan rocket as Ukraine steps up drone strikes on Russian refineries

Central Asian country relies on Russia for nine-tenths of its fuel.

El Salvador leads Latin America's democratic decline, global watchdog warns

The latest IDEA report warns El Salvador faces the fastest democratic erosion in Latin America, with security policies under Bukele raising concerns over freedoms, judicial independence, and long-term institutional damage.

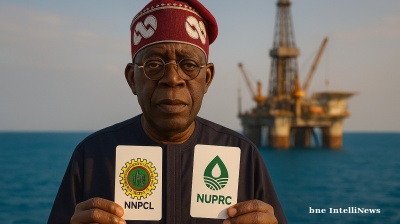

Nigerian president advances oil bill placing NNPCL under control of Finance Ministry, upstream regulator

President Bola Tinubu has endorsed a bill that would undermine the "independence" of NNPCL, shifting ownership to the Finance Ministry and handing new powers to upstream regulator NUPRC.

‘Tinder Swindler’ Simon Leviev detained in Georgia on Interpol red notice

Shimon Yehuda Hayut gained worldwide notoriety thanks to the 2022 Netflix documentary 'The Tinder Swindler', which detailed how he allegedly posed as the son of billionaire diamond tycoon to scam women he met on Tinder.

_1758026150.jpg)