Romania’s fob/cif trade deficit widened by 18.1% y/y to €3.6bn in Q3, thus returning to the sharp speed of deterioration that was interrupted by a more moderate development in Q2, the foreign trade data released by the statistics office revealed.

The advance in exports weakened while imports strengthened in Q3.

In the 12 months ending September, the exports increased by 9.1% y/y, not far from the 9.2% y/y advance seen in 2017. Imports advanced by 10.4% y/y compared to the 12.2% y/y advance in 2017, but this was not enough to keep the trade gap from widening: under fob/cif metrics it deepened by 17% y/y to €14bn while under fob/fob standards it hit €10.7bn (20% up y/y, over 5% of GDP).

The external balance improved temporarily in September, when the trade gap narrowed by 5.4% y/y to €971mn, but it is still premature to conclude that softer private consumption has already surfaced and significantly shifted the external balance. In the coming quarters, this might be the case as households’ incomes and consumer confidence are likely to deteriorate unless the government takes extreme steps to strengthen incomes (as the European Commission’s recently revealed Autumn Forecast implies).

The quarter’s performance was dragged down by the deep deficits in July-August when imports advanced faster than exports. Overall, both exports and imports are rising at slower rates compared to previous quarters but the export performance (the gap between the annual rise of exports and imports respectively) returned to negative territory after a short-lived improvement in Q2.

| Foreign Trade ( €mn ) | 2007 | 2008 | 2014 | 2015 | 2016 | 2017 | Q1 18 | Q2 18 | Q3 18 | 12M Sep-18 |

| FOB Exports | 29,380 | 33,725 | 52,460 | 54,609 | 57,392 | 62,644 | 16,988 | 16,988 | 16,872 | 66,893 |

| 13.7% | 14.8% | 5.8% | 4.1% | 5.1% | 9.2% | 9.8% | 10.2% | 7.4% | 9.1% | |

| CIF Imports | 50,883 | 57,240 | 58,508 | 62,970 | 67,364 | 75,604 | 19,710 | 20,580 | 20,509 | 80,904 |

| 24.9% | 12.5% | 5.9% | 7.6% | 7.0% | 12.2% | 10.9% | 8.7% | 9.2% | 10.4% | |

| FOB Imports* | 46,966 | 52,834 | 56,096 | 60,373 | 64,587 | 72,487 | 18,898 | 19,731 | 19,664 | 77,568 |

| FOB/CIF Balance | -21,502 | -23,516 | -6,049 | -8,360 | -9,972 | -12,960 | -2,722 | -3,591 | -3,637 | -14,011 |

| Balance y/y | 44.4% | 9.4% | 6.0% | 38.2% | 19.3% | 30.0% | 18.4% | 2.0% | 18.1% | 17.3% |

| FOB/FOB Balance* | -17,585 | -19,109 | -3,637 | -5,764 | -7,195 | -9,843 | -1,910 | -2,743 | -2,791 | -10,676 |

| Balance y/y | 49.6% | 8.7% | 6.1% | 58.5% | 24.8% | 36.8% | 21.9% | 0.1% | 21.1% | 19.7% |

| Source: INS, BNR, *estimates |

Data

Chobani yoghurt king Hamdi Ulukaya becomes richest Turk

Knocks Murat Ulker into second place in Forbes ranking as his company's valuation leaps to $20bn.

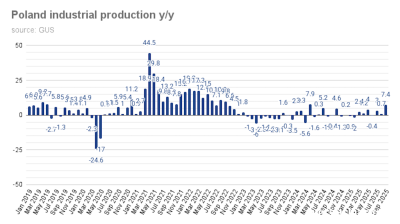

Poland’s industrial production jumps 7.4% y/y in September

September saw an unexpectedly sharp increase in industrial production after the surprise gain of 0.7% y/y in August.

Ukrainian M&A market grows 22% despite war, driven by local investors

Two large acquisitions by agriculture holding MHP and mobile operator Kyivstar accounted for more than half of the total deal value.

Ukraine’s credibility crisis: corruption perception still haunts economic recovery

Despite an active reform narrative and growing international engagement, corruption remains the biggest drag on Ukraine’s economic credibility, according to a survey by the Kyiv International Institute of Sociology.