Tajikistan, Turkey and Myanmar are three of the world’s few major producers of antimony that look set to benefit from a boom in prices for the much-sought-after mineral, used in bullets, lead-acid batteries, fire retardants and photovoltaic (PV) cells.

Dominant producer China has decided to restrict exports of antimony from September 15 on the basis of national security. Analysts expect the move will drive up the price of the commodity to new records. Antimony prices were at the end of last week already trading at all-time highs exceeding $22,000/tonne, approximately double what was seen at the start of the year.

As bne IntelliNews reported in June 2022, Tajikistan’s role as a substantial supplier of antimony, a shiny grey metalloid, sprung to the attention of the US Congress as lawmakers looked at potential critical mineral vulnerabilities in defence stockpiles.

China accounts for towards 50% of global antimony supplies. It supplied 83,000 tonnes of the critical mineral last year, according to the US Geological Survey (USGS).

Tajikistan, home to a great variety of untouched but often difficult-to-dig deposits of critical raw materials (CRM), supplied 21,000 tonnes of antimony last year, while Turkey shipped 6,000 tonnes and Myanmar 4,600 tonnes, USGS data also showed. Russia produced 4,300 tonnes of antimony in 2023, but Ukraine war sanctions and the fact of the conflict itself meant this was earmarked for domestic consumption.

Reuters reported consultancy Project Blue as assessing the antimony deficit in the market at 10,000 tonnes in May and as saying that European refineries of antimony trioxide have increased supply from Tajikistan, Vietnam and Myanmar to diversify from the Chinese feed, while India increased antimony ingot supplies to the US.

"The prospects of a small but antimony-rich country, Tajikistan, look good now," Alexey Kabanov, CEO at Swiss-based trading firm Voyager Group, told the news service.

Other critical minerals the West relies on China for include rare earths, gallium and germanium, exports of which Beijing has restricted since last year, Reuters noted.

It also reported analysts’ suggestions that once a new export licensing process for antimony kicks in, shipments of Chinese antimony might pick up once again following an initial decline brought about by the tightened restrictions.

News

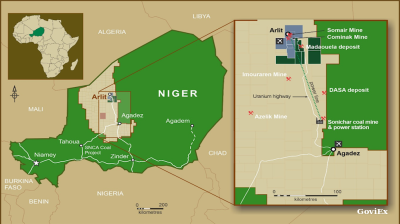

GoviEx, Niger extend arbitration pause on Madaouela uranium project valued at $376mn

Madaouela is among the world’s largest uranium resources, with measured and indicated resources of 100mn pounds of U₃O₈ and a post-tax net present value of $376mn at a uranium price of $80 per pound.

Brazil’s Supreme Court jails Bolsonaro for 27 years over coup plot

Brazil’s Supreme Court has sentenced former president Jair Bolsonaro to 27 years and three months in prison after convicting him of attempting to overturn the result of the country’s 2022 election.

Iran cleric says disputed islands belong to Tehran, not UAE

Iran's Friday prayer leader reaffirms claim to disputed UAE islands whilst warning against Hezbollah disarmament as threat to Islamic world security.

Kremlin puts Russia-Ukraine ceasefire talks on hold

\Negotiation channels between Russia and Ukraine remain formally open but the Kremlin has put talks on hold, as prospects for renewed diplomatic engagement appear remote. Presidential spokesman Dmitry Peskov said on September 12, Vedomosti reports.