Serbia was one of the best performers in the entire emerging Europe region in 2020, with its economy contracting by a mere 1% during the pandemic year, in stark contrast to some of its neighbours. The economy is now on track for rapid growth this year — provided the latest wave of the pandemic doesn’t prove to be too much of a setback.

In the depths of the crisis in Q2 of last year, Serbia’s economy contracted by only 6.3%. By the first quarter of 2021, the economy returned to year-on-year growth. Serbia’s real GDP growth in the second quarter was 13.7%, exceeding the flash estimate of 13.4%.

The reasons behind this are a combination of the structure of its economy and Serbia’s fiscal strength at the start of the pandemic that allowed it to offer a series of big stimulus packages.

Five years before the crisis, back in February 2015, Serbia embarked on a fiscal consolidation programme with the support of the International Monetary Fund (IMF). In 2017, the country reported its first consolidated budget surplus since 2005 after significantly improving its public finances. By the end of the precautionary €1.2bn three-year IMF stand by arrangement (SBA), Serbia had significantly outperformed the targets. There followed two years of growth of over 4%, rising as high as 5.2% y/y in 1Q21.

“Serbia has coped relatively well with the COVID-19 pandemic. The hard-won macroeconomic stability that was achieved prior to the crisis, and the large policy support package that was deployed as the crisis hit, helped mitigate the adverse impact of the pandemic on economic activity. Nonetheless, with the uncertain future course of the pandemic, sustaining a solid economic recovery should be a policy priority,” commented Tao Zhang, deputy managing director and acting chair of the IMF, in June, at the conclusion of the latest Article IV consultation with Serbia.

Secondly, in contrast to some of its tourism-dependent neighbours like Croatia and Montenegro, which suffered some of the deepest recessions in emerging Europe, Serbia has a diversified economy, with a relatively large industrial sector.

The European Bank for Reconstruction and Development (EBRD) wrote in its latest Regional Economic Prospects report: “The effects of the COVID-19 pandemic on the economy were moderate in 2020. The structure of the economy — limited reliance on tourism and a relatively high share of basic goods such as food and some chemicals in manufacturing — combined with large government aid packages and less restrictive lockdown measures for most of the year, contributed to a GDP contraction of only 1%.”

Finally, while Serbia introduced a strict initial lockdown last spring, this lifted earlier than in most European countries to prepare for the June 2020 general election, allowing the economy to return to normal by the beginning of the summer.

Fiscal stimulus

Serbia provided the Western Balkans region’s biggest stimulus packages since the start of the crisis, and continued to do so in 2021. Stimulus measures in 2020 amounted to close to 13% of GDP, including fiscal revenue and spending measures of 8% of GDP. The successive packages announced during 2020 included wage subsidies, cash transfers, support for the healthcare sector, tax deferrals and liquidity support to small and medium sized enterprises through credit guarantee schemes.

This pushed Serbia’s estimated 2020 fiscal deficit to a record 8.1% of GDP. Meanwhile, public debt increased by around 5 percentage points (pp) in 2020, to reach 58% of GDP at year-end, according to the EBRD. However, this figure is well below the debt levels in other regional economies such as Albania, Croatia and Montenegro.

“Serbia’s fiscal consolidation efforts in recent years meant that it entered the COVID-19 crisis in a strong fiscal position that allowed it to implement a large support program. The large stimulus package introduced early on helped to limit the negative impact of the crisis on growth,” commented the World Bank in a regional report earlier this year.

Belgrade adopted a supplementary budget for 2021 in April, in which it increased capital expenditure and extended policy support to households and companies.

“Expansionary fiscal policy is continuing as the government has adopted additional fiscal stimulus measures to the tune of 4.5% of GDP (€2.0bn) for 2021, consisting of increased expenditures in healthcare, wage subsidies and one-off payments to pensioners and some adults. The budget for 2021 also includes a significant increase in public investment,” according to the EBRD.

The IMF has urged Serbia to rebuild policy buffers once the recovery gains momentum. Spending isn’t expected to be reined in until well into 2022, however, as Serbia will hold both general and presidential elections in the spring.

Unemployment

The World Bank calculates that in 2020 around 69,900 jobs were lost in the Western Balkans; 144,000 jobs disappeared during the initial strict lockdowns in Q2 2020 — most of them in tourism, and concentrated in Albania and Montenegro — but almost half were later recovered. Other sectors with heavy (temporary) job losses were construction, manufacturing, trade and transport.

Serbia escaped lightly, thanks to the economic stimulus from the government and — after the initial lockdown — less stringent pandemic restrictions, as well as the structure of its economy. Unemployment reached a record low of 9% in 2020, although youth unemployment had risen to 32.4% by the end of the year. Despite the low unemployment figures, however, the World Bank points out to a rise in inactivity, with some unemployed people temporarily giving up their job searches, while others retired or moved abroad to work. Now, as the initial impact of the 2020 stimulus programmes wanes, unemployment is creeping back up.

On the other hand, according to the World Bank the ICT industry weathered the crisis well and became an important employer in Serbia, while public sector employment grew. This had the effect of "cushioning the pandemic’s impact but increasing the size of the already relatively large public sector in the Western Balkans.”

Future growth

Growth in Q1 2021 of 1.7% y/y was “underpinned by a strong recovery in the construction sector, but also by growth of industrial output and an increase in trade, transport and tourism activities,” the EBRD said. Y/y growth then accelerated sharply in Q2 as Serbia recovered from the low base the same time last year.

In June 2021, turnover in industry in Serbia increased by 31.8%, compared with June 2020, and by 32.9% relative to the 2020 average, the statistics office said.

Retail trade in Serbia increased by 24.2% y/y in the second quarter of 2020, according to the Statistical Office of the Republic of Serbia. There was also a 20.4% jump compared to the previous quarter.

Growth forecasts for Serbia this year are around the 6% mark. In mid-August, the National Bank of Serbia (NBS) raised its projection for the country’s GDP growth this year to 6.5%, from the 6% it projected in May. Serbian Prime Minister Ana Brnabic told Prva TV in June that Serbia will end 2021 with the “best economic results in Europe”, forecasting the country's economic growth could be as high as 7%.

The IMF is somewhat more pessimistic, expecting growth of around 6%, but it warned of high uncertainty about the path of the COVID-19 pandemic, and the need for accelerated structural and institutional reforms to ensure inclusive and sustainable growth in the medium term.

The IMF is somewhat more pessimistic, expecting growth of around 6%, but it warned of high uncertainty about the path of the COVID-19 pandemic, and the need for accelerated structural and institutional reforms to ensure inclusive and sustainable growth in the medium term.

Fitch Ratings has revised upwards its 2021 growth forecast to 6.3%, citing the strong rebound in domestic demand in 1H21. “There has been a fast Covid-19 vaccination rollout, at 86 doses per 100 people, but recent progress has stalled due to vaccination scepticism, and the potential for economic restrictions to contain a new wave represents a risk to our forecast,” the rating agency said in September.

Looking further ahead, the World Bank says: “Over the medium term the economy is expected to grow steadily at 3.5-4% annually, similar to levels before the pandemic, as the economies of main trading and investment partners recover fully from the pandemic.”

The IMF forecasts that in the medium-term growth will gradually converge to its potential of 4%. This will be “supported by strong FDI, continued high public investment, and an assumed recovery in trading partner countries”, the fund said.

Fitch anticipates GDP growth will moderate to 4.4% in 2022 and 3.9% in 2023. The rating agency says the forecast is “slightly above our assessment of the trend rate, which is constrained by unfavourable demographics and weak total factor productivity growth”.

The NBS has revised the medium-term economic growth projection from 4% to the range of 4-5% — again more optimistic than the international financial institutions — a move it said was based on an analysis of planned capital projects in road, railway, energy and utility infrastructure in the next ten years and their direct and indirect effects on other parts of the economy. The bank’s central projection for GDP growth over the medium term now stands at 4.5%, while overall risks to the projection are judged to be symmetric.

The IMF argues that further structural and institutional reforms are needed in Serbia. This would underpin high, inclusive, and greener growth, as well as accelerate income convergence with the EU. On top of this, developing the local capital market would support medium-term growth.

One politically sensitive issue that Belgrade has been trying to tackle for some time is the reform — and potential privatisation — of state-owned enterprises (SOEs). As they are some of the country’s major employers, this has happened in fits and starts. The IMF stressed the importance of strengthening the governance and management of SOEs and implementing structural reforms.

The World Bank noted a deterioration in the performance of some state-owned enterprises such as Telekom Srbija and Air Serbia — the latter being hit particularly hard by the coronacrisis — on top of other SOEs that were already financially troubled.

Inflation

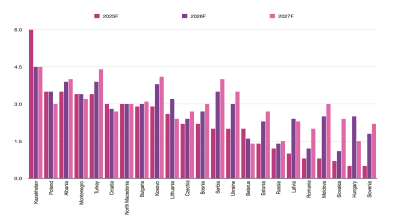

Inflation is rising as in other emerging Europe economies. Annual inflation in August in Serbia was 4.3%, nearly triple the low of 1.1% in January.

At its latest rate-setting meeting in August, the NBS kept the key policy rate at 1.0%. The central bank noted that inflation has moved around the target midpoint (3±1.5%) since April. As in other countries in the region, higher y/y inflation relative to the previous quarter is mainly attributable to the low base for petroleum product prices from the same period last year, as well as to the higher cost-push pressures fuelled by the surge in the global prices of oil and other primary commodities in the previous months, the NBS stated.

However, many people believe that Serbia’s real inflation rate is higher than the official statistics show due to the increase in the price of foodstuffs, as reported by the eKapija portal.

The NBS’ gross foreign exchange (FX) reserves stood at €14,580.3mn at end-July, and rose further to a record €15.6bn at the end of August due primarily to the inflow from the new general SDR allocation by the IMF to its members, of which Serbia received SDR627.6mn equivalent (€759.4mn) on August 31.

NBS gross FX reserves. Source: NBS.

Coronavirus

The main downside risk for this year’s growth is the evolution of the pandemic. Serbia is currently in the midst of its fifth wave of infections, with daily new cases topping the 5,000 mark in early September.

Daily new coronavirus cases in Serbia. Source: WHO Europe

Serbia was the first country in the Western Balkans to start vaccinating its own population, having secured vaccines from multiple sources, and has also distributed vaccines to several of its neighbours. It has already started producing the Russian Sputnik-V vaccine, and on September 9 started building a factory to produce the Chinese Sinopharm vaccine — it is set to become the first European country to produce the two vaccines.

However, within Serbia vaccination rates tailed off after the initial wave of enthusiasm and the government has been struggling to motivate people to get vaccinated against a high level of scepticism and apathy.

Vaccination rates in Southeast Europe. Source: Our World In Data

Features

US denies negotiating with China over Taiwan, as Beijing presses for reunification

Marco Rubio, the US Secretary of State, told reporters that the administration of Donald Trump is not contemplating any agreement that would compromise Taiwan’s status.

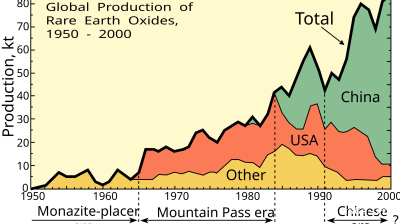

Asian economies weigh their options amid fears of over-reliance on Chinese rare-earths

Just how control over these critical minerals plays out will be a long fought battle lasting decades, and one that will increasingly define Asia’s industrial future.

BEYOND THE BOSPORUS: Espionage claims thrown at Imamoglu mean relief at dismissal of CHP court case is short-lived

Wife of Erdogan opponent mocks regime, saying it is also alleged that her husband “set Rome on fire”. Demands investigation.

Turkmenistan’s TAPI gas pipeline takes off

Turkmenistan's 1,800km TAPI gas pipeline breaks ground after 30 years with first 14km completed into Afghanistan, aiming to deliver 33bcm annually to Pakistan and India by 2027 despite geopolitical hurdles.