Foreign direct investment (FDI) inflows to countries in Central, Eastern and Southeast Europe fell by 58% year-on-year in the first half of 2020, as the coronavirus (COVID-19) pandemic and lockdown curbed economic activity, according to a report from the Vienna Institute for International Economic Studies (wiiw) released in December.

The decline was steeper than the 49% global fall, though less severe than the 75% decline in FDI in developed economies, the annual wiiw FDI Report showed. However, there were substantial variations in how severely the impact of the pandemic was on FDI across the CEE region and the negative FDI inflows to Russia dragged down the result for the region. In the eastern EU members, FDI fell by just 35% and the fall was as small as 8% in the Western Balkans. Meanwhile, a decline of around 40% was recorded in both the Commonwealth of Independent States (CIS) — excluding Russia — as well as in Ukraine and Turkey.

wiiw economists forecast that FDI inflows should return to pre-COVID levels in about two years. Both CEE’s EU members and parts of the Western Balkans could benefit from near-shoring of production by major Western multinationals, as they re-think their supply chains.

“Over the long run technological change — especially in the automotive industry — will change the structure of value chains and may see Western investors return investments from Eastern Europe to their home markets,” says the report.

They warn, however, that “the takeover of domestic-oriented sectors by national capital and economic nationalism may reduce foreign investment in Eastern Europe”.

By segment, wiiw reports that the capital pledged in greenfield investment projects across the region fell by 23%, less than the global decline. “Low commitments in greenfield investments continued also in the third quarter and amounted to 41% lower in the first three quarters of 2020 than in the previous year,” said the report. “However, the bulk of the decline in capital commitments in [Central, Southeast and Eastern Europe] CESEE can be attributed to Russia and Kazakhstan as a response to low international oil prices.”

Within the region, the eastern EU members did particularly well, seeing a fall in the number of greenfield investment projects of only 21%, while the investment value dropped by 16% in the first three quarters of 2020. Despite the adverse circumstances, four countries — Czechia, Latvia, Poland and Slovenia — “all received higher amounts of investment commitment than a year earlier, indicating the steady commitment of investors, especially in the real estate sector”, the report said.

Manufacturing was more vulnerable to the recession than other sectors, but investment continued in the automotive industry — an important component of the Central European economies — which is “under pressure to reduce the burden on the climate and to introduce profound technological changes, even while suffering a drop in demand during the COVID-19 crisis”, said wiiw. “The main current challenges to the automotive industry include the rise of electric cars, CO2 fleet emission targets, autonomous and connected driving.”

The industry accounted for as much as 38% of manufacturing production in Slovakia, 28% in the Czech Republic, 26% in Hungary and 23% in Romania.

News

Grand master mason arrested as part of Turkey’s Can Holding investigation

Second wave of detentions executed.

Istanbul prosecutors summon Koc official and Akfen boss in Imamoglu investigation

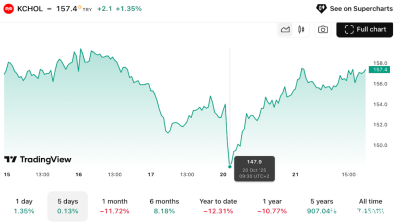

Word of move sparked volatility in stocks.

Ukrainian military strike for first time disrupts operations of Western oil majors

Drone attack damage caused to Russian gas processing plant forces scaling back of output at Kazakh field partly owned by Chevron, Shell and Eni.

_Foto2_Divulgação_Foresea_(1)_1761062969.jpg)

Petrobras secures controversial Amazon drilling licence ahead of COP30 climate summit

Brazil's Petrobras has obtained authorisation to drill an exploratory well near the mouth of the Amazon River, sparking fierce criticism from conservationists just weeks before Brazil hosts UN climate talks.

_1761050969.jpg)