The Hungarian Economic Development Ministry has threatened the country's banks that unless they show they will increase lending it will impose a higher windfall tax on the sector.

The ministry said it currently does not plan to increase financial levies on banks but it gave one week for the Hungarian Banking Association to present an action plan on restoring lending. The government expects the sector to play a stronger role in preventing the credit market from freezing up and restoring healthy lending and growth, according to a statement issued after minister Marton Nagy held talks with banking executives in his office.

The government expects the financial sector to actively participate in interest-subsidised public loan schemes and to boost housing and market loans.

Due to surging borrowing costs, market-based lending has plunged 40-60% in 2023 and only subsidised loans, accounting for roughly half of housing and corporate outlays, are lending support to the credit market.

The minister said the banking sector is making extra profits, which would justify higher levies, but the economy needs these funds more than the budget, he added.

His comments suggest that the government is relinquishing plans to impose additional burdens on banks, if there were any intentions in the first place.

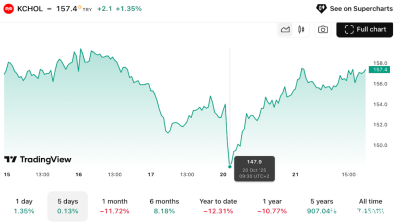

Finance Minister Mihaly Varga’s announcement last week sent shockwaves in the industry when he alluded to increasing the windfall tax on banks, as the government is scrambling to boost revenues and cut expenditures to address the budget shortfall. Initially, the government vowed to halve windfall taxes contingent on lenders boosting their holdings in government bonds.

Varga’s words were quickly refuted by the Fidesz faction a few hours later and Marton Nagy a day later. The spar between ministers has unveiled big tensions within the government over how to tackle the ballooning deficit.

The government has clearly abandoned the 3.9% deficit target, the question is to what extent the final figures will surpass the threshold. Speaking at the forum of economists last week, Nagy made it clear that sticking to the original deficit trajectory would sacrifice growth. Instead, he committed to ensuring that the budget gap remains below the 6.2% level recorded last year, but did not specify a figure.

The Banking Association replied in a subdued tone, saying that recovering from the economic recession is in the interest of all actors. They called for the acceleration of the de-cashing and digital switchover to meet the financial and economic challenges of the coming period.

As to the financial burdens facing banks, they stressed that the audited net profit of the banking sector as a percentage of equity (return on equity) fell to 7.3% in 2022 from 8.7% in 2021.

News

Afghanistan withdraws from Pakistan tri-nation T20 to protest murder of three local cricketers

The Afghanistan Cricket Board says it has secured clear video footage implicating the Pakistan state in an attack that killed three local cricketers.

Sanae Takaichi makes history as Japan’s first female prime minister

In her first press briefing as leader, the 64-year-old pledged to drive reform with confidence and determination, describing her administration as one “ready to decide and move forward.”

Grand master mason arrested as part of Turkey’s Can Holding investigation

Second wave of detentions executed.

Istanbul prosecutors summon Koc official and Akfen boss in Imamoglu investigation

Word of move sparked volatility in stocks.