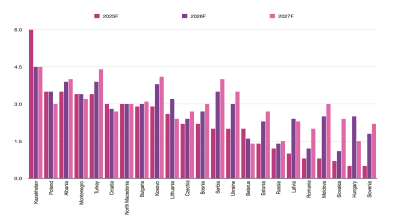

IIF analysis shows Kazakhstan’s economy faces bumps in the road – but no major obstacles as things stand

Delays in expanding the giant Tengiz oil field and moderation in private consumption are expected to push down the growth of Central Asia’s largest economy, Kazakhstan, to 3.5% this year from an estimated 5.1% last year, according to the Institute of International Finance (IIF).

The expansion of Tengiz, located in wetlands along northeastern shores of the Caspian Sea, is now scheduled to be finalised in 2025, versus an initial timeline of 2H22, according to a note compiled by IIF economists Ivan Burgara and Garbis Iradian.

Kazakhstan’s hydrocarbon output is forecast to only move up a modest 0.6% this year, primarily due to the Tengiz delay, with the authorities estimating oil production (including gas condensates) will reach 90mn tonnes, level with 2023 production.

Last year’s Kazakhstan GDP growth was driven by construction and manufacturing on the production side and private consumption on the expenditure side, Burgara and Iradian say in their analysis, adding: “Agriculture was a drag on growth due to a poor summer harvest. [And] unlike some of its regional neighbors, Kazakhstan has not largely benefited from the migration of Russian skilled labor or relocation of Russian firms caused by the war in Ukraine, rather growth has been driven by robust domestic public and private consumption.

“We expect this demand to moderate slightly this year, though it will continue to be supported by scheduled minimum wage hikes and pension indexation that will feed consumption, leading to non-hydrocarbon growth coming in at 3.8% in 2024.”

Returning to hydrocarbons, oil and natural gas production in Kazakhstan have stagnated in recent years. The country is burdened by a reliance on ageing oil fields and limited export options—the worrying reality is that around 80% of all oil exported from Kazakhstan still makes its way on to export markets via Russia’s Novorossijsk oil shipment terminal on the Black Sea coast, which it reaches through a pipeline run by the Caspian Pipeline Consortium (CPC).

As the analysts note: “Kazakhstan remains highly vulnerable to a potential Russia shutdown of the CPC. Regardless of whether such a shutdown happens because of a direct confrontation between Kazakhstan and Russia or because of the latter’s retaliation against the West [in relation to the Ukraine conflict], with 80% of all Kazakh oil exports running through the CPC, the effects could be dire.”

For Kazakhstan, the expansion of Tengiz and the diversification of export routes have to be top priorities.

Looking at monetary matters, Burgara and Iradian say the country’s tight monetary stance will this year be maintained.

Consumer price inflation declined substantially from a peak of 20.7% in January 2023 to 9.1% in March, still well above the central bank target of 5%.

“The sharp fall in inflation is attributed to tight monetary policy, lower commodity prices, and the strong performance of the Tenge. Nevertheless, inflation is forecasted to remain elevated in 2024, averaging 9% for the year,” say the IFI economists.

They add: “Month-over-month inflation remains volatile but has grown at an average pace of 0.8% over the last 6 months. Energy and utility tariff hikes, high trading partner inflation (most notably in Russia), minimum wage hikes, and the removal of price caps on food staples will all put upward pressure on inflation in the coming months. In recent communications the National Bank of Kazakhstan (NBK) has stated its concern for these developments, and we therefore expect monetary policy to remain tight for the remainder of the year.

“However, political pressures may yet prove to have a sway on the NBK, as witnessed by the recent 50bps rate cut in February.”

Weighing up prospects for the current account, Burgara and Iradian expect the deficit to narrow from the estimated 2023 shortfall amounting to an estimated 3.4% of GDP. Lower oil prices affected exports last year, which fell 7% y/y. At the same time, strong domestic demand and currency appreciation led to a near 18% y/y increase in imports.

“For 2024 we expect some of these developments to revert and forecast the deficit narrowing to 2.7% of GDP,” Burgara and Iradian advise.

They point out: “On the export side, higher oil prices will be supportive of hydrocarbon exports, a recovery in agriculture will boost wheat production, and higher base metal prices, most notably copper, will further bolster non-hydrocarbon exports.

“On the import side, moderating demand and currency stability will lead to a small fall from 2023 levels. The deficit will primarily be financed by FDI, as GCC [Gulf Cooperation Council] countries invest in exploration and extraction projects as well as renewable energy facilities (Kazakhstan has the goal to raise the share of renewable energy from 6% in 2023 to 15% in 2030), the authorities continue to attract FDI for infrastructure, and as Kazakhstan begins to expand its critical mineral production.

“Consequently, we expect Kazakhstan’s gradual reserve accumulation to continue.”

On the fiscal side, the analysts anticipate that the consolidated budget will this year slip to a deficit of 0.2% of GDP from a surplus of 0.6% in 2023. They see total revenues rising 10% y/y, with higher tax revenue from oil production providing a revenue injection.

Astana was working on plans to implement a VAT tax hike from 12% to 16%, but this will not go ahead, hurting revenues. The VAT increase was meant to compensate for lower transfers from the sovereign wealth fund over the medium term.

The state budget, say Burgara and Iradian, is set for a 2024 expenditure increase of 15% y/y. The state is facing a higher wage bill caused by a minimum wage raise that will affect 350,000 civil servants and higher social spending, in line with President Kassym-Jomart Tokayev’s social welfare agenda.

On the bright side, debt-to-GDP is expected to remain low and stable, at approximately 22% of GDP. There is a positive debt outlook over the medium term, with risks to the outlook prepared for the IIF by the economists balanced.

Providing an insight on trade, Burgara and Iradian observe: “Kazakhstan, like the rest of the region, has also pushed to diversify away from Russia. Currently, the EU is the country’s single biggest trading bloc while China’s total share [in trade] is quickly catching up to Russia’s.

“Furthermore, a regional initiative with the EU to develop the Trans-Caspian International Transport Route (aka Middle Corridor), which is a trade route between Europe and Asia that will bypass Russia, will help expand trade with Europe and Asia while also bringing in valuable infrastructure investment.”

The now ever-present threat of Western secondary sanctions faced by countries and businesses seen as helping Russia dodge sanctions introduced in response to its invasion of Ukraine is a clear concern for Kazakhstan, especially for its banks.

On this, Burgara and Iradian conclude: “Though Kazakh authorities have done a good job at avoiding such sanctions so far, with the latest example of this being the banning of Russia’s Mir payment system, any escalation of the war and consequent expansion of Russian sanctions could indirectly impact Kazakhstan.

“This is especially true considering that Kazakhstan, like other countries in the region, have significantly increased trade with Russia since the war in Ukraine began. Potentially pointing to sanctioned goods moving from Europe and China to Russia via Kazakhstan.”

Features

Turkmenistan’s TAPI gas pipeline takes off

Turkmenistan's 1,800km TAPI gas pipeline breaks ground after 30 years with first 14km completed into Afghanistan, aiming to deliver 33bcm annually to Pakistan and India by 2027 despite geopolitical hurdles.

Looking back: Prabowo’s first year of populism, growth, and the pursuit of sovereignty

His administration, which began with a promise of pragmatic reform and continuity, has in recent months leaned heavily on populist and interventionist economic policies.

Emerging Europe’s growth holds up but risks loom, says wiiw

Fiscal fragility, weakening industrial demand from Germany, and the prolonged fallout from Russia’s war in Ukraine threaten to undermine growth momentum in parts of the region.

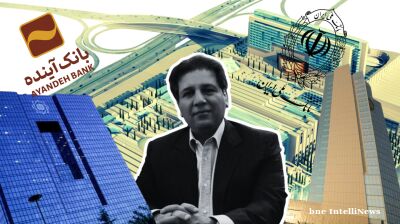

The man who sank Iran's Ayandeh Bank

Ali Ansari built an empire from steel pipes to Iran's largest shopping centre before his bank collapsed with $503mn in losses, operating what regulators described as a Ponzi scheme that poisoned Iran's banking sector.