Inflation expectations in Russia rose to 12.4% in July 2024 from 11.9% seen in June, increasing for the third month in a row and returning to the highest level since January 2024, according to the latest survey by the Central Bank of Russia (CBR). Notably, the inflation expectations exceed the CBR’s target range of 8%-10%. (chart)

In addition, the analysts polled by the CBR believe that the inflation will not return to the target 4% before 2026. The consensus inflation forecast for end-2024 from the CBR analyst survey rose by 1 percentage point to 6.5% year on year.

Both the population and the analysts thus maintain high inflation expectations despite the CBR's recent hawkish rhetoric on hiking the key interest rate and maintaining a prolonged tight monetary policy.

As followed by bne IntelliNews, the CBR's board at the June 7 policy meeting resolved to keep the key interest rate unchanged at 16%, making a neutral rate decision for the fourth consecutive time. (chart)

However, as inflation pressures continue to build up, the regulator is expected to significantly hike the interest rate already at the next July 26 policy meeting. The CBR officials have started clearly guiding for another key rate hike and a prolonged monetary policy tightening.

Alexander Isakov from Bloomberg Economics warned that the current level of inflation expectations should be "extremely worrying" for the CBR's board, estimating that population’s expectations are at least 3.5 percentage points above the 8-10% range corresponding to the 4% inflation target, according to Kommersant daily.

Renaissance Capital analysts commented that due to the continuous deterioration in inflation expectations are somewhat balanced out by slowing weekly inflation. But RenCap still continues to expect a 150-200 basis point key rate hike from the current 16% at the July 26 meeting, with an additional 50bp hike in September.

Data

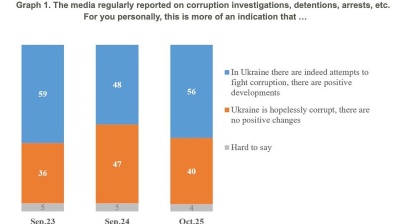

Ukraine’s credibility crisis: corruption perception still haunts economic recovery

Despite an active reform narrative and growing international engagement, corruption remains the biggest drag on Ukraine’s economic credibility, according to a survey by the Kyiv International Institute of Sociology.

India’s retail payment revolution

India’s payments landscape has reached a pivotal stage, with digital transactions now accounting for 99.8% of all retail payments.

Military aid for Ukraine falls despite new Nato PURL initiative – Statista

The Kiel Institute for the World Economy found that military aid to Ukraine dropped sharply in July and August compared to previous months, despite the implementation of the Nato PURL initiative.

IMF cuts Russia’s 2025 growth forecast to 0.6%, leaves Ukraine's unchanged at 2%

The International Monetary Fund has lowered its forecast for Russia’s economic growth in 2025 to just 0.6%, marking the second-steepest downgrade among major economies, even as it raised its global outlook.