European and Asian gas prices have remained well supported over the last month. Stronger Asian demand, supply disruptions and geopolitical risks in the Middle East have all provided support. However, US gas prices have come under renewed pressure.

European gas prices have hit year-to-date highs in early August, with growing supply concerns offsetting comfortable storage levels in Europe.

EU natural gas storage continued to tick higher through July and early August. As of 6 August, EU storage is more than 86% full, above the 5-year average of 78%. However, lower LNG inflows have meant that the pace of storage builds is somewhat slower year on year, and so inventories are starting to fall below year-ago levels. EU storage was 87% full at this stage last year. This is after storage stood at seasonal record highs at the start of the injection season.

This slower storage build will be one of the contributory factors keeping TTF prices well supported. However, our balance still shows that EU storage will likely go into the 2024/25 winter with storage close to 100% full, assuming no significant supply shocks. The slower-than-expected build in EU gas inventories, lower LNG inflows, lingering supply risks and healthy speculative interest in gas have led us to revise higher our European gas forecasts. We still expect the market to trend lower from current levels, but €25/MWh for TTF in the third quarter is looking increasingly unlikely. We now expect TTF to average €30/MWh this quarter.

EU LNG inflows remain under pressure

The main culprit behind the slower-than-expected storage build has been lower LNG inflows into Europe. Strong Asian LNG demand has ensured that JKM has traded at a healthy premium to TTF for much of 2024, which led to a diversion of LNG cargoes away from Europe to Asia.

EU LNG send-outs in July were largely unchanged month-on-month at a little under 7.6bcm. However, this still leaves July volumes down 25% y/y and the lowest monthly volumes seen since the start of the Russia/Ukraine war.

Total EU gas imports in July increased 3% month on month, driven predominantly by stronger pipeline flows from the UK and Russia. However, total import volumes are still down more than 7% y/y due to lower LNG flows. While Norwegian pipeline flows to the EU have been relatively stable in recent months, we should see some downward pressure on these flows through parts of August and September due to summer maintenance. As always, there is a risk that some of this scheduled maintenance overruns, which would leave the market tighter than expected. Lower flows from Norway over the next couple of months suggest that we could see some recovery in LNG imports into the EU in the coming months.

EU gas demand still struggling

Weak European demand continues to ensure that European storage remains comfortable, despite lower gas import volumes. Our numbers suggest that EU gas demand over the first seven months of the year is down a little more than 3% y/y. The power generation sector continues to drag on demand with spark spreads in negative territory. Strong renewable output and stronger nuclear generation have weighed on fossil fuel power generation. Weaker demand from the power sector, along with lower heating demand over the 2023/24 winter has more than offset the continued recovery in industrial demand.

Our balance shows that EU gas demand is likely to be largely flat y/y in 2024, growing less than 1%. This still leaves demand 19% below 2021 levels.

Ukraine transit route developments

The market remains concerned over potential developments in Russian pipeline flows, especially considering that these flows to the EU have been stronger so far this year. Russian pipeline flows via Ukraine and Turkstream are up 43% y/y during the first seven months of 2024. However, there are still concerns over the future of Russian pipeline flows via Ukraine, with Ukraine making it clear that it does not plan to extend the transit deal with Gazprom when it expires at the end of this year. However, a potential solution that is being looked into is a gas swap with Azerbaijan. In doing this, Russia has a commercial interest and is less likely to damage Ukrainian pipeline infrastructure, Ukraine continues to receive transit fees and the EU continues to receive gas via Ukraine.

However, the market will remain sensitive to developments relating to these flows. This is demonstrated in the recent price action following unconfirmed reports that Ukrainian troops captured the Sudzha entry point for gas into Ukraine. This is the only entry point for Russian gas transiting Ukraine that ultimately ends up in the EU.

Speculators still bullish TTF

Speculators remain stubbornly bullish on the European natural gas market. Despite comfortable storage, they are still holding a sizeable net long, which is the largest since 2021. The latest positioning data shows that investment funds hold a net long of almost 192 TWh, up from a net short at the start of 2024. While storage is comfortable, speculators appear fixated on the risks that hang over the market as we move towards the next heating season. Clearly, if fundamentals become overwhelmingly bearish, large speculative liquidations could see an aggressive sell-off in the market.

LNG supply disruptions

LNG supply disruptions have also been supportive for European and Asian gas prices over much of July. The 20bn cubic metre Freeport LNG export facility in the US suspended operations ahead of Hurricane Beryl in July and the restart of operations took longer than expected, reducing LNG availability. The plant has since returned to normal operations.

In addition, the 12 bcm Ichthys LNG export facility in Australia also suffered an unplanned outage in July and will be producing at a reduced rate as it restarts operation. In Malaysia, there are also reports of an outage at one of the production trains at the Bintulu LNG plant.

Asian LNG demand

Demand for LNG in Asia remains a supportive factor for global gas prices. LSEG data shows that imports over the first seven months of 2024 grew by 10.3% y/y. Imports grew into every key market in Asia except for Bangladesh. However, unsurprisingly the key drivers behind the growth in LNG were China and India, which made up 64% of the growth in Asian LNG demand so far this year.

Residential and commercial, power and industry demand have all witnessed growth this year in Asia. Relatively weaker spot prices mean that price-sensitive buyers are more active, while hotter weather across parts of Asia has also been supportive for cooling demand. Asia is expected to be the dominant driver in global gas demand growth this year, a trend which is unlikely to change in the years ahead as economies in the region transition towards cleaner fuels.

US gas prices under pressure

The US gas market has moved in the opposite direction to Europe and Asia and has also been weaker more recently than we expected.

Front-month Henry Hub futures broke below $2/mmBtu on several occasions in late July and early August, having traded above $3/mmBtu in June. Concerns over hot weather have eased, which would have driven stronger demand for cooling purposes. In addition, the prolonged outage at Freeport LNG over July would have also left more gas supply in the domestic market.

These factors, combined with the fact that US storage is still very comfortable, have seen speculators aggressively selling Henry Hub in recent weeks, which has shifted their position from a small net long to a net short.

However, while the US gas balance is comfortable for now, we expect it to tighten through the year and into 2025. US domestic natural gas production is expected to decline slightly in 2024, while demand from LNG plants is set to grow with two new export plants set to start operations over the second half of 2024. Domestic production is expected to return to growth in 2025, and the continued ramping up of LNG capacity along with further new LNG export additions in 2025 suggests the US balance will tighten further.

This note first appeared on ING’s THINK.ING portal here.

Content Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Opinion

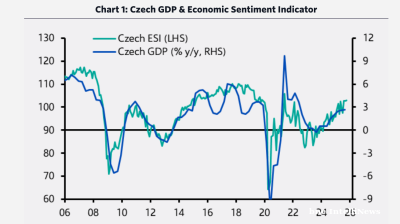

COMMENT: Czechia economy powering ahead, Hungary’s economy stalls

Early third-quarter GDP figures from Central Europe point to a growing divergence between the region’s two largest economies outside Poland, with Czechia accelerating its recovery while Hungary continues to struggle.

COMMENT: EU's LNG import ban won’t break Russia, but it will render the sector’s further growth fiendishly hard

The European Union’s nineteenth sanctions package against Russia marks a pivotal escalation in the bloc’s energy strategy, which will impose a comprehensive ban on Russian LNG imports beginning January 1, 2027.

Western Balkan countries become emerging players in Europe’s defence efforts

The Western Balkans could play an increasingly important role in strengthening Europe’s security architecture, says a new report from the Carnegie Europe think-tank.

COMMENT: Sanctions on Rosneft and Lukoil are symbolic and won’t stop its oil exports

The Trump administration’s sanctions on Russian oil giants Rosneft and Lukoil, announced on October 22, may appear decisive at first glance, but they are not going to make a material difference to Russia’s export of oil, says Sergey Vakulenko.