Turkey’s current account gap narrowed in May mainly due to an improving foreign trade balance, while capital flows significantly accelerated, leading to a jump in official reserves.

May's current account posted a US$1.2bn, lower-than-expected deficit that led to a marked drop in the 12M rolling deficit from US$31.7bn a month ago to US$25.2bn (translating into c. 2.2% of GDP). Accordingly, the annual deficit, which is the lowest since mid-2022, returned to its improvement trend after a temporary halt in April.

In the breakdown, and comparing with the same month of last year, we see:

- lower gold deficit at US$0.9bn vs US$2.2bn last year. Gold imports, which dropped significantly in the first two months, strengthened in March and April around the time of local elections but decelerated again in May and June

- improving energy bills to US$3.5bn from US$3.9bn

- turning of the core trade balance to a slight surplus at US$0.3bn vs US$3.9bn deficit a year ago

- higher services services income (including tourism revenues) at US$4.7bn.

A slight deterioration in primary and secondary income led to minimal impact on the May current account.

On the capital account, net identified flows that were weak in the first four months showed an acceleration in May with US$14.4bn. After one of the historic outflows ahead of March local elections - with US$9.9bn and another negative reading in April at US$0.3bn - net errors and omissions turned to a strong positive at US$4.5bn. With the monthly current account deficit and large flows, official reserves posted a record monthly increase at US$17.6bn.

In the breakdown of monthly data, non-residents’ movements drove the inflows with two major items:

- Portfolio flows to the government bond market at US6.1bn

- Net borrowing at US$4.1bn.

In May, rollover rates stood at 128% for corporates and 173% for banking (vs 100% and 128%, respectively, on a 12M rolling basis). The data showing significant short-term borrowing in the banking sector imply increasing appetite with tightening spreads after years of deleveraging.

Overall, regarding foreign trade, after relatively flat 12-month cumulative exports in the first four months, we saw a jump in May, though this can be temporary. 12-month imports, on the other hand, which have been gradually declining and contributing to the improvement in the current account deficit, will continue to decline as the impact of CBT actions on the balancing of demand factors is likely to be supportive of the external outlook.

On the capital account, the turnout was relatively weak in the first four months, though May data show a re-acceleration in inflows with foreign investors showing an increasing appetite for Turkish assets. The very low current account deficit until October, the possibility of a current account surplus in some months and the continuation of the tight monetary policy supporting foreign flows will continue to have a positive impact on CBT reserves in the near term.

Content Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Opinion

COMMENT: Hungary’s investment slump shows signs of bottoming, but EU tensions still cast a long shadow

Hungary’s economy has fallen behind its Central European peers in recent years, and the root of this underperformance lies in a sharp and protracted collapse in investment. But a possible change of government next year could change things.

IMF: Global economic outlook shows modest change amid policy shifts and complex forces

Dialing down uncertainty, reducing vulnerabilities, and investing in innovation can help deliver durable economic gains.

COMMENT: China’s new export controls are narrower than first appears

A closer inspection suggests that the scope of China’s new controls on rare earths is narrower than many had initially feared. But they still give officials plenty of leverage over global supply chains, according to Capital Economics.

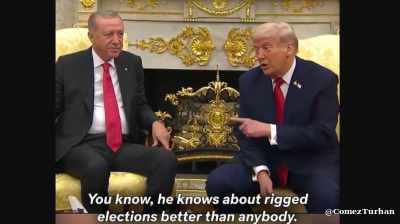

BEYOND THE BOSPORUS: Consumed by the Donald Trump Gaza Show? You’d do well to remember the Erdogan Episode

Nature of Turkey-US relations has become transparent under an American president who doesn’t deign to care what people think.