INTERVIEW: Eurasian Development Bank brings Central Asia together with sustainable green investments

Central Asia is one of the fastest growing regions in the world and is once again the “navel of the world”, as overland trade between Asia and Europe takes off.

The Eurasian Development Bank (EDB) is the leading development bank in the region that counts Kazakhstan, Kyrgyzstan, Armenia, Belarus, Russia and Tajikistan as members and is investing to bring these countries' economies together in a sustainable way with an emphasis on ESG-friendly investments.

bne IntelliNews' editor Ben Aris sat down with Nikolai Podguzov, chairman of the EDB’s board, to discuss its business and plans.

bne: Central Asia has returned to significance that it has not enjoyed for more than 100 years and is once again in the middle of the path for trade between East and West via the so-called Middle Corridor.

NP: Central Asia has not gotten enough attention in recent years, but given the global challenges and need for sustainable development, now people are starting to notice it again, as it lies at a strategic global crossroads. The region is developing very fast, much faster than the EU.

Currently the EDB is mainly focusing on Central Asia and sticking to its agenda to develop the region and make it more attractive to investors.

The Transcaspian Trade Route is a project that could make a big difference to the region. The route is very important to Central Asia itself. The region is landlocked and indeed [one country is] double-landlocked. The project opens up a route from Europe to Asia, and Central Asia will find a way to bring its goods to market.

bne: EDB has six members (Armenia (4.2%), Belarus (5.2%), Kazakhstan (37.3%), Kyrgyzstan (4.2%), Russia (44.8%) and Tajikistan (4.2%)); however, that does not include all the five ‘Stans. As the leading development bank in the region, are there plans for Turkmenistan and Uzbekistan to join? Could Afghanistan also join? Who else can join the bank?

NP: We are open to financial institutions and new countries. The EDB is currently in exploratory talks with other countries in the region that are not members, as it seeks to grow its membership and diversify shareholding structure. Talks are already in process with Uzbekistan.

bne: As a member of the “family of Development Financial Institutions”, you work closely with the other development banks that are active in the region. Of the others, how would you characterise your co-operation with the likes of the International Monetary Fund (IMF), World Bank, Asian Development Bank (ADB), IFC, European Bank for Reconstruction and Development (EBRD) and any other significant partner?

NP: The EDB is a multilateral development bank working, among other areas, in the Central Asian region. That makes us a perfect partner for global international financial institutions (IFIs), as the EDB can do the local risk analysis and project assessment in detail.

We have established strong partner ties with a number of IFIs and we have jointly financed some major investment projects. For instance, this summer, the Big Almaty Ring Road (BAKAD) was commissioned, and among the key investors for this project were the EDB and the Islamic Development Bank. We also provide financing for modernisation of the Almaty International Airport, jointly with the EBRD and the German investment and development corporation (DEG).

Our co-operation with some development institutions is in the initial stage and we are exploring our joint interest. We have active communication and co-operation with other IFIs, both at a global level like with the IMF and World Bank, and banks like the ADB, Islamic Development Bank and others.

In essence, development banks have a common agenda in addressing similar problems and challenges, albeit within different regions of the world. This is another argument for working together. Big global banks and regional development banks are both quite important and complementary in contributing to the achievement of the SDGs.

Co-operation with IFIs starts with shared research and analysis and then grows into joint implementation of investment projects. I’m sure that co-operation is the key to maximising the effectiveness of the IFIs in fostering the economic and environmental well-being of countries and entire regions, improving living standards and confronting the global challenges that countries cannot surmount without the support of development banks.

bne: The New Development Bank (aka the BRICS bank) seems to be especially relevant to your patch. How would you characterise your relations with the NDB?

NP: The NDB is a very important financial institution. I met [NDB chairwoman] Dilma Rousseff at the AGM and we discussed possible areas for our further co-operation.

We value very highly the NDB’s experience, expertise and scale of operations. The EDB, just like the NDB, is mainly focused on projects related to transport infrastructure, energy, water supply, green energy and energy efficiency, as well as environmental protection. We are ready to share our expertise, built up over a long period, and to contribute to development in close and productive co-operation with the NDB.

bne: Your mandate is to develop projects that are mutually beneficial for your member countries. What are the most beneficial projects you can do? What are the most significant infrastructure projects? What are the most significant industrial projects?

NP: We work to benefit all shareholders and support all members of the bank. We have three priority areas of operation – the three key investment mega-projects: the Central Asian Water and Energy Complex, the Eurasian Transport Network and the Eurasian Food Goods Distribution System. By 2026, we plan to invest over $1.2bn in these projects. The transport infrastructure projects affect several countries and hydropower projects are important for the whole region.

One project we are working on is renovation of the Astrakhan-Mangyshlak water pipe between Russia and Kazakhstan. It’s an important project to help increase the water flow, as about 30% of the water in the two Caspian regions of Kazakhstan comes from this pipeline, providing fresh water for 300,000 people. It’s a sustainable development project.

Water is a big issue in Central Asia. Temperatures in the region are rising much more rapidly in Central Asia than in other parts of the world, so the problem is getting ever more serious. But the solution is not in water pipes, as they are too costly and hard to build.

What is needed is much better water management and to use water more efficiently. Some 92% of all water is used for irrigation in Central Asia. There is a water deficit, and it is rising as the economies grow and agricultural demand rises. But the efficiency of the use of water is very poor. The irrigation infrastructure is very poor and old. We need to invest. We can save a lot of water if we can modernise the system.

Another related topic is hydropower: hydropower utilisation for Central Asia is only 25% – very low. Projects should be working for the whole region. Water regulations for the whole region need to be set up to make it mutually beneficial for all the countries. All the Central Asian countries understand the need to co-ordinate. They are all talking to the IFIs about the same issues and they understand that they need to co-ordinate too, but it hasn’t happened yet.

All these problems are very expensive to solve, and time is running out. We have no more than five years to solve them – and that is not much! After 2028, the problems will grow exponentially.

Now there are warning signs, but it is not a full-scale crisis. Countries and development institutions should move faster and improve co-ordination to address the problems.

bne: The bank’s mandate is on sustainable investment. What role does the green revolution play? Do you invest into things like renewables? Do you have an ESG strategy/guidelines? Do you have plans for a green bond?

NP: We are deeply involved in green investment and there is a special division for ESG development in the bank. It reviews all projects.

By 2026, green projects will make up 25% of our entire portfolio. ESG is also one of our strategic priorities.

The Almaty power plant project in Kazakhstan is a good example of decarburisation of electricity generation. The EDB project is a coal-to-gas switch project, which will make it possible to replace old and inefficient coal-fired units with 500-MW modern gas-fired co-generation units. The project will lead to significant resource efficiency improvements and a reduction in greenhouse gas [GHG] emissions in the Almaty region. In particular, the project will reduce emissions of harmful substances into the atmosphere of Almaty by 45%.

Overall, the Bank’s green agenda continues to grow. The EDB is actively investing in solar and wind power generation in Kazakhstan and solar plants in Armenia. The commissioning of the Kulanak Hydropower Plant in Kyrgyzstan will help reduce emissions in the region as well.

Our Technical Assistance Fund aims at fostering conditions for investment and development projects in the Bank’s member countries. Its primary goal is to strengthen new investment projects that are in line with its mission for future financing. It supports potential borrowers at the project planning and preparation stages, and also co-operates with beneficiaries such as national governments and organisations to implement projects aimed at institutional development and economic development and growth. In 2019, the Fund launched a buydown programme for eligible investment projects of the EDB, in accordance with their strategic importance for a project’s country and the EDB itself. The Fund is financed from the Bank’s net income and donor funds. Currently the TAF has a cumulative portfolio of 89 projects totalling $11.9mn.

Green financing is also appearing. We issued our debut green and social bonds of KZT40bn, or about $100mn, in 2021 on the Kazakh capital market.

bne: Your mandate is to aid your member countries develop their economies with an emphasis on cross-border co-operation and mutually beneficial projects. At the same time, Russia and China are also very keen to develop cross-border cooperation, trade and infrastructure. Do these overlapping interests have any effect on your plans? Is there any sort of co-ordination?

NP: You formulate the question as if there are contradictions in these initiatives, but the leaders of our shareholder countries and the leadership of China have always said that these initiatives complement each other.

Today, the most striking example of such co-operation is the development of transport corridors.

All Central Asian countries are landlocked, and Uzbekistan is double-landlocked, which means that goods have to cross at least two countries to reach the sea. This significantly increases the price that Central Asian countries have to pay to access global markets; therefore the margins for local producers are low. Hence it is critically important for the region to ensure transport connectivity in terms of both hard and soft infrastructure, that is, to harmonise transport regulations and simplify border-crossing procedures. It is necessary to create a system of land transport corridors that go in all directions. The emerging Eurasian Transport Network could help to solve problems related to the lack of access to global markets. This creates a significant amount of work for various players operating in the region.

Neighbouring countries are actively investing in the region, contributing to its sustainable development. Combining efforts could ensure better results for the region.

bne: The bank is funded by its members' paid up capital ($1,5bn paid, $5.5bn callable capital), but is this sufficient to fund all your projects? The current portfolio is about $5bn and the total cumulative is about $14bn from a total of 284 projects over the life of the bank. How do you raise additional capital if you need it? via bond issues?

NP: We mainly finance our activities with market borrowings and frequently issue bonds in the local markets of member-countries in local currency, dollars and yuan. We don’t use sovereign guarantees like many other development banks. The EDB’s long-term funding sources fully cover its loans. The bank has good access to debt capital markets. Despite the challenging market conditions, in 2022, the EDB issued a record high of $2bn in bonds in different currencies, including USD, KZT and CNY, in the local markets at favourable interest rates. We also made a debut placement in Chinese yuan in November 2022, totalling CNY1.9bn, which was used for financing projects in yuan. In September 2023, the EDB placed an inaugural bond issue in the Republic of Armenia, which was denominated in US dollars and listed on the Armenian stock exchange.

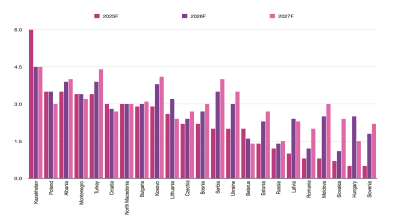

Central Asia today is an extremely interesting region for attracting investment from all over the world. The average annual economic growth rate of the Central Asian countries over the past 20 years is 6.2%, compared to the developing countries' growth rate of 5.3% and the global average growth rate of 2.6% per year. We are developing our investment activity and are interested in expanding co-operation in the financial markets of different countries and regions. We are looking at the Asian, in particular Chinese, capital markets too, and are preparing a panda bond issue.

The Eurasian Development Bank is beginning to actively promote Islamic finance. The Central Asian countries are predominantly Muslim; therefore the demand for Shari'ah-compliant financing is rising. In Central Asia, there is great potential for insurance and leasing instruments in the structure of this sector. The EDB is actively expanding its co-operation with GCC financial institutions and is collaborating with the organisations of the Islamic Development Bank Group.

The EDB has also created an Islamic finance division. In 2024, the Bank is considering issuing sukuk in international markets to finance projects in Central Asia, which could become a benchmark for the region. The list of potential projects for financing has already been drawn up.

We are open to partnership and investments from various regions of the world in order to promote the sustainable development of Central Asia.

bne: Russia is one of the founding members together with Kazakhstan and obviously Russia has since clashed with the West. Taking account of this, Russia has already reduced its share in the EDB from circa 60% to 44.8%. Will Russia reduce its share further? Are there any active projects in Russia? What role does Russia play in the bank today?

NP: With its focus on such investment mega-projects as the Central Asian Water and Energy Complex, the Eurasian Transport Network and the Eurasian Food Goods Distribution System, it would be impossible to exclude Russia for geographic reasons. However, the EDB takes into account the existing restrictions and does not violate its obligations to be compliant with applicable international sanctions. In our portfolio there are no projects that contradict our covenants. The EDB is constantly strengthening its compliance procedures in order to meet the highest international standards. The Bank does not participate in transactions and deals aimed at violating or circumventing the applicable sanctions.

Russia’s share in the bank has been reduced to 44%, which is still significant, but Central Asian countries amount to more than 50%.

At this moment, the EDB does not have one majority shareholder. Decisions are mostly determined by the Bank’s Council by a simple majority. The chairman of the bank’s Council is the Prime Minister of Kazakhstan, Alikhan Smailov.

As already discussed, we are waiting for new shareholders to join, which will further diversify the shareholder structure.

bne: From the various mechanisms for investing, which have you used and which are the most effective: public-private-partnership (PPP), equity participation, issuing guarantees, financing private investment funds, and providing loans to commercial banks for corporate on-lending? Is it business as usual?

NP: Unlike commercial banking, we do not have the goal of maximising profits from projects; we aim in the opposite direction – to provide maximum support at all stages to develop projects that are strategically important for the countries and the region. And depending on a project’s specific features, complexity and cost, as well as on its stakeholders, we choose the format for financing. We use all of the instruments you mentioned. And we build partnerships with other MDBs.

For example, funding PPPs is very important to our strategy, but it is complex to build a PPP project.

When you are doing a cross-border PPP project, there are many problems involving differing national regulations of the countries involved, which makes it even more complicated.

Today we are actively developing our co-operation with other multilateral development banks and investment organisations working or just planning to start working in our region. I am sure that the experience and expertise we have accumulated is unique for partners who are just thinking about investing in Central Asia. And we are ready to work together for the development of the countries and the well-being of the people.

Features

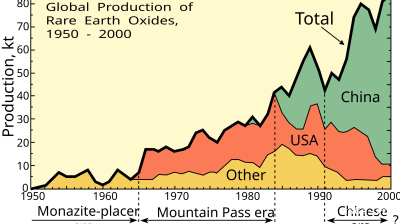

Asian economies weigh their options amid fears of over-reliance on Chinese rare-earths

Just how control over these critical minerals plays out will be a long fought battle lasting decades, and one that will increasingly define Asia’s industrial future.

BEYOND THE BOSPORUS: Espionage claims thrown at Imamoglu mean relief at dismissal of CHP court case is short-lived

Wife of Erdogan opponent mocks regime, saying it is also alleged that her husband “set Rome on fire”. Demands investigation.

Turkmenistan’s TAPI gas pipeline takes off

Turkmenistan's 1,800km TAPI gas pipeline breaks ground after 30 years with first 14km completed into Afghanistan, aiming to deliver 33bcm annually to Pakistan and India by 2027 despite geopolitical hurdles.

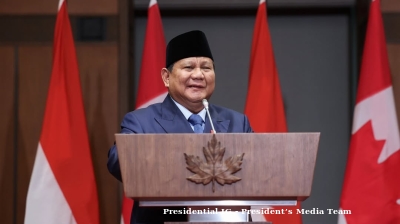

Looking back: Prabowo’s first year of populism, growth, and the pursuit of sovereignty

His administration, which began with a promise of pragmatic reform and continuity, has in recent months leaned heavily on populist and interventionist economic policies.