With the heating season officially due to start next week, gas prices have soared and Russia has been blamed for it, accused of cutting supplies to Europe as a way of putting political pressure on the EU and forcing it to rapidly certify Russia’s new Nord Stream 2 gas pipeline that cuts Ukraine out of the supply loop.

The reality is a lot more complicated. Nord Stream 2 does play a role but the main mechanism at work on the prices is a sharp V-shaped market where there was a gas glut in 2020 that depressed prices and led to record-high gas storage, exacerbated by the uncertainty of Russia and Ukraine renewing their gas transit deal in December 1999.

However, a long cold winter at the start of 2021, a hot summer (that drives up electricity usage and hence demand for gas) and various maintenance and accident outages in the main pipelines have all conspired to lead to extremely low storage. By the end of the summer when it became obvious that gas storage levels were going to be low going into the heating season prices took off as the scramble to secure supplies began.

The problems of gas supply have been exacerbated by the falling output at some of Europe’s biggest fields in the UK and the Netherlands, which have passed their sell-by date.

With its massive reserves Russia has become the main swing producer of gas for Europe, ramping up or cutting back supply as demand changes. But in Russia too, the main mega-fields that have supplied Europe for decades have passed maturity and are in slow decline, especially the Cenomanian gas fields in Western Siberia that feeds the central pipeline network that leads into the Ukrainian pipeline network. Massive investments have been made into Cenomanian simply to maintain production at current levels.

The falling output at Cenomanian has been replaced by the relatively young fields in Yamal that feed the northern system of pipelines that include Nord Stream 1 & 2 pipelines to Germany, but with Nord Stream 1 already working at full capacity and Nord Stream 2 yet to go into operation, the enormous reserves of gas in Yamal are unavailable during the current crisis.

And it is not possible to divert gas from Yamal and the northern pipeline system to the central pipeline system and on to Europe via Ukraine. There are interconnections, but the 40-year-old central pipeline network has already been slated for decommissioning and during the lead-up to the winter season the interconnectors are already at full capacity as Gazprom, like Europe, is rushing to fill Russia’s domestic storage facilities with enough gas to get through the winter: in September Gazprom had 25bn cubic metres in storage out of the total of 75 bcm it needs during the cold months.

Russia is suffering from the same supply and storage problems as Europe which has put added pressure on its ability to supply Europe with gas. Rather than cutting supplies, as bne IntelliNews has reported Gazprom is currently producing record amounts of gas and exporting record amounts.

Taken all together, the falling production at European and key Russian fields, the problems of switching gas from the northern pipeline system to the central one and the idle state of Nord Stream 2 have combined to limit Gazprom’s ability to act as the swing supplier, as it is running up against its practical ability to increase production or export volumes any further.

The bottom line is: all the governments say there will be enough gas for the winter. Naftogaz announced that it is ready for winter with just over 18 bcm in storage – sufficient for the winter and likewise Russia and the EU have also just about enough to get through; plus the EU has a fall back on LNG imports to make up any shortfall, although all the swing supply in LNG has been drawn off by Asia, where the prices are even higher than in Europe.

What everyone is afraid of is if there is another cold winter like last year’s, fuel supplies will be very tight and prices will remain at record highs.

Gas glut in 2020 pushed prices and production down

In 2020 gas prices crashed as both Russia and Ukraine built up as much stored gas as they could ahead of a potential energy crisis that could have been caused if their transit deal had not been renewed at the end of 1999.

“In 2020 the gas glut in Europe emerged even before the full extent of the COVID-19 threat became obvious. The global gas market had been oversupplied for some time due to the emergence of new LNG supply during 2018-2019 from projects, which took investment decisions in the mid-2010s. These supply additions entered the market at a time when global demand failed to meet growth expectations,” says Yermakov.

At the end of December 2019, an end-of-year record of 91.5 bcm – 20 bcm higher than at the end of 2018 – was in storage. As the coronacrisis began to unfurl the oversupply problem was only made worse, which led to record amounts of gas in storage by the spring of 2020. Gas prices tanked.

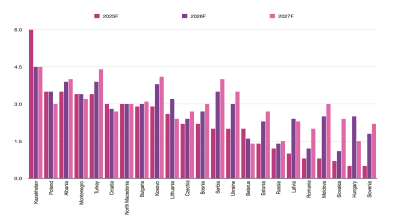

Faced with low prices and low demand in 2020 Russia cut back its overall production that year to 693 bcm, down by 46 bcm, or 6.2%, on the year before. Gazprom took the brunt of the blow and absorbed almost all of the reduction, taking its production down to 455 bcm (a fall of 47 bcm year on year, or 9.3%) while the other gas producers in Russia keep increasing their production steadily. At the same time, Russia reduced its gas purchases from Central Asia.

Facing shrinking and uncertain demand during 2020, Gazprom laid the foundations for the current supply crunch by also drastically reducing the pumping of gas into its domestic underground gas storage facilities by 20 bcm, down 38% y/y to 33 bcm.

As it turned out, Russia’s national supplier Gazprom signed off on a new transit deal at the last minute that commits the Russian gas giant to send 40 bcm via Ukraine’s Druzhba pipeline until 2024.

Bounce-back in 2021

The bounce-back started in the spring of this year as the market switched rapidly from overabundance to tightness. In Europe, a long cold spring extended the heating season, while the re-opening of business activity boosted economic growth. European gas demand rose robustly, by almost 25% y/y in the second quarter alone.

At the same time, indigenous European gas production declined more than 10% y/y in the first six months of this year, with Norway, the UK and the Netherlands all producing less gas than in the previous year. By the summer the supply problem became so obvious gas prices started setting new records on almost a daily basis.

Stored gas was drawn down but to add to the pressure Gazprom closed its Nord Stream 1 gas pipeline for annual maintenance in August, disrupting supplies, which were further disrupted after a fire at Gazprom’s Urengoy Condensate Treatment Plant in August closed part of the line.

“The record-high prices in Europe are driven by increased demand (due to the wider economic recovery and weather-related factors), competition with Asia for LNG, and a limited supply response from Gazprom, Europe’s largest supplier, providing about a third of Europe’s gas. Prices have also risen due to market fears of a gas deficit during the winter heating season due to low European storage utilisation compared to previous years,” said Vitaly Yermakov, senior research fellow the Oxford Institute for Energy Studies (OIES) in a paper entitled “Big Bounce: Russian gas amid market tightness.”

As bne IntelliNews reported, Gazprom has been exporting record amounts of gas to European clients, but has not taken up all of the capacity on offer from the Gas Transmission System Operator of Ukraine (GTSOU). With the controversial Nord Stream 2 gas pipeline completed but still missing the essential operating permits from Germany, that has led many to accuse Gazprom of artificially manipulating the supplies for both commercial gain and political reasons.

Yermakov argues that Russian gas production is maxed out and it is unable to supply more gas to Europe even if it wanted to.

“For Russian gas, 2021 has developed into a pivotal year, as the gas market pendulum has swung back from relative gas abundance and extremely low prices in 2020 to market tightness and very high gas prices so far in 2021. The past two years, therefore, have represented two slopes in a ‘V-shape’ trend for the gas market at large and for Russian gas in particular,” Yermakov said.

LNG supplies disappear, Gazprom to the rescue

Normally burgeoning LNG supplies could make up the shortfall, but prices for LNG in Asia have been even higher than those in Europe, sucking that supply away from European markets, leading to a triple whammy in gas supplies.

“With declining indigenous production in Europe and limited availability of LNG owing to the strong pull from premium markets in Asia, the European gas market is a case in point. Europe now demands greater flexibility from suppliers, in both price and the ability to swing gas deliveries,” says Yermakov, adding that Russia’s ability to add that extra flexibility may have been largely used up.

“Many European analysts and market watchers expected that Russia as the largest swing producer and exporter would value an opportunity to expand its market share, at least in the short term, and quickly respond to a higher call on gas in Europe in 2021,” Yermakov said.

And Russia did, with recent reports showing Russia’s gas exports to Europe (including Turkey) up almost 20% y/y in the first half of this year. “But this has proved to be insufficient to address a sudden void in Europe’s gas balance. Gas storage levels in Europe are at historical lows at the start of the heating season and gas prices have been testing record levels,” says Yermakov.

LNG could ease the pressure but Russia is still not producing enough to meet the demand. In 2020, Russia became one of the ‘Big Four’ global LNG producers, and production has increased from 10mn tonnes per year after the Sakhalin plant went online to 30mn tpy now. But that is still dwarfed by Qatar, the world’s biggest producer, with 125mn tpy.

The distribution of Russian LNG exports in 2020 was skewed in favour of Europe (18.35mn tonnes) at the expense of Asia (11.25mn tonnes) due to the disappearance of the usual Asian premium. Sakhalin LNG stayed in Asia but deliveries from Novatek’s Yamal LNG mostly ended up in Europe.

Overall Europe already has fairly diversified gas supplies. Gazprom’s share of European gas consumption peaked at 36.6% in 2018, and Russia’s overall share (for both pipeline and LNG) reached 39% that year. Russian pipeline gas market share returned to its more ‘normal’ 32.4% in 2020 as Gazprom had to accommodate the inflow of global LNG during the first half of 2020 as well.

Exports to the three largest purchasers of Gazprom gas in Western Europe were up in the first six months of 2021 compared to the same period of 2020: an increase of 8.7 bcm in Germany (up 43%), up 1.4 bcm in Italy (up 14%) and an increase of 9.9 bcm in Turkey (up 209%). Russian pipeline gas exports to China continued to ramp up according to plan and are set to amount to 10 bcm for the full year of 2021.

“Total exports to Western Europe and Turkey grew to 77.2 bcm, up 17.1bcm or 29% year-on-year. This was, in fact, higher than in the pre-crisis first half of 2019,” says Yermarkov.

Pipeline switches

Russia remains Europe’s swing supplier, in the strongest position to react to changes in demand. Previously the swing supplies would be sent via Ukraine, but Russia’s pipeline network is changing.

New pipelines have come online in the last two years -- Nord Stream 1 and TurkStream – and it is not a coincidence that these two countries also took the biggest increases in Russian gas flows west this year. Germany would have taken even more – enough to avoid the current supply crisis – had Nord Stream 2 been completed as scheduled at the end of last year.

Nord Stream 1 utilisation amounted to 58.7 bcm, 58.5bcm, and 59.3 bcm in 2018, 2019, and 2020 respectively (exceeding the nameplate capacity of the pipeline by 6-8%). This was helped by the start of the EUGAL pipeline that allowed Gazprom to overcome the regulatory restrictions imposed on the full use of the OPAL pipeline.

Gazprom launched its new 31.5 bcm TurkStream pipeline in January 2020. Russian gas exports via TurkStream amounted to 13.5 bcm in 2020 (43% utilisation of 31.5 bcm combined capacity of the two strings). It is expected to ramp up utilisation with the redirection of deliveries to Serbia and Hungary away from the Ukrainian route when the pipeline connections to these countries become fully operational.

With the two new forks to Russia’s gas pipeline delivery trident to Europe – Nord Stream 2 in the north and TurkStream in the south – the biggest loser has already been the central prong that goes via Ukraine.

In 2018 Gazprom transited 86.8 bcm via Ukraine using about 65% of Ukraine’s available transit capacity to Europe that year. In 2019 Russian gas transit through Ukraine rose by 3%, to 89.2 bcm. But under the new deal with Ukraine the annual booked capacity for 2020 was 65 bcm in 2020, falling to 40 bcm a year until the deal expires in 2024. In 2020 the actual transit via Ukraine was 55.8 bcm, but Gazprom had to pay for the full 65 bcm anyway under the terms of the new deal.

The deal specifies equal daily bookings of 178.1mn cubic metres per day in 2020 and 109.6 mcm per day in 2021-2024. The bonus for Ukraine is Gazprom agreed to take-or-pay terms: Russia has to pay for the capacity even if it doesn't use it out to the end of 2024.

“So far in 2021 the daily average transit flows via Ukraine (excluding deliveries to Moldova) have been 107.3 mcm per day from 1 January to 31 August, equating to an annual equivalent of 39.2 bcm. Aside from January 2021 (when Gazprom booked around 41.6 mcm per day of extra capacity), Gazprom booked 15 mcm per day of firm monthly capacity via Ukraine – the exact amount offered by GTSOU, the Ukrainian gas pipeline operator. This was also the maximum amount covered by the Russia-Ukraine interconnection agreement on the Russia-Ukraine border,” says Yermakov.

Gazprom remains reluctant to book more export capacity – GTSOU is also offering “interruptible” capacity where space in the pipeline is not guaranteed – partly as transit via Ukraine is now by far the most expensive option and GTSOU has not been offering the usual 60% discount for interruptible capacity.

Ageing fields

Russia has a lot of gas, but some of its fields are getting very old. In a speech in September Gazprom CEO Alexei Miller said that Gazprom has “reserves for 100 years” but the geography from where it extracts its gas is changing, says Yermakov.

“For almost forty years, Russia’s gas output has been supported by the Soviet legacy of super-giant Cenomanian gas fields in the Nadym-Pur-Taz (NPT) region in Western Siberia, but these fields are now in irreversible decline,” says Yermakov.

“Gazprom has been trying to manage the output decline by developing wet gas from deeper layers of the NPT super-giants, initially from Valanginian, and recently from Achimov deposits, but this can only slow the natural decline of the NPT production, not reverse it. In order to meet demand, Gazprom has been developing a new gas province on the Yamal peninsula in the Russian Arctic since the early 2010s, where the Bovanenkovskoye field, the first in a series of the new super-giants, produced 99 bcm of gas in 2020,” Yermakov added.

Nord Stream 2 has been criticised as being economically superfluous, as Ukraine has plenty of capacity (an estimated total of around 145 bcm) to transit all the gas Russia wants to send to the west. But that ignores the fact that in addition to the decline of the Cenomanian fields, the pipelines serving it are also at the end of their useful life and are due to be decommissioned.

“Gazprom has already announced that it will be decommissioning the older pipelines in the Central corridor in line with the reduction of flows from NPT caused by production declines there. Some of these pipelines have been in operation for over forty years and have passed the limits of their economic life, imposing high repair and maintenance costs on Gazprom,” Yermakov said. “This means that the capacity of Russian pipelines leading towards the Ukrainian transit corridor is going to decline substantially in the future, limiting the volumes of gas available for the Ukrainian route.”

The Yamal project is about tapping new super-fields and building new pipelines to service them that can supply Europe for decades to come. Moreover, the Nord Stream 2 gas pipeline is not only shorter; it is much cheaper to use, improving the profitability for the development of the Yamal fields and those beyond it in Russia's part of the Arctic, where some 75% of Russia’s untapped gas deposits are thought to lie.

All these assumptions are built into Gazprom’s long-term investment strategy for the development of its fields to 2035. All of the falling output at NPT will be taken up with new production from the Yamal complex.

The long-term demand from Europe may be limited after the EU launched its Green Deal this year. German Chancellor Angela Merkel was in Moscow in September to meet with Putin and talk gas but during her visit she said that gas imports from Russia could fall to nothing in the next 25 years as the EU moves increasingly to renewables and tries to become carbon neutral by 2050.

For Gazprom the future is in the east, supplying China, where demand is expected to decuple in the next few decades from the paltry 10 bcm China is currently importing from Russia, via the Power of Siberia pipeline.

“The Asian market – the market of Asia-Pacific – has an exceptionally large capacity. According to forecasts up to 2040, consumption in this region will grow by 1.5 trillion cubic metres of gas, of which 60% will be imported,” Miller said at a conference in September.

“There is no doubt that the Chinese market is the most dynamic and fast-growing one, and it shows simply unbelievable consumption growth rates every year. The year 2021 is no exception. In the first half of the year, natural gas consumption in China grew by 15.5%. The volume of imports increased by 23.8%. This means that China’s projected consumption based on the results of 2021 will amount to 360 bcm, and the volume of imports will total 160 bcm. Moreover, the annual volume of gas imports is expected to reach 300 bcm as early as by 2023, in just 15 years. The figure is just staggering,” Miller told delegates.

Gazprom can easily increase deliveries via the Power of Siberia route but also from Sakhalin by a spur to China from the Sakhalin-Khabarovsk-Vladivostok line. But a real game-changer could be a mooted pipeline to China from Western Siberia via Mongolia that could for the first time create an alternative to supplies to Europe for Russian gas in Western Siberia.

“The [Chinese] contract is a unique one. It is the world’s largest contract for gas supplies: 38 bcm of gas for 30 years. Having signed this contract, China has become one of our biggest consumers in a flash. In fact, today we can say that the co-operation between Russia and China is the co-operation between the largest producer and the largest importer,” Miller told the conference delegates. Gazprom plans to increase exports to China to 80 bcm a year by 2035, according to its long-term strategy.

The Eastern and Northern pipeline systems are being expanded, while those in the Central corridor are due to be phased out. Standing behind Nord Stream 2 is another new set of pipelines to feed into this important export route. The new Bovanenkovo-Ukhta and Ukhta-Torzhok pipelines were completed in 2018 with a capacity of 115 bcm per year and were built to evacuate new gas from the super-giant Bovanenkovskoye field, which is part of the Yamal complex, and send it on to Germany via Nord Stream 1 and 2.

There may well be a lot of politics involved in the decision to build Nord Stream 2 and cut Ukraine out of the gas delivery loop to Europe. However, there are a lot of business reasons too. The falling production at the traditional gas fields in West Siberia, the ageing pipeline system that supports it and most importantly, the anticipated shrinking demand for gas in the EU all make Europe a less interesting market. The future for Russian gas lies in the east and in the meantime Gazprom is trying to sell what gas it can to the west as profitably as it can.

Features

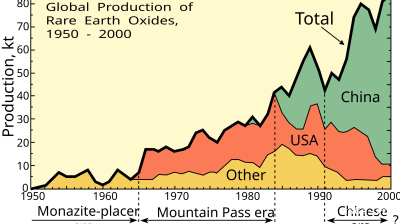

Asian economies weigh their options amid fears of over-reliance on Chinese rare-earths

Just how control over these critical minerals plays out will be a long fought battle lasting decades, and one that will increasingly define Asia’s industrial future.

BEYOND THE BOSPORUS: Espionage claims thrown at Imamoglu mean relief at dismissal of CHP court case is short-lived

Wife of Erdogan opponent mocks regime, saying it is also alleged that her husband “set Rome on fire”. Demands investigation.

Turkmenistan’s TAPI gas pipeline takes off

Turkmenistan's 1,800km TAPI gas pipeline breaks ground after 30 years with first 14km completed into Afghanistan, aiming to deliver 33bcm annually to Pakistan and India by 2027 despite geopolitical hurdles.

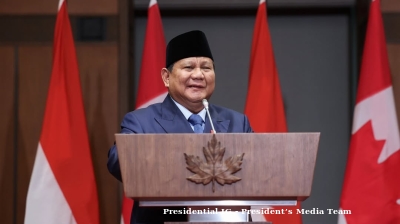

Looking back: Prabowo’s first year of populism, growth, and the pursuit of sovereignty

His administration, which began with a promise of pragmatic reform and continuity, has in recent months leaned heavily on populist and interventionist economic policies.