With Donald Trump securing a second term in office, Mexico now faces significant challenges in its relationship with the United States. Long-standing issues such as trade, migration, and security are at risk of taking a hard turn, with potential consequences reverberating across both countries.

Trump's past rhetoric – including his threats to impose hefty tariffs on Mexican imports, particularly vehicles, and his tough stance on immigration – has already sent ripples through the Mexican economy. Should these threats materialise, the already struggling peso could experience further pressure. For example, Trump’s earlier proposals to impose tariffs of up to 200% on Mexican cars could have serious ramifications for industries that rely on trade between the two nations. Companies like Honda, which imports thousands of vehicles from Mexico each year, have already expressed concerns over potential disruptions.

But even the more modest prospect of 25 per cent tariffs on Mexican imports, floated by Trump on the campaign trail, has rattled markets, sending the peso tumbling to a two-year low against the US dollar. Such measures could significantly impair Mexico's export-driven economy, potentially triggering sovereign credit downgrades and dampening foreign direct investment.

Financial analysts warn that the implementation of such steep tariffs would impact Mexico's formal employment sector and broader economic growth trajectory. The threat comes despite the extensive economic integration between the two nations, with intricate supply chains spanning the border.

In addition to trade, migration is expected to be a major point of tension. Trump’s promises to finish building the border wall, implement even harsher migration policies, and expel millions of undocumented immigrants could place enormous pressure on President Claudia Sheinbaum's administration. The US' push for greater control over migration has intensified in recent years, and with Trump’s victory, it seems unlikely that Mexico’s efforts to curb illegal crossings will go unnoticed. Sheinbaum's recent statements assure the Mexican public that "there is no reason for panic" and that her administration will continue to manage migration challenges, including a 75% decrease in illegal crossings between 2023 and 2024.

However, Trump’s hard-line stance could also test Mexico’s political will. The US president-elect’s “America First” policy could lead to a more aggressive approach towards trade and national security. While Mexico benefited from the renegotiation of the North American Free Trade Agreement (NAFTA) under Trump’s first term, the current political landscape is vastly different. The potential for a more protectionist stance, especially in the automotive sector, looms large. Sheinbaum’s government must also prepare for a review of the US-Mexico-Canada Agreement (USMCA) in 2026, a crucial moment for the future of trade relations.

Furthermore, Trump’s focus on combating drug cartels is another area of concern. Mexico’s battle with the flow of fentanyl – a synthetic opioid responsible for tens of thousands of American deaths annually – is a priority for both governments. Analysts warn that Sheinbaum will need to strike a delicate balance between cooperation and fending off the more extreme solutions Trump has mooted, such as direct military action against Mexican cartels. Although such interventions could severely damage bilateral relations, they remain a real possibility given Trump’s history of unorthodox foreign policy decisions.

Another emerging issue is China's increasing economic footprint in Mexico. Despite Washington's pressure, Mexico has allowed Chinese companies to expand their presence, a move that could create friction with Trump’s administration. His pledge to impose steep tariffs on Chinese goods, as well as his broader protectionist trade policies, could put Mexico in a difficult position. The expansion of Beijing's economic influence in the region, combined with Mexico’s efforts to attract foreign investment through an open incentive programme, could lead to a direct collision with the Trump administration’s hawkish stance on Chinese imports.

Yet, despite these looming challenges, Mexico does have some leverage. Sheinbaum can take a cue from the strategies employed by her predecessor, Andrés Manuel López Obrador, who managed to build a somewhat pragmatic relationship with Trump during his first term. The key lies in negotiation, leveraging areas of mutual interest, such as migration control, to negotiate favourable terms on trade and security. With Mexico’s trade ties with the US growing – Mexico surpassed China to become the US’ largest bilateral trading partner in 2023 – Sheinbaum’s administration can still employ diplomatic manoeuvres to protect Mexico’s interests.

Moreover, Mexico could leverage its strategic importance in the region, using its position as a critical partner in trade and migration to avoid the worst impacts of Trump's proposals. By engaging with US companies that benefit from the US-Mexico trade relationship within the framework of "nearshoring," Mexico could gain support to resist potentially harmful tariffs.

However, as the nation faces an unpredictable second term under Trump, it must be prepared for a turbulent period. The stakes are high, and Sheinbaum’s administration will need to tread carefully to navigate the complex web of economic, political, and security challenges posed by a Trump presidency. As the US becomes increasingly inward-looking, Mexico will have to rely on both its diplomatic acumen and its economic clout to maintain a stable relationship with its northern neighbour.

Features

Looking back: Prabowo’s first year of populism, growth, and the pursuit of sovereignty

His administration, which began with a promise of pragmatic reform and continuity, has in recent months leaned heavily on populist and interventionist economic policies.

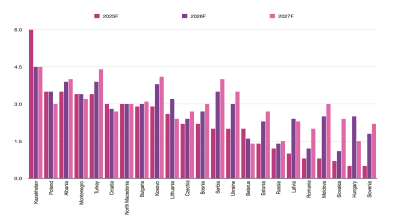

Emerging Europe’s growth holds up but risks loom, says wiiw

Fiscal fragility, weakening industrial demand from Germany, and the prolonged fallout from Russia’s war in Ukraine threaten to undermine growth momentum in parts of the region.

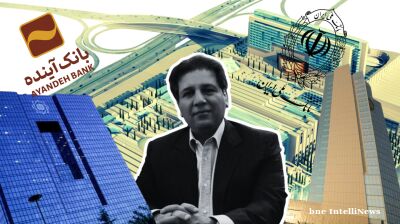

The man who sank Iran's Ayandeh Bank

Ali Ansari built an empire from steel pipes to Iran's largest shopping centre before his bank collapsed with $503mn in losses, operating what regulators described as a Ponzi scheme that poisoned Iran's banking sector.

Andaman gas find signals fresh momentum in India’s deepwater exploration

India’s latest gas discovery in the under-explored Andaman-Nicobar Basin could become a turning point for the country’s domestic upstream production and energy security

_1761147529.jpeg)

_1761050969.jpg)