Russia external debt has been falling steadily and reached $326.6bn in December 2023, compared with $322.3bn in the previous quarter and $383.6bn at the end of 2022. It could pay the entire amount off tomorrow – in cash. (chart)

The Kremlin has been paying off its external debt. Low external debt means Russia doesn’t need to tap international capital markets so is not vulnerable to any sort of sanctions on bond issues, which are easy to apply and enforce.

Coupled with Russia’s strong current account surplus, which was up to $5.2bn in February from $4.5bn in January, thanks to high oil prices, Russia can fund itself easily on this profit. (chart)

At the same time gross international reserves have been rising and are now hovering around $600bn at the end of the first quarter. Half of these reserves are frozen. About $150bn are in monetary gold (up from $135bn pre-war) and the rest in yuan.

Even counting out the frozen funds, Russia can cover its external debt dollar for dollar with cash, whereas everyone in the West is massively leveraged, including the Ukraine where the debt-to-GDP ratio is almost at 100%.

It is these rock-solid fundamentals – no one else in world has even remotely similar metrics – which is the essence of Putin’s Fiscal Fortress. It is a ridiculously strong basis, which means even if the West manages to reduce Russia income from oil and gas exports, it will still have a massive amount of wiggle room.

And its ongoing commodity exports to the global south mean that it will continue to enjoy the raw materials subsidy for its economy. Because of their external debt (USA, Italy, much of G7, everyone in Africa and even China) everyone else is a lot more vulnerable to a global slow down. Russia is probably currently the least vulnerable on a macro fundamentals basis.

Having said that, MinFin is increasingly turning to the OFZ domestic T-bill market to fund the deficit – expected to be RUB1.6 trillion year, down from RUB3.4 trillion last year, or 0.8% of GDP and 1.9% of GDP respectively.

Pre-war MinFin used to issue around RUB2 trillion (c$20bn) of OFZ a year, and most of them on a very long maturity of up to 20 years. Yields on these bonds were a hansom 6-7% and foreign investors poured in to buy billions of dollars’ worth.

Post-war of course those foreigners have left with non-rez share falling from a peak of c34% to c7% now. (chart) Moreover, the cost of this borrowing has gone up as yields have risen to c14%. So, this is relatively expensive borrowing.

Moreover, the volumes issued have gone up dramatically. In an underreported story Siluanov said at the start of last year MinFin planned to issue about RUB1.5 trillion of OFZ but ended up issuing RUB2.5 trillion. (It would have been more, but oil prices recovered in Q4).

The plan for this year, at the start of last year, was also for RUB1.5 trillion, but in December Siluanov was already talking about RUB4 trillion – that is almost double pre-war levels. And the $3-6bn of annual Eurobond issues has also obviously stopped.

The total outstanding OFZ has doubled to cRUB20 trillion (chart) since the pandemic started when Russia spent around 3% of GDP on economic relief (globally a very low level). You can see issues jumped again since the war started and total outstanding is now cRUB20 trillion (c$200bn). So, the debt situation is not quite as rosy as first appears.

Still, even $200bn worth of outstanding domestic debt is not bad at all. Firstly there is a pool of some RUB19 trillion of liquidity in the banking sector so again all this debt can be covered in cash by domestic resources.

Secondly, £200bn is about 10% of GDP, so even this borrowing is extremely modest by developed economy standards and easily managed.

Data

Eurobonds of Istanbul-listed Zorlu units offer attractive yields amid rating downgrades and no default expectation

Debut paper currently offering 14-15% yield.

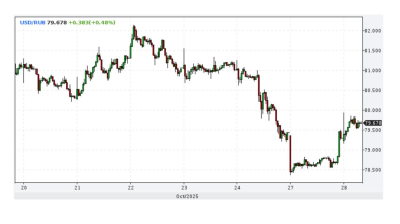

Ruble strengthens as sanctioned oil companies repatriate cash

The Russian ruble strengthened after the Trump administration imposed oil sanctions on Russia’s leading oil companies, extending a rally that began after the Biden administration imposed oil sanctions on Russia in January.

Russia's central bank cuts rates by 50bp to 16.5%

The Central Bank of Russia (CBR) cut rates by 50bp on October 24 to 16.5% in an effort to boost flagging growth despite fears of a revival of inflationary pressure due to an upcoming two percentage point hike in the planned VAT rates.

Ukraine's trade deficit doubles to $42bn putting new pressure on an already strained economy

Ukraine’s trade deficit has doubled to $42bn as exports fall and imports balloon. The balance of payments deficit is starting to turn into a serious problem that could undermine the country’s macroeconomic stability.