After four years of stagnation consumer demand is finally back as a main driver of Russia’s economic growth. An uptick in real incomes in October has fed through to retail sales which expanded by 1.6% year-on-year, reported Rosstat on November 20.

Retail turnover growth had been slowing all year but in the last month the fall has stopped and reversed. Real wages have been contracting for almost six years now but they expanded by 3.1% in September, partly lifted by the faster than expected fall in inflation, which was down to 3.8% in October and is now expected to end the year under the Central Bank of Russia (CBR) targeted 4% level.

While analysts say the positive results are not the start of a boom, this autumn's results were welcomed as signs of a strong economic recovery as Russia emerges from its two year oil price collapse induced recession between 2014 and 2016.

“Real sector of the economy shows continued expansion. Growth dynamics in other key sectors of the economy were also positive: agricultural output increased by a robust 5.2% y/y last month, industrial production was up 2.6% y/y and volumes of construction rose 1% y/y (vs 0.8% in September and 0.3% in August). Fixed investment grew c1% y/y in 3Q19, up from 0.5-0.6% growth seen in the previous two quarters,” BSC Global Markets chief economist Vladimir Tikhomirov said in a note. “The only small negative was a slight increase in the unemployment rate (4.6% v 4.5% in September), but this is merely a reflection of seasonality (cuts in temporary jobs in agriculture and construction).”

The boom during the noughties was driven by the state’s decision to close the gap between public and private sector wages and a decade of 10% wage hikes each year that fuelled a consumer led expansion. That is not going to happen again, but consumption remains one of the three big economic drivers and a recovery in real wages, helped by the ongoing falling inflation, will improve Russia’s business climate. The mild recovery in construction – the volume of residential construction was up by 11.1% year-on-year in October vs 2.8% in September – is another positive signal and another one of the main economic drivers. The fly in the ointment is the last big driver of growth is investment and that is lagging.

Investment next year will be driven by the 12 national projects that will see state investment into infrastructure rise from the 2% average of recent years to circa 3-4% of GDP that could add as much as 1% of GDP growth. But the jury remains out on the efficacy of this spending and how effective it will be. A recent study from Oxford Economics suggested that all the economic growth gains from the extra spending on the national projects will be cancelled out by the tax increases used to raise the money.

Data

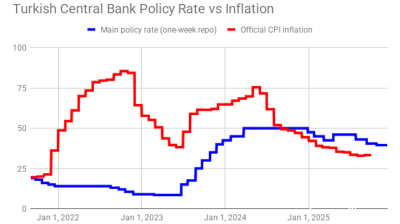

Turkey's central bank remains cautious, delivers 100bp rate cut

Decision comes on eve of next hearing in trial that could dislodge leadership of opposition CHP party.

Polish retail sales return to solid growth in September

Polish retail sales grew 6.4% year on year in constant prices in September, picking up from a 3.1% y/y rise in August, the statistics office GUS said.

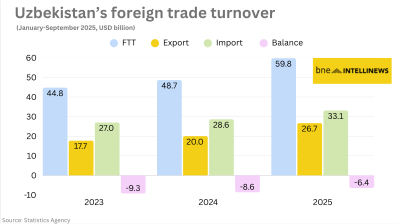

Uzbekistan’s nine-month foreign trade nears $60bn

Export growth of 33% and import expansion of 16% y/y produce $6.4bn deficit.

Hungary’s central bank leaves rates unchanged

National Bank of Hungary expects inflation to fall back into the tolerance band by early 2026, with the 3% target sustainably achievable in early 2027 under the current strict policy settings.