The seasonally adjusted S&P Global Russia Manufacturing Purchasing Managers’ Index (PMI) posted 48.2 in April, up from 44.1 in March, to signal the third successive deterioration in the health of the Russian manufacturing sector.

Although the rate of decline eased from March's recent low, it was the second-sharpest since August 2021. Any result below the 50 no-change mark is a contraction.

The effects of the war on the Russian economy have so far been surprisingly mild.

Consumption has spiked, with retail sales growing by a further 2% year on year in March, driven by food sales. At the same time, stocks of many foods, such as vegetable oils and sugar, dwindled to exceptionally low levels. Non-food sales also did well, but that was partly due to Russians buying things like cars and washing machines as a store of value in the face of yet another deep devaluation of the ruble, which fell from RUB80 to the dollar to RUB122, before recovering thanks to fast action and capital controls imposed by the Central Bank of Russia (CBR).

The rise in unemployment was also surprisingly mild in March and remained unchanged at 4.1% against the previous month. Likewise, industrial production grew by 3% in March y/y, largely driven by an uptick in commodities extraction and sales, as prices soared thanks to the war. But again, Finance Minister Anton Siluanov says that oil production could fall by as much as 17% this year once energy sanctions kick in, which are expected any day in the sixth package currently being discussed in Brussels.

Going forward, the outlook for the economy is poor as real incomes are expected to decline in double digits this year and the CBR anticipates an 8% to 15% contraction in 2022.

The forward-looking April PMI data from S&P Global also indicate a further decline in operating conditions across the Russian manufacturing sector in the coming months.

“The overall deterioration in the health of the sector was driven by further falls in output, new orders, employment and stocks of purchases, with supplier delivery times lengthening markedly. Rates of contraction in production and new sales eased from March, but sanctions weighed on client demand and the ability of firms to source raw materials. Input shortages and unfavourable exchange rate movements meanwhile led to further substantial upticks in cost burdens and output charges,” S&P Global said in a press release.

“Meanwhile, output expectations were historically subdued amid concerns regarding the impact of sanctions on future demand and new orders. Contributing to the further decline in operating conditions was a steep fall in production. The rate of decrease was the second-fastest since May 2020 during the initial stages of the pandemic. Firms often stated that lower output levels were due to a drop in new orders as the impact of sanctions was felt and customer purchasing power was reduced by rising prices,” S&P Global added.

The Russian economy is slowing down due to the uncertainties and also a renewed round of widespread disruptions to supply chains as imports are halted both due to sanctions and “self-sanctions” as foreign firms break off business ties with Russia voluntarily. New order inflows decreased again in April, S&P Global reports, and at a “strong pace.”

“Manufacturers mentioned that lower sales were the result of sanctions, higher prices and increased uncertainty amid geopolitical tensions. Despite easing from March's recent low, the pace of decline was the second-fastest since August 2020. In line with total sales, new export orders fell markedly. Some firms stated that imposed sanctions had led to the loss of a wide range of international customers,” S&P Global said.

High ruble volatility is also depressing business as companies husband their resources in the face of the restrictions placed on banks and uncertainty over the exchange rate. Together this drove up input costs during April, reported S&P Global. The rate of input price inflation was substantial and the second-steepest for over a year, S&P Global added.

Manufacturers continued to pass through higher cost burdens to their clients, which is adding to inflationary pressures, as selling prices rose at a marked pace. With the exception of March's series record rise, the rate of charge inflation was the sharpest since January 2015, reports S&P Global.

Consumer prices climbed by 17% y/y in March and rapid inflation has already begun to gnaw at the purchasing power of households. However, by the end of April the CBR said that inflation pressures were beginning to ease, partly thanks to its rapid emergency interest rate hike to 20% in March, and the central bank managed to cut rates twice in a month bringing the prime rate down to 14% at the end of the month.

Nevertheless, higher cost burdens and reduced production requirements had a knock-on effect and reduced employment. The rate of decline in workforce numbers was strong overall and sharper than the series average, suggesting the official RosStat results are running behind the realities.

Logistics delays and material shortages led to longer lead times for inputs, with April seeing the third-steepest lengthening of supplier lead times over 25 years of survey history, reports S&P Global.

“Although stocks of purchases and finished goods were depleted further, firms were reluctant to purchase more materials and input buying fell solidly as a result,” S&P Global said.

“Finally, output expectations across the Russian manufacturing sector remained historically subdued in April. Where firms were confident of growth, they linked this to opportunities from import substitution and hopes of an uptick in client demand. That said, the degree of optimism was the second-lowest in the current sequence of positive sentiment that began in June 2020. Sanctions and a drop in customer purchasing power weighed on confidence,” S&P Global concluded.

Data

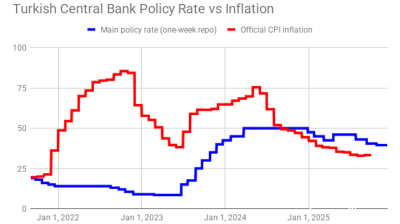

Turkey's central bank remains cautious, delivers 100bp rate cut

Decision comes on eve of next hearing in trial that could dislodge leadership of opposition CHP party.

Polish retail sales return to solid growth in September

Polish retail sales grew 6.4% year on year in constant prices in September, picking up from a 3.1% y/y rise in August, the statistics office GUS said.

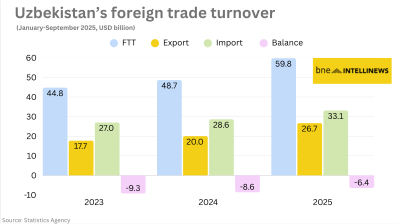

Uzbekistan’s nine-month foreign trade nears $60bn

Export growth of 33% and import expansion of 16% y/y produce $6.4bn deficit.

Hungary’s central bank leaves rates unchanged

National Bank of Hungary expects inflation to fall back into the tolerance band by early 2026, with the 3% target sustainably achievable in early 2027 under the current strict policy settings.