Russia's service PMI growth slows to 50.5 in September, as combined PMI goes into the red on slowing economic growth

Business activity in Russia’s services sector continued to expand in September, albeit at a marginal pace, according to the latest S&P Global services PMI. (chart)

The Russia Services PMI Index fell to 50.5, down from 52.3 in August, signalling only a slight increase in output and just anove the 50 no-change benchmark. While this marks the third consecutive month of growth, it represents the slowest expansion in this period, reflecting softening demand across the sector.

The services PMI follows a fall in the manufacturing PMI, which dropped to 49.5, down from 52.1 in August, dropping below the 50 benchmark for the first time since April 2022. New orders in manufacturing also fell, contributing to weaker total sales growth, the slowest in a 20-month growth streak.

Taken together and the weakening performance of both services and manufacturing dragged the S&P Russia Composite PMI Index down to 49.4 in September from 52.1 in August. The downturn was driven by declining manufacturing output, while the rise in services activity slowed.

As bne IntelliNews has reported, Russia’s economy is cooling as the military Keynesianism bump factors begin to wear off and the Central Bank of Russia (CBR) has put its foot on the break using non-monetary policy methods to cool an overheated economy. This year economic growth for the full year is expected to come in in the range of between 2.8% and 3.8%, but in 2025 economic growth is expected slow sharply.

With both services and manufacturing facing rising cost pressures, firms passed on these expenses to customers, resulting in higher selling prices across the board. However, job creation remained subdued, with services firms adding jobs only fractionally and manufacturing employment contracting.

New services business orders rose for the third straight month, though the pace of growth decelerated from August. "Despite demand increasing on average, there were instances of a slowdown in client activity," noted respondents in the survey. In line with this softer demand, job creation also slowed, with employment levels rising only modestly—at the weakest rate since February.

“Spare capacity persisted, as the level of incomplete business fell for the sixth consecutive month,” the survey highlighted, indicating that service providers had room to handle more business without straining resources.

Inflationary pressures remained a concern, with input prices rising at a robust pace, driven by higher wages and supplier costs. Inflation remains stuck at around 9%, despite continuous tightening of monetary policy by the CBR since the first quarter of last year to the current 19% prime rate. At least one more hike to 20% is expected before the end of this year.

While services cost inflation accelerated slightly compared to August, it remained below the series average. In response, service firms passed these higher costs onto customers, resulting in a historically elevated rate of charge inflation.

Despite these challenges, business confidence in the sector improved. Plans for increased advertising and optimism around new orders pushed sentiment to its highest level since May. “Service providers expected output to rise over the coming year,” the report noted.

Data

Chobani yoghurt king Hamdi Ulukaya becomes richest Turk

Knocks Murat Ulker into second place in Forbes ranking as his company's valuation leaps to $20bn.

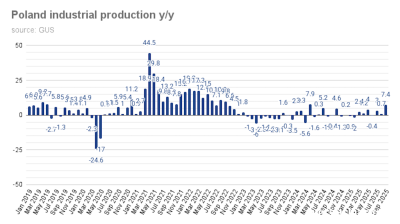

Poland’s industrial production jumps 7.4% y/y in September

September saw an unexpectedly sharp increase in industrial production after the surprise gain of 0.7% y/y in August.

Ukrainian M&A market grows 22% despite war, driven by local investors

Two large acquisitions by agriculture holding MHP and mobile operator Kyivstar accounted for more than half of the total deal value.

Ukraine’s credibility crisis: corruption perception still haunts economic recovery

Despite an active reform narrative and growing international engagement, corruption remains the biggest drag on Ukraine’s economic credibility, according to a survey by the Kyiv International Institute of Sociology.

_2_1761012864.jpg)