Russian state-owned banking giant VTB is trapped in an expensive lease for its European headquarters in London for another four years even as the Kremlin-controlled lender builds up a new investment base in Frankfurt, bne IntelliNews can reveal.

As Russian companies scramble to cut costs in the face of the coronacrisis, VTB is stuck in London in an top of the market office where its business was already dwindling.

Russia's second-biggest bank signed a 20-year lease in 2008 for its office bang in the heart of the City’s financial district on Bank Junction, immediately adjacent to the Royal Exchange, the Mansion House and the Bank of England.

But VTB only occupies two of the five floors and hundreds of staff have been cut in recent years, according to annual accounts filed to UK Companies House on May 19.

“The group has the option, as stipulated in the agreement, to first break the lease in August 2024,” said the filing. “Office space for the five floors at 14 Cornhill, London as the lessee, have the lease term of twenty years to February 2028.”

In a statement to bne IntelliNews, VTB press office elaborated that the lender had in fact never occupied two of the five floors, which were sublet on a commercial basis. In 2018, the bank sublet a further floor. "At the beginning of 2019, we performed a market analysis of property lease rates and our Cornhill lease rate is 30% below average City of London rates."

The number of bankers at VTB Capital in London was further reduced by almost 25% last year to 159 as pre-tax losses expanded to $61.5mn from $43.4mn. “Headcount decreased from 206 to 159 at the end of the period and will reduce further in 2020 from actions taken as part of the restricting plan,” according to the 150-page filing.

In the emailed statement, VTB added that "the target headcount" is 120 people, which entails a further 39 jobs losses.

bne IntelliNews last year reported that VTB, which once boasted over 600 bankers in London, had started to relocate bankers and business lines to Frankfurt after losses had tripled amid the looming cloud of Brexit. That process of setting up a trading capability in Frankfurt was accelerated following the UK’s exit from the European Union but VTB can’t Brexit itself due to the onerous penalties related to breaking its lease.

“You can stop paying but they [the landlords] will file legals,” a London commercial property expert told bne IntelliNews. “Or they could try to negotiate through lawyers but a bank would not want the problem to be known.”

Setting up shop in the heart of the city was a bold statement that the Russians had arrived as a force in capital markets. With the blessing of President Vladimir Putin, VTB boss Andrei Kostin famously started the investment bank after engineering a dawn raid of some of Deutsche Bank's top talent. The Russian bank lured about 150 personnel from the German giant, including Yuri Soloviev, then first deputy chairman. A staggering $500mn was set aside by the parent group to try to create a top investment bank from scratch, called VTB Capital, in the midst of the 2008 crisis.

Within three or four years, VTB Capital had replaced Deutsche Bank as the biggest trader of Russian securities and the leading organiser of Russian initial public offerings and debt deals.

At the time, VTB executives told me they wanted VTB Capital to become as pervasive and powerful in Russia as Deutsche Bank is in Germany as well as influential on global markets. Offices were opened in New York, Dubai, Singapore and Hong Kong to expand VTB’s international footprint but its calling card was always London, which was fast becoming a reservoir for Russian wealth and a home for oligarchs, including well-connected billionaires such as Roman Abramovich, Alisher Usmanov and Mikhail Fridman.

Kostin authorised multi-million packages to hire talent from Goldman Sachs, JP Morgan, UBS and Morgan Stanley. Its annual “Russia Calling” London conference showcased the investment potential of Russia and attracted big names such as French politician Christine Lagarde, Xavier Rolet, then Chief Executive Officer of the London Stock Exchange and a roll-call of curious top-tier investors.

But VTB fortunes in London were to sour after the Kremlin annexed Crimea in 2014 and backed a separatist campaign in Eastern Ukraine. The bank’s London shares tumbled 18% on March 3, 2014 after Putin's troop invasion in Crimea led to the biggest sell-off in Russian stocks for more than five years.

VTB, along with Sberbank and a host of other state lenders and officials, were sanctioned months later. EU and US prohibitions have restricted Russian banks in ways that go beyond the initial design, which was to restrict their ability to borrow on international markets. Leading Western investors reined in all trading activities with VTB Capital and other Russian brokerages for fear of drawing regulatory scrutiny and fines.

The bank's position was further undermined after the UK expelled 23 Russian diplomats in 2018, who the government said were “undeclared intelligence officers,” after accusing Moscow of using a nerve agent in the attempted murder of former Russian spy Sergei Skripal in Salisbury.

As part of an initial retrenching, VTB closed its fixed income cash bonds business in Hong Kong and dumped its loss-making Wall Street operation in a management buyout. Previous fillings show that VTB lost $1mn after vacating the lease early for its Wall Street base. At one stage, Kostin even threatened to remove the bank's listing from the London Stock Exchange in favour of China.

Kostin, who himself was sanctioned, has accused the UK regulators of making excessive demands of the UK operation due to Russia’s conflict with Ukraine. A former diplomat, Kostin also caused a stink in September 2018 after describing the now British Prime Minister Boris Johnson as a “jerk” at a press conference in Moscow.

In late 2015, New York-based Evercore Partners ended its deal-making joint venture with VTB due to US sanctions. As business has dried up in the US and the UK, both VTB Capital and its parent have made an aggressive push to secure more business in Africa and Asia with mixed results.

In 2019, the latest filing said the size of its lending portfolio remained largely unchanged and is dominated “by two legacy facilities guaranteed by a sub-Saharan African sovereign.” Its maximum credit to any client is $200mn to Lloyds of London, who helped VTB “to de-risk some of its larger African sovereign exposures by writing comprehensive credit insurance.” VTB has sued a Mozambican government company over an unpaid loan that is part of a $2bn multinational fraud scandal known as “tuna bonds,” which plunged the Mozambique into deep financial crisis.

Mozambican state-owned companies, including a tuna fishing venture and a coastal security company, borrowed more than $2bn from VTB and Credit Suisse between 2013 and 2016. The loans were packaged into bonds and sold to investors around the world. However, hundreds of millions of dollars then went missing. The scandal produced a series of lawsuits in London, New York and South Africa that implicated Mozambique’s ex-Finance Minister, five Credit Suisse business executives and about 20 others.

The retreat to Frankfurt has been in the works for a while. In 2017, Kostin told German newspaper Handelsblatt about his plans to bundle its European businesses in a new HQ in Frankfurt."We want Frankfurt to be the headquarters for this bank because we believe that this city will become an even more important centre for financial activity after Brexit," said Kostin, who added that VTB may yet remain in London in some capacity.

The bank said VTB Capital Zug in Frankfurt has "now become the heartbeat" of its international commodities business following the merging of three of the group's entities continental Europe but there are not plans for further changes to the investment bank's business model.

In the statement, the bank said VTB Capital remains an intengral part of the group's business but should not be taken "as a proxy" for the bank's overall performance. "VTB Capital's loss for 2019 results exclusively from the bank's residual lending peformance," it said.

In its heyday, VTB Capital contributed a third of its parent’s profits but those days appear to be long gone as its fights for relevance amid sanctions and a global recession triggered by covid-19.

“While we acknowledge that uncertainties in respect of the geopolitical situation remain, the extent to which these could affect the group’s results and financial position is not currently determinable,” said VTB secretary Roger Munger in the filing. “However, we are confident that the ultimate parent bank, VTB, remains extremely supportive of the bank.”

Features

Indian bank deposits to grow steadily in FY26 amid liquidity boost

Deposit growth at Indian banks is projected to remain adequate in FY2025-26, supported by an improved liquidity environment and regulatory measures that are expected to sustain credit expansion of 11–12%

What Central Asia wants out of the upcoming Washington summit

Clarity on critical minerals and a lot else.

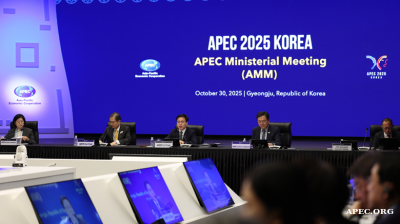

Global leaders gather in Gyeongju to shape APEC cooperation

Global leaders are arriving in Gyeongju, the cultural hub of North Gyeongsang Province, as South Korea hosts the Asia Pacific Economic Cooperation summit. Delegates from 21 member economies are expected to discuss trade, technology and security.