South Korea's central bank has opted to keep its benchmark interest rate unchanged at 3% despite mounting concerns over the country's economic performance. This decision follows two consecutive rate cuts in October and November, marking the first such back-to-back cuts since the global financial crisis of 2009. The Bank of Korea (BOK) made the decision during its monetary policy meeting in Seoul on January 16, highlighting the uncertainties surrounding the local economy and currency, as reported by Yonhap.

The BOK cited the growing risks posed by shifting domestic political landscapes and changing economic policies from major countries, particularly the United States under its new administration. The central bank's cautious stance is rooted in the weakening of the South Korean won, which has recently dropped below KRW1,450 per dollar, a level not seen since the aftermath of the financial crisis. The sharp decline in the won is attributed to President Yoon Suk Yeol's controversial martial law imposition and concerns over US President-elect Donald Trump's tariff threats, both of which have sparked political turmoil and economic instability.

The won's weakening further compounds inflationary pressures, with experts predicting that it could push consumer prices up by 0.05 percentage points. A widening gap between South Korea’s interest rates and those of the US could also lead to increased foreign capital outflows, putting additional strain on the local currency. The Federal Reserve’s more cautious approach to rate cuts, scaling back its initial four cuts to just two in 2025, has added to the uncertainty in Asian currencies.

Amid these external challenges, the South Korean economy is grappling with weak domestic demand, slowing exports, and potential policy changes from Washington. The BOK has revised its growth forecast for 2025 down to 1.9%, below the country's potential growth rate of 2%. The finance ministry's outlook is even more pessimistic, forecasting a mere 1.8% expansion for next year.

The decision to maintain interest rates comes as the BOK navigates the delicate balance between supporting weak growth momentum and ensuring financial stability in a volatile global environment.

Data

Chobani yoghurt king Hamdi Ulukaya becomes richest Turk

Knocks Murat Ulker into second place in Forbes ranking as his company's valuation leaps to $20bn.

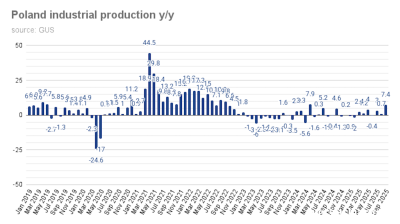

Poland’s industrial production jumps 7.4% y/y in September

September saw an unexpectedly sharp increase in industrial production after the surprise gain of 0.7% y/y in August.

Ukrainian M&A market grows 22% despite war, driven by local investors

Two large acquisitions by agriculture holding MHP and mobile operator Kyivstar accounted for more than half of the total deal value.

Ukraine’s credibility crisis: corruption perception still haunts economic recovery

Despite an active reform narrative and growing international engagement, corruption remains the biggest drag on Ukraine’s economic credibility, according to a survey by the Kyiv International Institute of Sociology.