For years, the Kremlin has wanted to block YouTube. However, Russian authorities have been dragging their heels, waiting for YouTube's local rivals to mature. Now that point is fast approaching: the growth of “RuTube” has been slow, but steady.

YouTube streaming speeds will be slowed due to “technical problems” with Google’s equipment in the country, state-owned telecom giant Rostelecom announced July 12. Rostelecom said that “growth in traffic” had led to a “serious overload” that serve YouTube videos and other Google services. “This may affect the download speed and playback quality of YouTube videos for users of all Russian operators,” Rostelecom said, the Moscow Times reported.

YouTube still on top

According to tech research firm Mediascope, watching videos accounts for 18% of Russians' total time spent on the Internet. YouTube remains the largest platform in this category. In March and April 2024, the service's monthly reach was 90mn people, and in May it grew to 96mn.

At last month's St. Petersburg International Economic Forum, Russia's digital development minister Maksut Shadaev announced that local service VK Video had outpaced YouTube in mobile traffic, albeit by a symbolic 1%.

Last year, the State Duma, Russian Parliament's lower chamber, ruled out blocking YouTube until the arrival of full-fledged local alternatives. Back then, Alexander Khinshtein, chairman of the State Duma's committee on information policy, told Interfax that "there is no adequate Russian replacement for YouTube at the moment, but the key word is 'at the moment'."

Window of opportunity

Several video streaming services are operating in Russia, which in one way or another can be considered YouTube's competitors. All of them have been recently gaining momentum, also taking advantage of a situation when YouTube is blocking pro-war and pro-Kremlin content.

In early July, YouTube blocked the channels of several major Russian artists who support the country's war in Ukraine, following an appeal from the Lithuanian Radio and Television Commission (LRTK). LRTK threatened the streaming giant with fines, insisting that hosting pro-war artists was in violation of the EU's sanctions.

Among the artists banished from YouTube were Shaman and Polina Gagarina, who were included in the EU's fourteenth package of sanctions against Russia last month over staging concerts in occupied regions of Ukraine and participating in state-sponsored propaganda events.

YouTube also suspended the channels of singers Oleg Gazmanov, Grigory Lepsveridze and Yulia Chicherina, all of whom have actively supported Russia's invasion of Ukraine.

Local competitors on the rise

The biggest Russian video streaming services are RuTube, owned by the state-run media giant Gazprom Media; VK Video, the video arm of the social networking website VK); Dzen, formerly owned by the tech giant Yandex and sold to VK in 2022, and Nuum, a new project launched by the mobile phone giant MTS.

In March-April 2024, RuTube's monthly audience increased by 161% compared with the beginning of the year, Mediascope calculated. The platform's monthly reach amounted to 48.9mn people. The core of the audience also grew younger. Instead of the 45-54 years-old, as it was a year ago, now the core is made up of 25-34 years-old and 35-44 years-old viewers.

In April 2024, the audience of VK Video reached 70.5mn users, according to Mediascope. VK claims that average daily views increased by 21% and reached 2.5bn in the first quarter. And cumulative time spent viewing on the platform increased by 95% compared to the same period in 2023.

Dzen does not separately count its audience for video, as the platform also offers text content. Still, video is the most popular format on Dzen, accounting for 40% of all time spent on the platform.

Nuum, which has been operating for less than a year, said that it has over 6mn users per month, MTS said.

Growth strategies

RuTube says it does not aim to replace YouTube, rather intending to become a convenient and interesting environment for bloggers. "But if YouTube is really blocked in Russia, RuTube will be ready," the company said. "We conducted a number of trials and tests showing that the platform will be able to accommodate all users within a short time." Similarly, Nuum does not see its task as "replacing YouTube."

MTS says that the service is developing its own business model, which will be different from that of YouTube. This model includes direct interaction between the creator and the advertiser, combining offline and online events. These can be integrations into festivals, concerts, creating online content based on backstage footage, interviews etc.

VK Video says it has been focused on creating exclusive content. It hired popular Russian bloggers, such as Satyr, Kukoyaki or Ida Galich, to make their shows. The service has also launched VK Video Originals, featuring cooking and travel shows, as well as documentary projects.

The VK Video team will soon release an application for tablets with interactive formats enabling users to interact with the content.

Dzen is pursuing a similar strategy. Between June 2023 and June 2024, it launched 18 exclusive shows. Content is posted by popular figures, such as Slava Marlow, Dmitry Kuplinov and Sergey Minaev. Meanwhile, Dzen is planning to monetize the exclusives and introduce a paid subscription.

"We have already started testing this feature," the company said in a statement. "Bloggers will be able to publish videos, articles and clips behind a paywall - for the full version, the service will offer users to pay for monthly access. Also, authors will be able to specify the cost of a monthly subscription to their exclusive content in the range from RUB99 ($1.1) to RUB100,000 ($1,135)."

Challenging task

Still, building and running a Russian video streaming service that could compete with YouTube is a major challenge.

One issue that the local companies operating in this segment are facing is a shortage of qualified IT personnel, as many IT professionals have left Russia over the last two years, although as bne IntelliNews reported, Russia’s brain drain is has reversed recently thanks to the flourishing Russian economy according to the Central Bank of Russia (CBR) latest macroeconomic survey, and a multitude of well-paid job opportunities.

Another major issue is building recommendation algorithms for which substantial amounts of user data are needed.

"YouTube has a huge audience that can be segmented however you want, and for the entire time of use there is accumulated information about each user, as it is a product of the Google ecosystem," Sergey Grebennikov, director of the Russian Association of Electronic Communications (RAEC), was quoted as saying by the Russian business daily Kommersant. "The entire Google database, including information from the search engine and browser is also available to YouTube. As a result, their recommendations are more personalized and meet the interests of users".

In addition, content offered by Russian video streaming services is limited, especially in certain areas.

According to Grebennikov, Russian video services are lagging behind in some genres, such as user-generated educational content, which is in high demand as many video platform users go there to learn new skills.

Can they replace YouTube?

Meanwhile, observers admit that none of Russia's existing video streaming services could realistically replace YouTube in the near future.

"No matter how much I advocate domestic video services, so far I do not see any alternatives to YouTube in terms of the volume and variety of content," Alexei Byrdin, general director of the Internet Video Association, told Kommersant. "True, our largest services have come close to YouTube in terms of monthly audience, but the daily audience and, most importantly, the total volume of media consumption, expressed in viewing time, are simply not comparable." However, according to Byrdin, it is still technically possible to create a global competitor to YouTube and Instagram, as the example of TikTok shows. "And I will be glad to see the development of VK, RuTube, Nuum and other Russian platforms," he said.

Still, the Russian video streaming segment continues to attract new players. Last month, a Russian organization called the regional public centre for internet technologies presented a new video streaming service, Platform.

"Since 2020, YouTube has removed the channels of all Russian state-run TV networks, and continues to remove patriotic bloggers," says Platform's presentation, stating it as the main reason for the new project's launch. Incidentally, Platform's interface is very similar to that of YouTube, "so users will not have to change their habits".

Tech

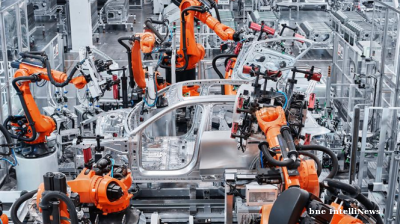

China increasing its lead in robot technology use

China is consolidating its dominance in the global industrial robotics market, accounting for 41% of the world’s operational robot stock and more than half of all new installations in 2024, according to the International Federation of Robots.

The Iranian inventor that invented the floating shoes, has now built a propeller-less propulsion system ideal for flying taxis

Mohsen Bahmani is an Iranian-born mechanical engineer and a man with a dream. When he was just 17 years old, he made a pair of floating shoes that allow you to walk on water. Now he has built a propulsion system ideal for flying taxis.

_(1).jpg)

OpenAI to invest up to $25bn in Argentina under Milei incentive scheme

Artificial intelligence giant OpenAI and energy company Sur Energy have signed a letter of intent to develop a data centre hub in Argentina requiring investment of up to $25bn.

Helium was China's rare earth metals Achilles' heel

China has a devastating tool in its escalating trade war with the US: rare earth metals (REMs). Last week, Beijing announced new restrictive export controls on the export of anything with even a smidgen of Chinese-produced REMs.

.jpg)