Turkey’s official consumer price index (CPI) inflation was recorded at 55% y/y in February compared to 58% y/y in January, the Turkish Statistical Institute (TUIK, or TurkStat) said on February 3 (chart).

In a somewhat incoherent note, TUIK also said that it was unable to collect price data in the region hit by the earthquake disaster at the start of Februay. It was, however, able to reflect the actual situation as regards price increases in the country, with the earthquake the only standout problem, it added.

The official inflation rate as measured by TUIK peaked in October at 86%, which was the highest headline rate posted by Turkey since the 91% registered in June 1998. With the advent of December, the base effect from a year previously came into effect, pulling inflation down.

At 55%, Turkey now sits in eighth place in the world inflation league.

The Istanbul-based ENAG inflation research group of economists, meanwhile, released an inflation figure of 127% y/y for February. The ENAG figure calculated for January was 122% y/y.

TUIK also gave an official figure of 77% y/y for February producer price index (PPI) inflation.

In January, the central bank left its expectation for end-2023 official inflation unchanged at 22% (upper boundary: 27%).

The guidance was based on the assumption that the lira will not experience another crash. As of March 3, the USD/TRY pair was weaker by 2% at TRY 18.8970 from 18.6 on October 27.

If the USD/TRY remains stable, Turkey’s official inflation figure is set to decline to the 30-40%s across 2023.

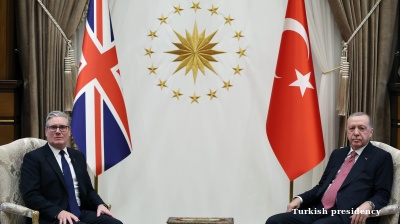

On February 23, the monetary policy committee (MPC) of the central bank cut its policy rate by 50bp to 8.50%. Guidance is awaited from Turkey’s president, Recep Tayyip Erdogan, on whether the policy rate is currently satisfactory or should be lowered further.

But in Turkey, the policy rate and central bank are essentially idle on the sidelines. The government conducts monetary policy via macroprudential measures and non-capital controls.

Amid the booming lira supply and hard currency outflows via record trade deficits, the lira remains stable thanks to sticks held to the exposed backs of bankers by officials who demand the blocking and gumming up of domestic FX demand. Also supportive are unidentified inflows and support from “friendly countries”.

Another lira tragedy would come as no surprise. It could happen at any time.

Meanwhile, the political stage is hotting up. Erdogan retains the option of delaying the presidential and parliamentary elections from May 14 in his pocket (see here how a postponement would be delivered and see here for an explanation of how delaying the elections is one of Erdogan’s three alternatives).

There is an argument that the latest pledge by Erdogan suggesting that the elections will indeed be held on May 14 should strengthen expectations that he is in fact getting ready to delay the elections.

The publicity grab on when the elections should be amounts to a typical manipulation staged by the Erdogan administration. It has been seen dozens of times during Erdogan’s two decades in power. Erdogan has misled and staged such plots throughout his political career.

Media players typically have a memory of one day. So, Erdogan can withhold the truth and repeat himself continuously without ever being nailed. The media overall does not remember what happened two days ago.

On March 3, the opposition alliance descended into a very public row over who their presidential candidate should be. The IYI Party (Good Party) is against main opposition Republican People’s Party (CHP) chairman Kemal Kilicdaroglu winning the nomination.

There’s a very strong argument that Erdogan would have no chance of a win at the polls in a fair election. A vast majority would vote for whoever was made his main rival. However, staying in power is a vital necessity for Erdogan. As a president kicked out of office who remained in Turkey, he would end up in jail together with clan members.

So the identity of the main challenger is really not that important.

Erdogan’s other two options to resolve his predicament are the proclamation of another ‘victory’ that in no way could be verified thanks to skulduggery arranged by officials (foreign policy has been prepared for this option, meaning Erdogan will be expecting the key phone calls of congratulation rather than protests from the big capitals) or an escape to self-exile abroad (which might only delay jail given live legal cases ongoing in foreign jurisdictions).

The political noise will get louder and louder in the coming weeks. The opposition candidate fiasco has already overshadowed the continuing earthquake coverage.

It looks pretty clear that more than a hundred thousand Turks died in the earthquakes that impacted 11 provinces (despite the official death toll having only reached 46,000 so far) and more than 10 million people. Yet it only topped Turkey’s agenda for around three weeks.

This is Turkey. Non-stop action. Most of it in vain as the rot endures.

In the wider world, the turbulence-free mood on the global market continues. Turkey’s five-year credit default swaps (CDS) remain below the 600-level, while the yield on the Turkish government’s 10-year eurobonds remains below the 10%-level.

Data

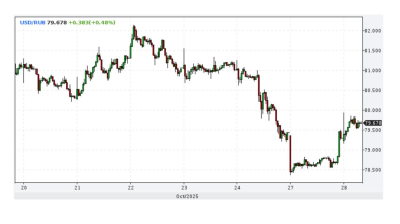

Ruble strengthens as sanctioned oil companies repatriate cash

The Russian ruble strengthened after the Trump administration imposed oil sanctions on Russia’s leading oil companies, extending a rally that began after the Biden administration imposed oil sanctions on Russia in January.

Russia's central bank cuts rates by 50bp to 16.5%

The Central Bank of Russia (CBR) cut rates by 50bp on October 24 to 16.5% in an effort to boost flagging growth despite fears of a revival of inflationary pressure due to an upcoming two percentage point hike in the planned VAT rates.

Ukraine's trade deficit doubles to $42bn putting new pressure on an already strained economy

Ukraine’s trade deficit has doubled to $42bn as exports fall and imports balloon. The balance of payments deficit is starting to turn into a serious problem that could undermine the country’s macroeconomic stability.

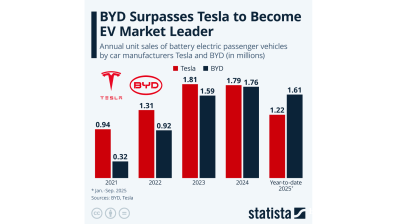

BYD surpasses Tesla to become EV market leader – Statista

While Chinese manufacturer BYD already pulled ahead of Tesla in production volume last year, with 1,777,965 battery electric vehicles (BEV) produced in 2024 (4,500 more than Tesla), the American manufacturer remained ahead in sales.

_Cropped_1761809941.jpg)