The Turkish central bank has simultaneously cut reserve requirements and hiked interest rates it pays on required reserves for lenders that achieve loan growth of between 10-20%, the regulator said on August 19 in a written statement.

Accordingly, for those banks that qualify with loan growth, the required reserve ratio for deposits with up to 3-month and 6-month maturities has been pushed down to 2% from the previous 7% and 4%, respectively.

Meanwhile, the national lender has raised the interest rate on required reserves to 15% from the previous 13%, but again only for those lenders who make it into the loan growth band of between 10-20%. Another move sees the interest rate on the required reserves of lenders whose loan growth is not in the reference band cut to 5%.

Government pushes private banks

The central bank’s announcement comes with the government demanding that private banks join state banks in boosting loans with the aim of stimulating economic activity that has collapsed amid the stark economic downturn Turkey has suffered since last year’s lira crisis. However, previous lending cycles have resulted in rising FX demand and growing imports due to low confidence in the government’s economic policy making. Following the central bank announcement, the lira weakened to 5.75 against the USD, a level it had not been seen at since June. The currency was 7% weaker against the dollar compared to where it stood at the end of last year. Dollar-denominated bonds issued by Turkey's government edged lower after the central bank issued its statement.

There is some speculation that the Erdogan administration is not concerned that the measures do not feed into sustainable growth because it is looking for a 12-month economic splash in line with a plan to call early elections.

With the revisions, the central bank is to provide TRY5.4bn and $2.9bn worth of gold and FX liquidity to the market, according to the statement from the authority.

Seen as radical

The central bank’s steps to revive loan growth are radical in the eyes of Seker Invest, as relayed in its August 20 daily bulletin. The equities house noted that the authority said the changes were aimed at supporting financial stability, but in essence the decision aims to encourage banks to grant new loans given that lower required reserve ratios and higher returns go to those lenders that generate higher loan growth.

Banks with loan growth that stays below 10% will be penalised, Istanbul-based Seker Invest observed, adding that the additional lira liquidity that will be provided to the system should also change indirectly through the reserve option mechanism (ROM) channel, which is hard to quantify.

Seker considered the move to be a further step in loosening monetary policy with the aim of reviving domestic demand. It follows the recent 425bp rate cut introduced by the central bank after its governor was fired by presidential decree for not following interest rate policy “instructions” and the decision to hold 1 and 3 month swap auctions in which the central bank provides lira liquidity at lower rates.

William Jackson, chief emerging markets economist at Capital Economics, said the move worried investors because high rates of loan growth during recent Turkish economic recoveries had lead to higher imports and a widening current account deficit. “The move essentially reduces the required reserve ratios for banks with higher loan growth. I think it is worrying, if we consider that what is needed is weak domestic demand and growth lead by exports,” Jackson said in remarks cited by Reuters.

News

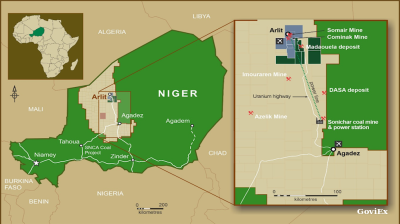

GoviEx, Niger extend arbitration pause on Madaouela uranium project valued at $376mn

Madaouela is among the world’s largest uranium resources, with measured and indicated resources of 100mn pounds of U₃O₈ and a post-tax net present value of $376mn at a uranium price of $80 per pound.

Brazil’s Supreme Court jails Bolsonaro for 27 years over coup plot

Brazil’s Supreme Court has sentenced former president Jair Bolsonaro to 27 years and three months in prison after convicting him of attempting to overturn the result of the country’s 2022 election.

Iran cleric says disputed islands belong to Tehran, not UAE

Iran's Friday prayer leader reaffirms claim to disputed UAE islands whilst warning against Hezbollah disarmament as threat to Islamic world security.

Kremlin puts Russia-Ukraine ceasefire talks on hold

\Negotiation channels between Russia and Ukraine remain formally open but the Kremlin has put talks on hold, as prospects for renewed diplomatic engagement appear remote. Presidential spokesman Dmitry Peskov said on September 12, Vedomosti reports.