The monetary policy committee (MPC) of Turkey’s central bank on September 19 kept its policy rate unchanged at 50% for the sixth straight month in line with market expectations (chart).

While core goods inflation remained low despite a slight uptick, an improvement in services inflation can be expected to occur in the last quarter, the MPC noted.

The decisiveness shown with the tight monetary stance would bring down the underlying trend of monthly inflation through a moderation in domestic demand, a real appreciation in the Turkish lira and an improvement in inflation expectations, the authority reiterated.

The tight monetary policy would be maintained until a significant and sustained decline in the underlying trend of monthly inflation was observed and inflation expectations converged to the projected forecast inflation range, it also restated.

The central bank said it would also keep employing macroprudential measures and sterilisation tools.

Rate cuts in Q4

The next MPC meeting is scheduled for October 17. The rate-setters at this point look set to again stick with the 50% benchmark.

As things stand, a rate cut is expected in the fourth quarter.

In June 2023, following the post-election appointment of Turkey’s new economic team led by finance minister and ex-Wall Street banker Mehmet Simsek, the Erdogan regime U-turned on monetary policy and launched a tightening process that is ongoing.

The policy rate was hiked to 50% by March this year from the ultra-loose 8.5% that was in play in June last year.

Central bank tracking monthly inflation

On September 3, the Turkish Statistical Institute (TUIK, or TurkStat) said that Turkey’s consumer price index (CPI) inflation officially stood at 52% y/y in August versus 62% y/y in July.

TUIK also posted monthly official inflation of 2% for August. It released 3% m/m for July and 2% m/m for June, after releasing 3% m/m figures for the three previous months.

In the coming months, TUIK is set to deliver further outcomes in the 1-2%s for the official monthly headline indicator.

With reference to "inflation expectations", the MPC refers to the central bank’s monthly expectations survey.

Critics, with arched eyebrows, complain that the authority has rather a lot of luck in receiving official monthly inflation and inflation expectation figures in line with its wishes.

Tweets: "The logo on the right" is the central bank. TUIK and the central bank jointly prepare tourism income (or officially "travel income" in the balance of payments (BoP)) ‘data’.

ISTANBUL BLOG writes:

The survey method and the macro data business are pure charlatanry.

Even if the interviewers in question manage to convince some real tourists to fill in the form, the output would remain a perfect nonsense due to the intrinsic weaknesses of the survey method.

Plus, a few years ago, after unidentified inflows under its net errors and omissions account smelt to heaven, the Erdogan regime transferred some of the unidentified inflows to the travel income account by ‘updating’ the tourism income data.

Big big men, meanwhile, devise ‘analysis’ based on the central bank’s BoP ‘data’ , just as they talk about gods, nations, histories and so forth with the same seriousness.

Positive real rate in September

On October 3, TUIK will release the official September inflation data and the annual figure will fall below the policy rate for the first time since July 2021.

End-2024 inflation is set to be released at around 42% y/y

TUIK’s inflation series peaked at 75.45% in May. It is now quickly falling back to the 40%s thanks to the base effect.

Putting out a headline figure of below 40% would perhaps prove too much of a stretch even for the country’s infamous statistical institute.

On August 8, Turkey’s central bank kept its end-2024 official inflation "target" unchanged at 38% in its latest quarterly inflation report.

The upper boundary of the forecast range was also left unchanged at 42%.

The inflation report also reiterated that average "seasonally-adjusted" official monthly inflation will decline to 2.5% in 3Q24 and to below 1.5% in 4Q24.

On September 5, the government cut its end-2024 inflation to 41.5% y/y in its new medium-term economic programme (OVP).

On November 8, the central bank will release its next inflation report and updated forecasts.

Technical recession on cards

On September 5, the government also cut its 2024 official GDP growth release target to 3.5% y/y.

As things stand, a technical recession (negative official GDP growth figures posted for two consecutive quarters on a q/q basis) is on the cards.

On November 29, TUIK will release its 3Q24 data.

On September 2, it released a 0.1% q/q official growth rate for 2Q24.

On November 29, a revision to a minus 0.X% q/q rate for 2Q24 and the announcement of a minus 0.Y% rate for 3Q24 would do the job for the announcement of a technical recession.

In this case, rather than launching the rate-cutting cycle with 250-bp cuts in October and/or November, a 500-bp cut could commence the cycle in December, based on the technical recession argument.

Fed begins with a jumbo cut

Looking at the global markets, the Federal Reserve (Fed) has jumped on the global easing train with a jumbo rate cut on September 18. The Fed uses 25bp units in its policy rate. Americans dub a 50bp move "jumbo".

Turkey’s CDS remain below the 300-level, while the yield on the Turkish government’s 10-year eurobonds fell below the 7%-level thanks to the Fed.

After launching its rate-cutting cycle with a 25bp cut in June, the European Central Bank (ECB) delivered another 25bp cut on September 12.

The possibility of some "short-breathed" turbulence at the beginning of November should not be excluded. However, with the beginning of the new year rally, the easing atmosphere will come in strong.

Carry resumes with September

Since August 27, the Erdogan administration has turned to its straight line policy in the USD/TRY rate. The pair is currently drawing a line around the 34-level.

Between March and July, the Erdogan regime drew a line around the 32-level. Come August, the 33s and shortly after the 34s were seen as the new USD/TRY level.

Since the local elections that took place on March 31, the central bank has managed to build up its reserves thanks to portfolio inflows (mainly carry trade), declines in FX deposits at local banks and increases in FX loans.

With July, the portfolio inflows slowed sharply and the central bank introduced caps on FX loan growth (due to tightening concerns).

During the summer dry-up in August, portfolio flows turned negative. With September, inflows resumed.

There is now a short window ahead for renewed inflows prior to the possible shake-up in November.

| Carry Trade Flows to Turkey (estimate) | ||||||||

| million USD | Turkish Banks Off-Balance Sheet FX Position | Turkish Central Bank's Total Swap Stock with Local Banks | Swaps Converted to Deposits |

Lira-settled FX Frowards | Turkish Central Bank's Net FX Derivatives Stock with Local Banks | Turkish Banks' Swap Stock with Foreign Counterparts (estimate) | Carry Trade Flows (estimate) | Cumulative Flow |

| Mar 29, 2024 | 55,781 | 57,898 | 433 | 4,279 | 61,744 | -5,963 | ||

| Apr 26, 2024 | 43,446 | 39,586 | 363 | 3,384 | 42,607 | 839 | 6,803 | 6,803 |

| May 31, 2024 | 35,224 | 20,811 | 243 | 592 | 21,160 | 14,064 | 13,224 | 20,027 |

| Jun 28, 2024 | 21,134 | 4,719 | 0 | 0 | 4,719 | 16,415 | 2,352 | 22,378 |

| Jul 26, 2024 | 18,656 | 55 | 0 | 0 | 55 | 18,601 | 2,186 | 24,564 |

| Aug 9, 2024 | 17,925 | 0 | 0 | 0 | 0 | 17,925 | -676 | 23,888 |

| Aug 16, 2024 | 19,015 | -225 | 0 | 0 | -225 | 19,240 | 1,315 | 25,203 |

| Aug 23, 2024 | 18,762 | 0 | 0 | 0 | 0 | 18,762 | -478 | 24,725 |

| Aug 29, 2024 | 17,337 | 0 | 0 | 0 | 0 | 17,337 | -1,425 | 23,300 |

| Sep 6, 2024 | 17,906 | 0 | 0 | 0 | 0 | 17,906 | 569 | 23,869 |

| Sep 13, 2024 | 21,020 | 0 | 0 | 0 | 0 | 21,020 | 3,114 | 26,983 |

Table: Carry trade flows to Turkey.

| Weekly net flows to Turkey's lira papers | |||||

| million USD | Government papers | Cumulative since end-March | Stocks | Total cumulative | |

| April | 843 | 843 | 225 | 225 | 1,068 |

| May | 6,597 | 7,440 | -394 | -169 | 7,271 |

| June | 688 | 8,128 | -1,368 | -1,537 | 6,591 |

| July | 2,974 | 11,102 | 94 | -1,443 | 9,659 |

| Aug 2, 2024 | -162 | 10,940 | -169 | -1,612 | 9,328 |

| Aug 9, 2024 | 18 | 10,958 | -324 | -1,936 | 9,022 |

| Aug 16, 2024 | 1,404 | 12,362 | -298 | -2,233 | 10,129 |

| Aug 23, 2024 | -1,026 | 11,336 | 66 | -2,167 | 9,168 |

| Aug 29, 2024 | 683 | 12,018 | -20 | -2,187 | 9,832 |

| Sep 6, 2024 | -864 | 11,155 | -51 | -2,238 | 8,917 |

| Sep 13, 2024 | 1,647 | 12,801 | -321 | -2,558 | 10,243 |

Table: Net flows into Turkey’s domestic government paper and equities.

| FX loans and deposits at Turkish banks | ||||||

| USDmn | FX loans | Change | Cumulative change | FX deposits | Change | Cumulative |

| Mar 29, 2024 | 134,675 | 210,403 | ||||

| Apr 26, 2024 | 140,714 | 6,039 | 6,039 | 205,381 | -5,022 | -5,022 |

| May 31, 2024 | 150,233 | 9,519 | 15,558 | 192,793 | -12,588 | -17,610 |

| Jun 28, 2024 | 151,399 | 1,166 | 16,724 | 188,742 | -4,051 | -21,661 |

| Jul 26, 2024 | 155,315 | 3,916 | 20,640 | 190,908 | 2,166 | -19,495 |

| Aug 2, 2024 | 156,640 | 1,325 | 21,965 | 191,594 | 686 | -18,809 |

| Aug 9, 2024 | 157,400 | 760 | 22,725 | 194,229 | 2,634 | -16,175 |

| Aug 16, 2024 | 158,503 | 1,103 | 23,828 | 195,477 | 1,249 | -14,926 |

| Aug 23, 2024 | 160,590 | 2,087 | 25,915 | 199,338 | 3,861 | -11,065 |

| Aug 30, 2024 | 160,509 | -81 | 25,834 | 198,245 | -1,093 | -12,158 |

| Sep 6, 2024 | 161,312 | 803 | 26,637 | 199,281 | 1,036 | -11,122 |

| Sep 13, 2024 | 161,595 | 283 | 26,920 | 197,133 | -2,148 | -13,270 |

| Sep 16, 2024 | 161,889 | 294 | 27,214 | 198,644 | 1,511 | -11,759 |

Table: FX loans and deposits at Turkish banks.

After burning through about $7bn worth of reserves in August, the central bank added around $8bn to its reserves in the first two weeks of September.

| Turkish central bank's net FX position | |||||||||

| A.1_FOREIGN ASSETS (Thousand TRY) | P.1_TOTAL FOREIGN LIABILITIES (Thousand TRY) | Net (A.1-P.1) | USD/TRY Buying | Net USDmn | 2. Aggregate short and long positions in forwards and futures in foreign currencies | 3. Other (specify) | Net (minus) swaps | Cumulative change (USD bn) | |

| Mar 29, 2024 | 4,057,007,074 | 3,834,312,295 | 222,694,779 | 32.26 | 6,903 | -76,653 | -4,338 | -74,088 | |

| May 30, 2024 | 4,675,489,675 | 3,476,230,575 | 1,199,259,100 | 32.25 | 37,188 | -39,291 | -4,680 | -6,783 | 67 |

| Jun 28, 2024 | 4,762,091,401 | 3,700,003,784 | 1,062,087,617 | 32.83 | 32,355 | -24,565 | -3,264 | 4,526 | 79 |

| Jul 31, 2024 | 4,967,794,204 | 3,565,009,078 | 1,402,785,126 | 33.08 | 42,401 | -23,112 | 0 | 19,289 | 93 |

| Aug 29, 2024 | 5,142,259,219 | 3,967,022,626 | 1,175,236,593 | 33.92 | 34,644 | -22,339 | 0 | 12,305 | 86 |

| Sep 13, 2024 | 5,274,745,527 | 3,838,014,895 | 1,436,730,632 | 33.82 | 42,487 | -22,324 | 0 | 20,163 | 94 |

| Sep 18, 2024 | 5,354,472,609 | 3,890,392,525 | 1,464,080,084 | 34.03 | 43,025 | ||||

Table: Turkish central bank’s net FX position.

Data

Chobani yoghurt king Hamdi Ulukaya becomes richest Turk

Knocks Murat Ulker into second place in Forbes ranking as his company's valuation leaps to $20bn.

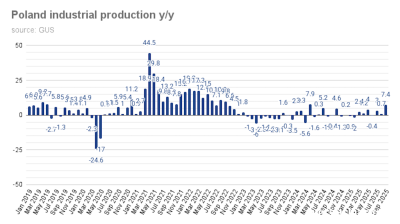

Poland’s industrial production jumps 7.4% y/y in September

September saw an unexpectedly sharp increase in industrial production after the surprise gain of 0.7% y/y in August.

Ukrainian M&A market grows 22% despite war, driven by local investors

Two large acquisitions by agriculture holding MHP and mobile operator Kyivstar accounted for more than half of the total deal value.

Ukraine’s credibility crisis: corruption perception still haunts economic recovery

Despite an active reform narrative and growing international engagement, corruption remains the biggest drag on Ukraine’s economic credibility, according to a survey by the Kyiv International Institute of Sociology.