Vladimir Kiriyenko, the new CEO of internet major VKontakte, enjoyed a day in the limelight at the St Petersburg International Economic Forum in June (SPIEF). “We have exceeded a monthly audience of 100mn and a daily audience of 50mn,” he told a room full of executives and officials. “For us, that’s a big achievement, the group has been working towards it for a long time,” he added.

Before Kiriyenko joined, Vkontakte (more commonly known as VK) had been stagnating in comparison with its international peers. Revenue growth had been falling steeply since the end of 2020, and the company had a net debt to EBITDA ratio of around 2.5 going into 2022.

When Russia sent troops into Ukraine in February, however, VK’s fortunes changed. Sanctions on Russian tech companies saw some of the competition drop away, driving their users into VK’s open arms. Bans on some foreign social media platforms also helped VK. A host of new opportunities presented themselves – like acquiring assets being ditched by struggling rivals for knockdown prices and riding a wave of support from a government embroiled in an information war.

Now, VKontakte is consolidating its position in the Russian market, even as its competitors suffer from a dramatic tech crisis which has seen industry professionals flee en masse and foreign investors ditch positions in Russian companies.

Old news

The change of shareholders in December 2021 and the arrival of Kiriyenko was meant to represent a new course. East-West Digital News reports that business motives were a consideration in the restructuring, including helping the company to avoid potential US sanctions. But it was clear that the main message behind the restructuring was a political one: Kiriyenko’s father is President Putin’s first deputy chief of staff, and The Bell reports that the new management structure would see control of the company ultimately split with insurance company Sogaz, which is part-owned by a longtime ally of Putin.

Now the group appears to be adopting a new strategy: focusing on growing its flagship social media platform as much as possible.

Rival tech company Yandex is known for its adventurous investments in a vast range of verticals – from ride-hailing services to delivery robots. In contrast, Kiriyenko’s speech at SPIEF focused on VK’s social media platform.

He emphasised VK’s efforts to reinforce the infrastructure supporting its social media service. As a resul of these efforts, Kiriyenko said, VK can handle a 30% surge in traffic. The app has also launched a call function, a messenger and even short-form videos.

Nonetheless, much of VK’s current popularity rests not on improvements to its service, but rather on a lack of competition. Russia’s decision to label Meta (the owner of Facebook, WhatsApp and Instagram) as an “extremist organisation” has rendered many of the world’s most popular social networks unusable without a VPN. Users of VK surged by over 4mn in the month following Russia’s invasion of Ukraine.

80% of Russian internet users now use VK. With user numbers growing, VK is looking to invest in new functionalities. And there is no better time to be on the market. As foreign companies try to offload their Russian assets to limit reputational risk, VK has been acquiring a raft of new services.

VK’s consolidation in the media sphere has been particularly successful. It has recently reached a deal on the acquisition of Yandex’s news division, including blogging platform Yandex.Zen and aggregator Yandex.News.

Yandex.News is the main source of information for 41% of Russians, according to opposition activist and politician Alexei Navalny. But with the aggregator obliged to promote stories chosen by the state media regulator, Yandex was coming under fire from foreign shareholders for effectively boosting the Kremlin narrative.

Yandex entered talks with VK about selling its media services in late February. The details of the transactions have not been disclosed, but The Bell suggests that Yandex could swap Zen and Novosty for food and grocery delivery service Delivery Club (if it can cut deal with joint owner Sber).

Sweeping up

Yandex’s media assets are not the only targets for VK’s ambitious expansion. Dutch holding company Prosus has put classifieds site Avito on sale, and VK is rumoured to be among those competing to buy it. Avito boasts over 90mn users, topping Similarweb’s list of the world’s most visited classified advertisement sites in November 2021.

Classified advertisement platforms saw a surge in popularity during the pandemic, and have continued to thrive even as traditional advertising methods have flagged over the past year.

Another service which is rumoured to be in VK’s sights is online cinema platform ivi, according to the Bell. ivi is the biggest online streaming service in Russia by user numbers, and would be a huge boost to VK’s plan to grow its online presence and drum up new users.

It remains unclear how VK would finance the deals. Swapping its own assets for the new acquisitions could be a popular method in the current business climate, but to secure such high-ticket purchases VK would have to be prepared to give away significant assets.

Alternatively, VK could take on more debt. But with relatively high levels of debt already, this move could test the nerve of investors and executives.

Trading in over $400mn in VK global depositary receipts was halted by the London Stock Exchange in March, and the bonds were subsequently de-listed. VK has said that it may have enough money to pay back bondholders, but is yet to set out a detailed plan for repayment or restructuring.

New friends

Options for financing VK’s buying streak seem slim. But the group may be hoping for the support of an unlikely backer to help sustain its growth – the Russian government.

State banks can provide low-interest loans for the purchase of Avito or Yandex’s news assets – the government’s actions in Ukraine are, after all, a factor in the sale of both entities.

It’s also possible that the government will follow the Chinese model exemplified by WeChat, integrating public services with the most visited sites or apps – including VK. This could further increase traffic to the app, driving up revenue. A trial by the Ministry of Digital Development is already trialling a verification process for its school and hospital portal, which allows users to sign in using VK.

Another law passed in June will oblige all organs of the state to create pages on social media. Given that many foreign social networks are blocked in Russia, this will likely create a good deal more traffic for VK in practice.

The good news for VK executives hoping to secure the support of the Russian government, is that it appears to have evaded the crackdown on social media which followed the outbreak of war in Ukraine. This is a sign that it is viewed as an asset in the effort to build a “sovereign internet”, rather than a threat.

VK’s founder, the renowned entrepreneur Pavel Durov, left the company in 2014, citing a decline in the “freedom of action” of the company’s management.

Tech

The Iranian inventor that invented the floating shoes, has now built a propeller-less propulsion system ideal for flying taxis

Mohsen Bahmani is an Iranian-born mechanical engineer and a man with a dream. When he was just 17 years old, he made a pair of floating shoes that allow you to walk on water. Now he has built a propulsion system ideal for flying taxis.

_(1).jpg)

OpenAI to invest up to $25bn in Argentina under Milei incentive scheme

Artificial intelligence giant OpenAI and energy company Sur Energy have signed a letter of intent to develop a data centre hub in Argentina requiring investment of up to $25bn.

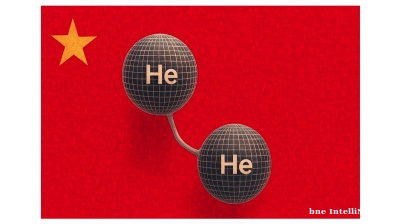

Helium was China's rare earth metals Achilles' heel

China has a devastating tool in its escalating trade war with the US: rare earth metals (REMs). Last week, Beijing announced new restrictive export controls on the export of anything with even a smidgen of Chinese-produced REMs.

Takeoff not far away for Turkey’s first flying car AirCar

It will set you back $99,000 and you'll also need a pilot's licence.