Russia’s economy will contract by 1% in 2020, according to the latest forecast by the widely respected Bank of Finland Institute for Economies in Transition (BOFIT).

Russia started this year with an official forecast for 1.9% growth. But the double whammy of an oil price shock following OPEC+ production cut deal collapsed on March 6 closely followed by an escalating coronavirus (COVID-19) pandemic that has brought the global economy to a standstill will hurt the Russian economy.

As bne IntelliNews reported after crunching the numbers Russia’s macroeconomic fundamentals are strong, but Russia Inc will not escape unscathed. Finance Minister Anton Siluanov said last week that the virus-related slow down will blow a RUB2 trillion hole in the budget and growth will slow to at least 0.5% this year.

However, with over RUB10,000 trillion in the National Welfare Fund (NWF) the ministry can fund this sort of budget deficit for the next five years. Siluanov claims the government can cover the budget deficits that result from $30 oil prices for as long as a decade.

Former Finance Minister and Audit Chamber head Alexei Kudrin, who is a widely respected authority on Russia’s economy, warned that if oil prices fall and stay low then the slowdown will be deeper and longer.

BOFIT calculates that the economy will contract by 1% this year,” due to notably lower commodity prices and a weakened outlook for the global economy. We expect Russian GDP to return to moderate growth next year.”

The BOFIT prediction tallies with the conclusions of other economists. Wiiw came to a similar result in a forecast it released last week for the whole Central and Eastern Europe (CEE) region and commented that public health crises tend to be deeper than financial crises but don't last as long.

JP Morgan also said that it was expecting a 24% contraction for the US economy in the second quarter, but that would followed by a robust rebound in the third quarter of 8% and a more gradual recover thereafter, assuming the coronavirus burns out in the summer months.

BOFIT pointed to the Russian plans to hike public spending as a plus for Russia’s growth and Siluanov says there are no plans to stop spending plans for the 12 national projects that will consume a large part of the public spending.

But most of the forecasts are currently assuming that the virus will burn out after about six months. China was first into the epidemic, which appeared in Wuhan province in January and is now seeing infections rates fall three months later. But the virus has already mutated into a second “more aggressive” strain and could mutate again into a more durable form.

“In the current situation risks are exceptionally large and Russia’s economic development can turn out considerably weaker if the global uncertainty caused by the corona pandemic is prolonged. Given the unlikely prospects for major structural economic reforms, Russia’s longer-term growth potential remains moderate,” BOFIT said in its forecast.

Falling oil prices undermine Russia’s budget

The first whammy has been the collapse of the oil prices, which reduce tax revenues and force the Ministry of Finance to rely on the NWF to top of the budget.

The average price of Urals-grade crude oil in March has been around $37 a barrel, or about 40% lower than the average price in 2019, BOFIT reports.

“The current market expectation is that oil averages a price of roughly $39 a barrel this year, and then a gradual rise to $45 a barrel in 2022. Forecasts for China and the global economy this year have also been generally reduced on the negative impacts from the coronavirus pandemic,” BOFIT said.

Russia may have strong macrofundamentals, but the lack of structural reform means growth has been disappointingly low. Preliminary data shows that GDP was up by just 1.3% last year.

“Growth was restrained by a slowdown in growth of private consumption from the hike in the value-added tax and shrinking exports [in 2019],” says BOFIT.

However, despite the continuing importance of oil to the Russian economy, the reforms of the last six years since the last oil shock in 2014 have considerably reduced Russia’s dependence on oil.

“The oil price is still an important factor for Russia’s economic development, but due to prudent fiscal policy and shift to floating exchange rate policy, Russia is now better equipped to deal with an oil price fall than before,” says BOFIT.

That means the budget plans will not be altered substantially and the policies laid out in Putin’s January state-of-the-nation address for a “transformation of the economy” remain in place. If anything, public spending on social issues should rise slightly more than anticipated last autumn, according to BOFIT.

Fiscal policy loosing

The Kremlin has been running a tight ship in recent years as it builds up its reserves and pays down its debt as part of the construction of a “financial fortress” that was designed to withstand any harsh sanction attacks by the US.

However, with the launch of the national projects last year the government will loosen fiscal policy and the coronavirus pandemic will only encourage further loosening. The state has already announced a RUB300bn fund to support companies that have been directly affected by the virus and other measures are expected to follow. That may mean a budget of intentional deficit spending, which would be a first for Russia.

The Russian government carries little debt (just 14% of GDP), but US sanctions have limited its ability to borrow abroad. Instead the state intends to rely on the National Welfare Fund that currently holds about $150bn in liquid assets, or 9% of GDP.

Private consumption and investment decline this year

Another drag on economic growth will be the fall in private consumption and shrinking real incomes. Russia’s real incomes have been stagnant for most of the last six years, but finally started to grow at the end of 2019. In 2019 consumer returned an economic growth driver, albeit modestly.

That trend is likely to reverse now and incomes will fall again as a result of the multiple shocks, says BOFIT.

“We expect private consumption to turn to decline this year. Consumption is hampered by slower economic activity and factors related to the dispersion of the corona pandemic,” says BOFIT. “The recent ruble depreciation is set to increase inflation and thus reduce purchasing power. In addition, consumption growth will be restrained by lower growth in consumer credit due to tighter regulation.”

BOFIT goes on to say that the situation will improve next year and there after as consumption will be supported by a gradual rise in incomes, partly funned by the the planned increases in social spending.

Fixed investment on the rise

Rising investment will also provide some support for growth. Fixed investment recovered slightly last year, growing by slightly more than 1%, according to BOFIT.

Several major infrastructure projects were completed, including the bridge over the Kerch Strait that now connects Crimea with the Russian mainland, the Power of Siberia natural gas pipe-line that runs from central Siberia to China, and Yamal peninsula LNG project on the Arctic Sea.

“Fixed investment is expected to fall notably this year due to the deteriorating economic outlook over the near term. Fixed investment should gradually pick up, however, in coming years as spending on national projects gets into full swing. The growth in fixed investment is also highly reliant on the public sector and state-owned enterprises,” says BOFIT. “Private investment should remain sluggish also in coming years.”

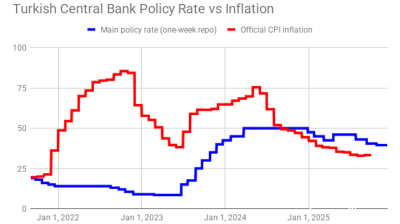

The CBR’s accommodative monetary policy has made it easier for firms to finance fixed investments. Inflationary pressures caused by the recent ruble depreciation may restrict possibilities of the CBR to continue monetary easing. Notably at the CBR rating meeting on March 19 where the central bank kept rates on hold at 6%, the central bank did not issue its customary inflation forecast and said explicitly that the current situation was too unpredictable to be able to make forecasts.

“For many Russian firms, however, the issue is not access to financing so much as Russia’s poor business environment, particularly the lack of property right protections and corruption,” says BOFIT. “The investment rate has averaged just 21% in recent years and no sudden improvements are expected during the forecast period.”

Trade terms deteriorate

Russian exports contracted last year by 2% for the first time in decades. Much of the contraction was due to a decline in metal and grain exports. Exports are expected to contract even more this year due to the weakness in China and the global economy overall. Exports should recover gradually next year as demand returns, says BOFIT.

Supported by ruble appreciation, Russian imports grew last year moderately, but imports are expected to contract notably this year, following the ruble down.

The ruble lost about 9% of its value in March against both the dollar and the euro compared to its 2019 average. Imports should also be dampened by investment demand’s public-sector focus, which favours domestic suppliers. Moreover, imports of tourism services are expected to fall substantially this year due to the corona pandemic. Chinese tourist in particular have become a staple of Russia’s tourism business and they have disappeared from Russian streets overnight.

“Imports are expected to return to growth next year, but the volume of imports is not expected to recover to the 2014 level during the forecast period,” says BOFIT.

The slowing of trade will hurt Russia in the pocket. The current account surplus last year was $70bn, or about 4% of GDP. The current account this year is expected to remain in surplus, but decline substantially due to the oil price fall.

“If oil price trends conform to current market expectations, the ruble’s nominal exchange rate should not experience further significant pressures, but considerable uncertainty is related to the market development,” says BOFIT.

The CBR’s forex operations on behalf of the finance ministry to comply with the fiscal rule slightly dampen the impacts of oil price swings on the ruble’s exchange rate. The ruble’s real effective exchange rate could begin to appreciate slightly next year as Russian inflation is expected to return to a higher rate than the inflation rates of most of its trading partners, says BOFIT.

Risks outlook

“Risks In the current situation risks related to the forecast are exceptionally high. The oil price poses the biggest near-term risk to the Russian economy. If oil prices fall further for an extended period, Russian growth could severely undershoot our forecast,” says BOFIT. “Moreover, Russia’s economy could be hit harder by a weaker-than-expected performance of the global economy. In addition, GDP could decline more strongly, if private consumption would contract more than anticipated especially taking into account its high share in GDP.”

The government has been through multiple crises and going into this one it is exceptionally well prepared – ironically as it has been preparing for six years for a sanctions shock imposed by the US.

“Russia has the capacity to soften the impact of negative shocks through government support. The upcoming referendum on changes to the Russian constitution in late-April and the approaching Duma elections in 2021 could also put pressure on politicians to increase public sector spending,” says BOFIT.

A stronger-than-expected fall in imports could mitigate GDP contraction, which is what happened in 2014 following the last oil price crash.

“Russia’s long-term growth is still constrained by structural problems in the economy such as the lack of property right protections, corruption and the state’s oversized role in the economy. There is currently no indication that the government is prepared to make the structural reforms needed to tackle these deficiencies,” said BOFIT.

|

Russian GDP realised, preliminary (p) and forecast (f), % |

||||||

|

2017 |

2017 |

2018 |

2019p |

2020f |

2021f |

2022f |

|

2018 |

1.8 |

2.5 |

1.3 |

-1 |

1.5 |

1.8 |

|

2019p |

3.4 |

2.8 |

2.4 |

-0.9 |

2 |

2.2 |

|

2020f |

4.7 |

0.1 |

1.4 |

-6.5 |

2 |

2.5 |

|

Exports |

5 |

5.5 |

-2.1 |

-5 |

2 |

1 |

|

Imports |

17.3 |

2.6 |

2.2 |

-10 |

4 |

3 |

|

Oil price (Brent)* |

$54/bbl |

$71/bbl |

$64/bbl |

$39/bbl |

$41/bbl |

$45/bbl |

|

Sources: Rosstat and BOFIT |

||||||

Features

Russian e-commerce giant Wildberries goes on a mysterious M&A spree

Russian e-commerce giant goes on M&A spree Almost a year after the controversial merger with a leading outdoor advertising firm, Russia’s leading e-commerce site Wildberries is indulging in a fresh bout of eyebrow raising deals.

US expands oil sanctions on Russia

US President Donald Trump imposed his first sanctions on Russia’s two largest oil companies on October 22, the state-owned Rosneft and the privately-owned Lukoil in the latest flip flop by the US president.

Draghi urges ‘pragmatic federalism’ as EU faces defeat in Ukraine and economic crises

The European Union must embrace “pragmatic federalism” to respond to mounting global and internal challenges, said former Italian prime minister Mario Draghi of Europe’s failure to face an accelerating slide into irrelevance.

US denies negotiating with China over Taiwan, as Beijing presses for reunification

Marco Rubio, the US Secretary of State, told reporters that the administration of Donald Trump is not contemplating any agreement that would compromise Taiwan’s status.