Even as Donald Trump talks tariffs, tariffs, tariffs, China is settling down to play the long game and wait out the four years US energy authorities need to be on permanent damage limitation duty

What: Tariffs are not all one-way as China retaliates against US, and Donald Trump, energy sector levies with their own historically proven ‘go-to’ technique of ‘wait it out’.

Why: The US is an important part of international energy flows, but with a loose cannon so fond of tariff imposition in the Oval Office, the best policy may be to just sit tight and wait for US president number 48 to calm things down.

What next: Patience, and a discreet search for alternative suppliers of LNG, oil and coal.

In a swift response to President Donald Trump's imposition of a 10% tariff on Chinese imports, Beijing has retaliated by levying tariffs on US energy exports. The Chinese government announced a 15% tariff on US coal and LNG, alongside a 10% duty on crude oil imports. These measures, effective since February 10, 2025, are poised to reshape global energy trade flows, with significant implications for coal, oil, and also LNG markets.

Immediate impact

Already this has seen Chinese energy traders opt to reroute cargoes of LNG and crude oil to alternative markets. Europe, still officially in winter, and having faced long-term supply issues following Russia’s 2022 invasion of Ukraine, has eagerly absorbed the redirected LNG supplies. The European Union's increased demand for LNG is evident, with imports rising by approximately 50bn cubic metres in 2023 compared to 2020. The share of US LNG making its way to EU buyers in the same timeframe also doubled from 23% in 2020 to 47% by 2023. India too has seen US crude oil exports initially destined for China now being offloaded at ports around the country.

While the shift itself initially appears to be the result of Chinese tariffs on US oil and gas, Beijing’s own reduced reliance on US crude, which accounted for a mere 1.7% of its total oil imports prior to the tariffs, plays a significant role in the global shift in flow.

Coal under pressure does not always produce diamonds

The coal industry however, faces a more pronounced impact. In 2024, US exports of coking coal to China, used predominantly in steel production, surged by approximately 33%, reaching a value of $1.84bn according to Reuters. However, the newly imposed 15% tariff is now expected to deter Chinese buyers from opting for US supplies. In knock-on effect alternative suppliers are being sought out with Mongolia and Australia poised to fill this gap.

Mongolia alone is said to be aiming to increase coal exports to China by 20% through 2025, Reuters says, in the process targeting a total export capacity of 165mn tonnes.

This in turn sees US coal exporters rely more on exports to India which, given the recent Trump-Modi meetings, may see New Delhi look to purchase more coal to help offset potential tariffs elsewhere. Should this prove to be the case, the increase in US coal exports to the subcontinent would inevitably see Australia and Russia's market share in the Indian market decrease.

LNG market shifts

The LNG sector is also undergoing significant adjustments. China, previously a major importer of all-things US LNG, is now turning to other suppliers to mitigate the impact of the 15% tariff. And with this realignment occurring amidst a broader global context where LNG demand is projected to rise by 60% by 2040 according to Shell, Asian markets are being predicted to lead the bulk of the growth in LNG demand; a concept driven primarily by economic growth in the region and LNG’s role as a stepping stone in decarbonisation efforts across the heavy industry and transportation sectors.

In response to this shifting landscape, US LNG exporters are now understood to be intensifying their own efforts to secure additional contracts in Europe and India. New Delhi in particular is aiming to increase the share of natural gas in its energy mix from 6% to 15% by 2030 and this presents a lucrative opportunity for American LNG suppliers.

Broader economic and geopolitical implications

The tariff exchange spat between the US and China and their influence on long-term energy strategies and geopolitical alliances therefore is palpable. To this end, the tariffs being applied on both sides of the Pacific are increasingly likely to help accelerate Beijing's diversification of energy imports, reducing its dependence on US supplies even further.

Looking long-term, this will only hurt US sellers and energy producers, forcing them to explore and develop alternative markets more aggressively, or with the passage of time to recognise the ultimate futility of many of Trump’s tariffs in influencing global energy markets in the years ahead.

Additionally, the uncertainty created by the US president in applying tariffs left, right and centre at times may slowly deter investment in new energy projects stateside.

The LNG sector, in particular, is an industry that requires substantial capital investment and long-term contracts to operate effectively. Thus the current volatility created during Trump’s first month in the White House could lead to a degree of hesitancy on the part of long-time or future stakeholders with funds to use, in turn potentially slowing the growth trajectory of US LNG in the long term.

And if any nation is known to play – and excel – at the long-game it is China. Beijing rarely thinks of ‘today’, preferring to plan for years and even decades from now.

Such a mentality in a stare-down with a president offering little but promises of immediate results will not end well for the US energy sector once it realises Trump’s time is limited, but the world will need powering forever.

While alternative markets like Europe and India offer some respite for US exporters today, the long-term implications of this trade dispute may end up reshaping the global energy landscape, influencing production and affecting consumption and geopolitical alliances for years or decades to come.

Features

Minerals for security: can the US break China’s grip on the DRC?

The Democratic Republic of the Congo is offering the United States significant mining rights in exchange for military support.

Southeast Asia welcomes water festivals, but Myanmar’s celebrations damped by earthquake aftermath

Countries across Southeast Asia kicked off annual water festival celebrations on April 13, but in Myanmar, the holiday spirit was muted as the country continues to recover from a powerful earthquake that struck late last month

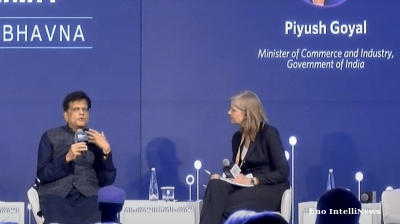

India eyes deeper trade ties with trusted economies

India is poised to significantly reshape the global trade landscape by expanding partnerships with trusted allies such as the US, Indian Commerce and Industry Minister Piyush Goyal said at the Carnegie India Global Technology Summit in New Delhi

PANNIER: Turkmenistan follows the rise and rise of Arkadag’s eldest daughter Oguljahan Atayeva

Rate of ascent appears to make her odds-on for speaker of parliament role.