Depositing money in high-yielding bank deposits is back as Russians’ favourite store of wealth to protect their life savings against the ravages of high inflation rates.

Total deposits were up by 70% in in 2024 as the population (and companies) took advantage of the Central Bank of Russia (CBR)’s historically high interest rates, currently at 21%, and the extraordinary spread of 11% of real interest rates, as inflation, albeit high, is still only around 10%. That means a punter can earn 10% a year on a ruble term deposit in a bank.

The preference for deposits over other financial instruments has widened significantly over the past year. As of early December, the total volume of individual funds in bank deposits reached RUB53.9 trillion ($594bn), surpassing November levels by RUB1 trillion ($11bn), or 2%. "Even without considering December inflows, 2024 has already set a record for deposit growth in Russia’s banking industry," Kommersant-Review reported.

Money market funds were the next most popular investment, followed by gold, which is currently trading at historical highs.

The return to the traditional high-yielding bank deposits is a turnabout for Russian retail investors, who poured into the Russian equity market for the first time before the invasion of Ukraine transformed Russia’s economic landscape.

Russia has suffered from high inflation since 1991, only falling into single digits in 2007. Banks have traditionally paid high interest rates on deposits, which have always been a major source of funding for their operations.

But that changed in July 2020, when the CBR’s prime rate fell to an all-time low of 4.25%, coupled with an all-time low inflation rate of 3.7% in 2017, and stayed low until the war in Ukraine broke out. The CBR even started talking about reducing its target inflation rate from the current 4% to 3% in 2021.

Stock market crashes

With such low rates, for the first time bank deposits stopped producing healthy returns and Russian retail investors began casting about for better returns on alternative investments and jumped into the stock market.

This suited the Kremlin, which has been promoting the domestic capital market and create a new domestic source of investment capital for the development of the economy. In December 2024, during the fifteenth VTB "Russia Calling!" Investment Forum, President Vladimir Putin said he wants the Russian stock market to double in size by the end of the decade to reach two thirds of GDP, up from the current level of 23.4% of GDP.

Russia has always struggled to persuade retail investors to buy stocks, usually with disastrous results. The first effort was in 1996, when then president Boris Yeltsin launched domestic retail mutual funds, known as PIFs in Russia. The initiative was met with cautious enthusiasm and several large international funds entered the Russian market in what they hoped would turn into a bonanza.

The market crashed in 1998, with the RTS index falling from a high of 571 points in October 1997 to a low of 38 two years later in 1999. Everyone who had invested in stocks lost a massive amount of money and it took six years for the RTS to get back to 571 in April 2004.

Another attempt to entice badly burnt retail investors into the equity market was made with the so-called “People’s IPO” of state-owned VTB bank in May 2007, and Russian retail investors poured around $1bn into the listing.

Again, the market crashed just over a year later during the Great Financial crisis of 2008 and VTB’s stocks remained underwater for years afterwards.

Russians had a third go at investing into stocks starting around 2019, and made good returns as the markets soared, but they were burned yet again when the market collapsed following the invasion of Ukraine in February 2022. Since then, the ruble-denominated MOEX index has grown, but the ruble has also dramatically weakened, cancelling out most of the return in FX-adjusted terms. The dollar-denominated RTS index has also remained moribund. Foreign investors used to hold about half of the market capitalisation of the RTS, but now only investors from the friendly countries are allowed to hold Russian equity.

Deposits dominate, money market funds surge

Russians trust their banks, despite the regular bank crises. The bank deposit insurance scheme is highly efficient and always pays out if a bank goes bust on up to RUB2.8mn ($28,000) of deposits.

Indeed, the deposit insurance scheme is so trusted and works so well that in the last banking crisis in 2018, some retail investors were actively seeking out smaller banks paying extraordinarily high interest rates on purpose, the most unstable and riskiest banks, confident that if the bank went bust – and many did – they could get their money back within a month and invest it into the next dodgy bank.

In the current times of brouhaha, Russian retail investors have gone back to banks as both the safest bet and to earn the best returns. Russian savers have poured approximately RUB10 trillion ($110bn, or three times more than this year’s expected federal budget deficit) into term deposits and money market funds in 2024, reports Kommersant. The total volume of these investments now exceeds RUB 50 trillion ($550bn) as a result of the CBR’s aggressive monetary tightening since the second quarter of 2023.

Investors have also flocked to physical gold, purchasing more than RUB700bn ($7.7bn) worth of the metal, which has seen its value surge by 50% over the past year alone. While market participants remain focused on signals from the central bank regarding future rate moves, analysts do not anticipate a significant change in investment trends in the near term.

In its February macroeconomic survey, the CBR says interest rates have peaked and are expected to fall 50bp this year to 20.5%, but commenting on the report, CBR Governor Elvia Nabiullina also said that there is still no sign of inflation starting to fall and high interest rates will remain in place for a “long time”. The next CBR monetary policy meeting is due on St Valentine’s Day and the CBR is now expected to keep rates on hold, as Nabiullina tries to balance supporting economic growth with bringing sticky inflation down.

Despite the unexpected pause in rate hikes at the December meeting, analysts remain cautious about the prospect of a policy reversal. Most expect rates to remain high well into 2025, keeping deposits and money market funds attractive to Russian savers.

In the meantime, bank deposits as an investment is a no-brainer for most Russians. Total savings growth was nearly 70% year on year to RUB9 trillion ($99bn) in 2024. The surge was driven entirely by short-term deposits of up to one year, reports Kommersant. At the same time, money market funds, a relatively niche segment, saw a remarkable 3.5-fold rise in investment to RUB777bn ($8.5bn) – the largest annual inflow into money market funds in the 28-year history of Russia’s retail mutual fund industry.

Gold, traditionally a safe-haven asset, has secured third place in popularity among Russian savers. According to data compiled by Kommersant-Review, total investments in physical gold now stand at RUB734bn ($8bn).

Monetary policy fuels deposit boom

Ruble term deposits grew by RUB8.92 trillion ($98bn) over the first eleven months of 2024 to reach RUB35.3 trillion ($390bn). Demand deposits declined by 2.5%, or RUB370bn ($4bn), to RUB14.44 trillion ($160bn).

Foreign currency deposits also increased, climbing 11.3%, or RUB430bn ($4.7bn), to RUB4.2 trillion ($46bn) in the same period. However, when adjusted for the 8% rise in the ruble-dollar exchange rate to RUB97 per dollar over the same period, the actual growth in dollar terms was a modest 3%, equivalent to just $1.2bn, bringing total foreign currency holdings to $43.1bn.

"The expectation that the key rate has peaked at 21% has influenced deposit rates," said Vladimir Evstifeev, head of the analytical service department at Zenit Bank. According to data from Russia’s largest banks, the average maximum deposit rate decreased by 0.164 percentage points to 21.523% in January, down from its historical peak a month earlier.

While deposits have been the clear beneficiary of the high-rate environment, money market funds have also seen a historic influx of cash. Their total assets have grown fivefold in a year, surpassing RUB1 trillion ($11bn) for the first time. This has propelled their market share in the retail mutual fund sector from 20.8% to 56.3%, overtaking equity funds (16%) and bond funds (13.7%), Kommersant reports.

Given the surge in demand, Russian asset managers have rushed to launch new money market funds. By the end of 2024, eight management firms – including Promsvyaz, BCS, Sistema Capital, MKB Investments, Finstar Capital, Finam Management, AAA Asset Management and Dokhod – had introduced new products. Currently, 20 funds from 13 management companies are available to retail investors, Kommersant reports.

Features

Minerals for security: can the US break China’s grip on the DRC?

The Democratic Republic of the Congo is offering the United States significant mining rights in exchange for military support.

Southeast Asia welcomes water festivals, but Myanmar’s celebrations damped by earthquake aftermath

Countries across Southeast Asia kicked off annual water festival celebrations on April 13, but in Myanmar, the holiday spirit was muted as the country continues to recover from a powerful earthquake that struck late last month

India eyes deeper trade ties with trusted economies

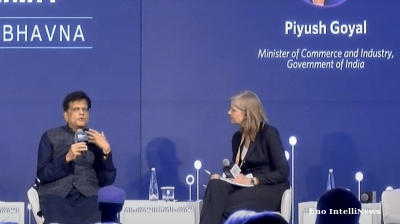

India is poised to significantly reshape the global trade landscape by expanding partnerships with trusted allies such as the US, Indian Commerce and Industry Minister Piyush Goyal said at the Carnegie India Global Technology Summit in New Delhi

Farm to front line: Ukraine's wartime agriculture sector

Despite the twin pressures of war and drought, Ukraine’s agricultural sector continues to be a driving force behind the country’s economy, with experts confident of continued growth and investment.

_1744669887.png)