The China-Pakistan Economic Corridor (CPEC), once hailed as a transformative initiative for Pakistan’s economy, has left the nation grappling with substantial debt and soaring electricity costs, according to Oil Price. Launched in 2013, the $62bn partnership was aimed at boosting economic cooperation, trade, and infrastructure development, with a significant focus on addressing Pakistan’s chronic energy shortages.

Of the total investment, nearly $35bn was channelled into 21 power projects under CPEC, most of them coal-fired, adding 6,000 MW to the national grid. Pakistan’s power generation capacity now stands at 42,131 MW—double its domestic demand, as reported in the Economic Survey (2023-24). However, this surplus has come at a steep price.

Oil Price reports that the Power Purchase Agreements (PPAs) with Chinese Independent Power Producers (IPPs) obligate Pakistan to pay hefty “capacity payments,” even when the electricity isn’t consumed or produced. Chinese IPPs reportedly enjoy returns on equity of 27%-34%, far above Pakistan’s earlier 15%-18% rate. For instance, Pakistan pays more in capacity payments to the Sahiwal coal power plant than it did to all IPPs combined in 2002.

Pakistan’s debt to Beijing has thus surged, with Oil Price citing AidData figures that reveal CPEC alone added $26bn to Pakistan’s total debt exposure of $67.2bn from 2000-2021. Islamabad’s repeated pleas for restructuring $15bn of its energy debt have so far been ignored.

Amid this financial strain, Pakistan’s energy landscape received a glimmer of hope last year with the discovery of substantial oil and gas reserves in its territorial waters. This discovery could potentially reverse the country’s reliance on costly energy imports, which account for 29% of gas, 85% of oil, and 50% of liquefied petroleum gas (LPG) requirements. The total energy import bill reached $17.5bn in 2023 and is projected to climb to $31bn by 2030.

However, exploiting these reserves is a daunting challenge. Former Oil and Gas Regulatory Authority (OGRA) member Muhammad Arif told Dawn News TV that an investment of $5bn and four to five years of development are required before the reserves can be utilised.

Despite the promise of energy independence, Pakistan struggles to attract foreign investment for oil and gas exploration. Shell Plc sold its Pakistan assets to Saudi Aramco in 2023, while auctions for exploration blocks saw minimal interest. Security concerns are also a significant deterrent. In 2024, attacks on Chinese engineers and assets, including incidents in Khyber Pakhtunkhwa and Gwadar, highlighted the risks. The Balochistan Liberation Army (BLA), a separatist group, has frequently targeted Chinese projects.

As such, with international investors hesitant, Pakistan’s hopes largely rest on China or Saudi Aramco stepping in. Discussions with Chinese state-owned explorers are reportedly underway, as Pakistan navigates a precarious path towards energy security.

Meanwhile, the nation’s energy woes have fuelled a thriving black market. It has been widely reported that Iran is smuggling $1bn worth of fuel into Pakistan annually, underscoring the dire state of the country’s oil and gas sector.

Economic challenges faced by Pakistan have also led to a drop in electricity consumption. As a result, last year, Islamabad postponed a deal to procure LNG from Qatar by a year, with deliveries now scheduled for 2026 instead of 2025, Reuters reported at the time.

Petroleum Minister Musadik Malik said in December 2024 that the decision was influenced by the country's current LNG surplus, which has eliminated the need for new shipments. No financial penalties were incurred for deferring rather than cancelling the agreement, he added.

Pakistan's annual electricity consumption has now dropped by 8-10% year-on-year over the past three quarters, largely due to higher tariffs reducing household demand, according to the power minister in speaking to Reuters in November. With over one-third of its electricity generated from natural gas and the nation deferring five LNG cargoes from Qatar, it is now negotiating the deferral of five more from other sources, Malik said, without naming the suppliers.

Features

Minerals for security: can the US break China’s grip on the DRC?

The Democratic Republic of the Congo is offering the United States significant mining rights in exchange for military support.

Southeast Asia welcomes water festivals, but Myanmar’s celebrations damped by earthquake aftermath

Countries across Southeast Asia kicked off annual water festival celebrations on April 13, but in Myanmar, the holiday spirit was muted as the country continues to recover from a powerful earthquake that struck late last month

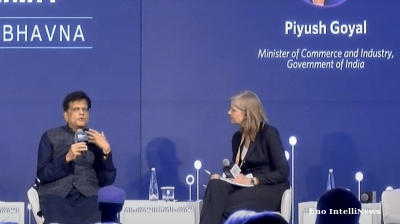

India eyes deeper trade ties with trusted economies

India is poised to significantly reshape the global trade landscape by expanding partnerships with trusted allies such as the US, Indian Commerce and Industry Minister Piyush Goyal said at the Carnegie India Global Technology Summit in New Delhi

PANNIER: Turkmenistan follows the rise and rise of Arkadag’s eldest daughter Oguljahan Atayeva

Rate of ascent appears to make her odds-on for speaker of parliament role.

_Cropped.jpg)