Lebanon’s latest ongoing economic crisis has revealed just how fragile its financial system is. With banks collapsing and inflation soaring, the public is losing faith in the new government’s ability to handle the economy.

According to the World Bank, Lebanon is one of the "most severe global crises since the mid-nineteenth century," posing a serious question to the backers of the new Aoun government about how to revive the dead currency.

This impending economic collapse is the fruition of three decades of erratic and sometimes seemingly baffling fiscal and monetary policies, which had already caused the currency to depreciate by more than 95% by 2023. The economy has been in a coma-like state while war with Israel raged with Hezbollah with no movement of the pound, but with changes now afoot and the economy slowly waking up, the old problems have returned.

Reeling back from its lowest against rate of LBP107,000 to pound, it has remained flat at 89,000 to the USD for more than a year but people are increasingly worried about the reintroduction of expected economic conditions, the stoppers will be taken off and it will continue its slide causing a new flight of wealth from the country in anticipation of the next round of currency decline.

To make matters worse, corruption in the banking sector is rampant, turmoil is occurring, and the threat of “spontaneous dollarisation” is ever-present. Like other Middle Eastern countries, cryptocurrencies, specifically Bitcoin, have emerged as new financial safe-haven assets. Increasing numbers of Lebanese are turning to Bitcoin as a store of value and to protect themselves from further economic chaos.

On the back of older cryptocurrencies, stablecoins pegged to the US dollar are also becoming popular, including Tether (USDT), which has become the bureaux de change crypto of choice for dodging banking restrictions and avoiding US sanctions.

Initially, the idea of Bitcoin was met with scepticism in Lebanon. Many preferred investing in traditional alternative assets, including real estate or small businesses, viewing Bitcoin with scepticism, if not outright distrust.

As the country's financial situation has worsened, attitudes are shifting, with younger demographics leading the charge. This change in attitudes has not been matched by authorities, however, with the Central Bank of Lebanon, the first in 2013, warning locals about the risks of Bitcoin, while in February 2018, the Capital Market Authority (CMA) prohibited licensed financial institutions from issuing, marketing or trading in them.

Beirut-based Cyber expert Roland Abi Najem, speaking with IntelliNews, warns of the risks associated with Bitcoin.

“The value of cryptocurrencies depends entirely on the trust of those who trade them. Most people don’t fully understand how these currencies work.” He points to US President Donald Trump’s attempt to launch his currency, Trump Coin, which saw initial investments rise above $70, only to plummet to under $20.

“Cryptocurrencies,” Abi Najem continues, “have no fixed value and rely on public confidence. The most prominent of these currencies is Bitcoin, alongside so-called ‘meme currencies,’ which, by their very nature, have no intrinsic value.”

On how Lebanon should react to cryptocurrencies: “We need to understand better how these currencies are being used in Lebanon and whether those involved truly comprehend their worth and how to use them properly.”

Abi Najem pointed out that while some countries have embraced Bitcoin, even risking their local currencies, there is no consistent standard governing these digital assets. He further warned that cryptocurrencies could be a haven for money laundering, as the banking system’s tracking mechanisms do not apply to them. This lack of regulation, he argues, makes them particularly susceptible to abuse.

Abi Najem referenced the words of investor Warren Buffett, who famously said that “the value of Bitcoin is zero and will eventually return to zero.”

Features

Minerals for security: can the US break China’s grip on the DRC?

The Democratic Republic of the Congo is offering the United States significant mining rights in exchange for military support.

Southeast Asia welcomes water festivals, but Myanmar’s celebrations damped by earthquake aftermath

Countries across Southeast Asia kicked off annual water festival celebrations on April 13, but in Myanmar, the holiday spirit was muted as the country continues to recover from a powerful earthquake that struck late last month

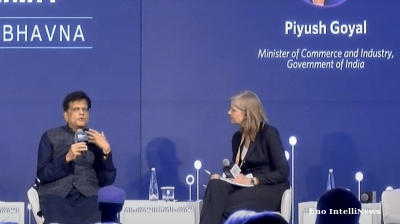

India eyes deeper trade ties with trusted economies

India is poised to significantly reshape the global trade landscape by expanding partnerships with trusted allies such as the US, Indian Commerce and Industry Minister Piyush Goyal said at the Carnegie India Global Technology Summit in New Delhi

PANNIER: Turkmenistan follows the rise and rise of Arkadag’s eldest daughter Oguljahan Atayeva

Rate of ascent appears to make her odds-on for speaker of parliament role.