Russia’s leading discount store Fix Price’s promise is you can buy anything in the store for a maximum of RUB199, or about $2.60. -- the highest of six price points at which Fix Price sells all its goods. That is not very much, even by Russian standards, but the selection of goods is large in Fix Price stores and it keeps changing every week.

“People often come in for the basics like toilet paper or pasta, as we even offer these things for a very competitive price,” says Anton Makhnev, the chain’s CFO. “But they stay for the bargains, the things they were not expecting to buy. And they buy them because they are both cheap and good quality. After while people start to come into the stores just to see what is on offer in case there is another bargain they want to buy.”

Fix Price was set up in 2007 by the founders and managers of Kopeika discounter chain (named after the Russian kopek coin, the unit of the ruble) which was sold by the founders in 2007 and later was acquired by the X5 Retail Group in 2010 for a reported $1.7bn.

X5 rebranded the chain’s stores and subsumed them into its leading Pyaterochka chain at a time when all the leading retailers were racing to grab as much market share as they could. That also took the Kopeika discount format off the market.

Having made some money and with nothing better to do the founders decided to focus on Fix Price and build up the business for themselves in the now vacant discount niche.

As bne IntelliNews reported, Russia’s retail sector has reached maturity and the competition between the leading companies has become fierce. The market leaders have slowed opening new stores and refocused from grabbing market share to improving profitability and have started to close the less lucrative stores down.

“None of that affects us. We are in an entirely different niche. We are eating into the sales of the traditional retailers, but we don't compete with them directly,” says Makhnev. “It's the company’s major competitive advantage: the management team had already been running Kopeika for years and they had already made every possible mistake you can make in that business, so when they launched Fix Price they already knew exactly what they were doing.”

They need to, as running a discounter that last week opened its 4,000th store and that stretches right the way across Russia is a logistical nightmare.

The concept is not new. There are analogous stores in most other markets, Dollar General and five Below in the USA, Dollarama in Canada, b&m in the UK and Tchibo in Germany.

The trick is to find a supplier that can make the goods cheaply, but of a decent quality and then getting the goods out to all the chains so that they hit the shelves in 4,000 stores right across Russia on more or less the same day. Finally, as the goods change every week you have to have a pretty good idea of how many stock keeping units (SKU) you will sell so that you don't make too many pieces, as after a week the shelf space is needed for something else.

The team’s timing turned out to be good. In 2008 the whole world fell apart after Lehman Brothers went to the wall and Russia saw its economy go from 7% growth in the first half of the year to a 7% contraction in the second half of the same year.2008 didn't kill Fix Price and as the following crises of 2014 and 2020 have only made the company's business stronger.

“The previous crises were not as bad as it seems now,” says Makhnev. “Of course in the fourth quarter of 2008 the financial sector collapsed, but in 2009 there was a strong rebound. Besides the business was only just getting going there were not too many stores. And on top of that it is a discount store, so the sales volumes were held up by people trading down during the crisis and looking for cheaper goods.”

The team spent the first three years fine tuning the assortment of goods and had built up a chain of 100 stores by 2010. The offering breaks down to roughly 30% foods products – mostly dry goods that don't need expensive temperature-controlled storage – and more than 50% is general merchandise.

“By 2011 the team thought they had found the secret sauce of this subsector and began to expand this subsector aggressively,” says Makhnev.

Makhnev says the growth of Fix Price in Russia is following a global trend where consumers are increasingly looking for better value when they shop. The fact that Russia has been in crisis pretty much continuously since the oil prices collapsed in 2014 has probably helped.

Incomes in Russia rose by circa 10% a year for almost all of the noughties as the government consciously tried to close the income gap between the private and public sectors, but since 2008 the economy has begun to stagnate and real disposable incomes have stagnated for the last six years. That has made Russia’s consumers increasingly price conscious and opened the Fix Price niche up wider.

The company just reported double-digit same store sales growth for the third quarter of this year – its 15th quarter in a row of double-digit same store sales growth during a period when Russia’s economy has been stagnating and incomes have been falling since 2008. Sova Capital recently named Fix Price as one candidate for an IPO after leading e-commerce company Ozon is reportedly set to IPO sometime around the end of this year.

“The offering is a combination of convenience and value,” says Makhnev. “Online sales are growing but they can’t compete on the combined convenience and value. E-commerce is eating into traditional bricks and mortar retail, but the discount value-retailers are seen as insulated from this trend. Online can’t offer the same convenience."

Logistics and suppliers

Getting the product mix right is only half the battle. The equally complicated part of the business is the logistics of supplying the stores on time.

“We offer 50 new SKUs every week. We deliver to small towns and villages. It makes us one of the few Russian retailers. We are in 78 of Russia’s 85 regions and we are in six other countries as well, including Belarus, Kazakhstan and Uzbekistan, with franchises in Latvia, Georgia and Kyrgyzstan,” says Makhnev. While the company started out in Moscow today the capital only makes up approximately 10% of its total sales.

All this is possible only thanks to the long term development of Fix Price’s IT system. The team manages a constant flow of inexpensive goods that are at the right cost and arrive at the right time.

“The way it is done is to have a 100% standardisation of the store base, assortment, pricing and the percentage of shelf space given to each good across all categories,” says Makhnev. “We don't manage 4,000 unique stores. We effectively manage one store that is copied over and over again. There is very deep automation of all the processes.”

To make this happen the company has nine distribution centres across the country that they manage themselves. The transport is outsourced to third parties. Some of the distribution centres are rented and a few Fix Price has built themselves.

“Building a distribution centre is usually expensive, but ours are relatively cheap. As we don't have any perishable goods the space is very simple. No expensive temperature control. So the cost of the centres doesn't make up a big cost in the grand scheme of things.”

The other piece of the puzzle is sourcing the goods. Today Fix Price works with over 600 suppliers, and three quarters of the money it pays them stays in Russia while only a quarter goes abroad, primarily to China.

“The foreign-based suppliers used to make up a bigger share but following the devaluation of the ruble in the 2014 crisis it became much cheaper to use local suppliers and there are plenty of companies on the market willing to work,” says Makhnev.

Normally an emerging market starts its development by becoming a low-cost manufacturing base of large multinationals like carmakers of electronics manufacturers. Russia missed out on this stage as the ruble appreciated too quickly in the '90s and it became cheaper to import high-quality goods so local lightweight industry never had a chance to develop. The silver lining of a series of crises in 2008, 2014 and now 2020 is they have pulled down the value of the ruble so low that Russian manufacturing is now more competitive than Chinese and light industry is rapidly developing as a result.

Deciding what to make, what is likely to appeal to the punters, is also a skill. Here Fix Price works with a network of agents that are monitoring sales and trends throughout the world. They observe what other manufacturers are making in other markets. They monitor social media for trends. And they are constantly making suggestions. When a product becomes trendy then a team deconstructs and works out how to make something similar that will cost less than RUB199.

“You ask: where can we save money? The first thing to go is usually the packaging, as you don't need that and normally you can come up with an analogue,” says Makhnev. “Toys tend to be made in China, but food, drugs, cosmetics and some non-food items we usually order from local suppliers.”

Makhnev says that an IPO could eventually be on the cards, but its up to the shareholders to decide.

"If you look at someone like Dollar General in the US it has been growing for 29 years. We believe there is a structural change going on that will favour the value retailers, we think there is a lot more growing in this market for us and the nature of the business benefits from all cycles of the market, both when it turns up and when it turns down.”

Features

Minerals for security: can the US break China’s grip on the DRC?

The Democratic Republic of the Congo is offering the United States significant mining rights in exchange for military support.

Southeast Asia welcomes water festivals, but Myanmar’s celebrations damped by earthquake aftermath

Countries across Southeast Asia kicked off annual water festival celebrations on April 13, but in Myanmar, the holiday spirit was muted as the country continues to recover from a powerful earthquake that struck late last month

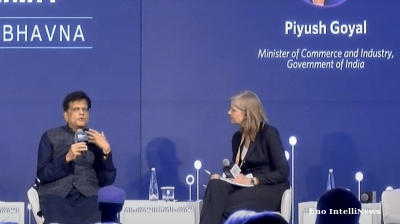

India eyes deeper trade ties with trusted economies

India is poised to significantly reshape the global trade landscape by expanding partnerships with trusted allies such as the US, Indian Commerce and Industry Minister Piyush Goyal said at the Carnegie India Global Technology Summit in New Delhi

PANNIER: Turkmenistan follows the rise and rise of Arkadag’s eldest daughter Oguljahan Atayeva

Rate of ascent appears to make her odds-on for speaker of parliament role.

_1744669887.png)