POLITICS

January 10 is presidential election day in Kyrgyzstan following the late autumn upheaval that resulted in a revolution or coup d’etat, depending on your point of view.

There is deep concern that the early poll called to help resolve the turmoil in the Central Asian nation might result in an administration that could be very much in the pocket of organised crime. That anxiety thickened in late December when Kyrgyz MPs approved an economic amnesty bill that allows individuals who have obtained financial assets through illegal means to avoid prosecution by surrendering the assets to the State Treasury.

Japarov, the "Kyrgyz Donald Trump" (Image: kremlin.ru).

The threat that organised criminals may pose to democracy in Kyrgyzstan was voiced by the US embassy in Bishkek last October after the fall of the Sooranbai Jeenbekov presidency and the rise to power of fervent nationalist Sadyr Japarov, sometimes known as the “Kyrgyz Donald Trump”, who was freed from jail – where he was serving a sentence for kidnapping a political rival – by supporters during the turmoil that followed a parliamentary election that losing opposition parties decried as fixed.

Kyrgyz authorities have reportedly said that the amnesty bill may affect around 1,300 individuals convicted or suspected of enriching themselves through tax evasion, financial fraud, smuggling and other economic misdeeds. Critics, however, say the legislation was proposed and hastily prepared by lawmakers to avoid a conviction for the former deputy chief of the Customs Service, Raimbek Matraimov. He has been implicated in a high-profile case involving the illegal funnelling of hundreds of millions of dollars abroad. The idea for an economic amnesty was announced by Japarov, then acting Kyrgyz president, just a day after Matraimov was detained and placed under house arrest. The State Committee for National Security (UKMK) said at the time that Matraimov had agreed to pay about Kyrgyz som (KGS) 2bn ($24.7mn) in damages to the state, and that KGS80mn had already been transferred to its account.

In mid-November, Japarov suspended his role as acting president and prime minister to become eligible to seek the presidency, as Kyrgyz law does not allow anyone serving as president in an interim capacity to run in an election for the post. Seventeen candidates in all have been registered to run in the poll of the country of 6.7mn. January has seen Kyrgyz police reject allegations of voter intimidation prior to the election.

In late November, hundreds took to the streets in Bishkek to protest against a proposed altered constitution – referred to by opponents as a “Khanstitution” – that critics fear could empower the presidency to operate in an authoritarian manner and restrict freedom of speech. Following revolutions in 2005 and 2010, which toppled regimes headed by presidents seeking permanent autocratic rule, Kyrgyzstan changed its constitution to fit the model of a parliamentary democracy. The draft constitution will be subject to a referendum to be held in tandem with the presidential election.

Should Japarov win the election, he will need to take account of the fact that where the US is concerned, he will not be dealing with Donald Trump – a US president who has shown a clear toleration of strongmen. Instead, he will be dealing with the Joe Biden administration, backed by a Democrat-controlled Senate. In mid-December, the US Treasury announced that it had added ex-customs chief Matraimov to its Global Magnitsky Act list of sanctioned individuals. While Matraimov remains free, the sanctions may complicate penurious Bishkek’s calls for aid.

During the crisis that gripped Kyrgyzstan after the parliamentary poll, Chinese businesses were reportedly targeted for sometimes violent shakedowns nationwide. A group of 35 Chinese executives were said to have fled to a hotel in Bishkek, only to be surrounded by an armed mob seeking ransom. So far, China has kept Japarov at arm’s length. Russia is keeping a wary eye on unfolding events, as always most concerned that “stability” is preserved in its backyard.

MACRO

The Kyrgyz Republic likely saw an economic output contraction of 8% in 2020, following growth of 4.5% in 2019, and can anticipate a GDP expansion of 3.8% in 2021, according to the January edition of the World Bank’s Global Economic Prospects report. The World Bank cautioned that more political strife could blow its projection for the country – Central Asia’s poorest, with poverty levels just slightly better than those seen in Tajikistan – into negative territory. Last June, prior to the upheaval, the World Bank was estimating that Kyrgyzstan’s 2020 GDP contraction would only be 4%, while 2021 growth was anticipated at 5.6%.

The Asian Development Bank (ADB) estimated Kyrgyzstan’s 2020 GDP shrinkage will measure 10%, while it saw 4% of growth in 2021. The International Monetary Fund (IMF) calculated that the Kyrgyz economy contracted by 9.8% in 2020.

Kyrgyzstan’s annual inflation in 2020 grew to 7.0% from 3% in 2019 and looks set to fall to 5% in 2021, according to the ADB. The IMF gave figures of 8.0% and 5.5% respectively.

The ADB calculated Kyrgyzstan’s 2020 current account balance at minus 15%, also forecasting an improvement to minus 10% in 2021. The IMF saw figures of minus 13.4% and minus 12.8% respectively.

Government gross debt stood at 68.1% of GDP in 2020, according to the IMF.

Amid the economic impacts of the coronavirus (COVID-19) pandemic, including a drop in remittances from workers abroad that usually account for just under a third of Kyrgyzstan’s GDP, the Kyrgyz central bank in 2020 intervened in the foreign exchange markets to stabilise the Kyrgyzstani som (KGS) and mitigate volatility, the World Bank noted. The regulator at the end of November held its benchmark interest rate at 5%, where it had been since late February when it was hiked by 0.75pp.

Source: IMF DataMapper.

In foreign trade, Kyrgyzstan’s turnover shrank by 8.1% year on year to $4.676bn in the first 10 months of 2020, down from a 0.6% contraction registered in the same period last year. The contraction was mainly driven by a major plunge in imports driven by pandemic effects. Imports collapsed by 26.9% y/y to $3.012bn, while exports rose by 4.7% y/y to $1.664bn. There was a notable surge in exports of gold by 30.9% y/y. Trade with fellow Eurasian Economic Union (EEU) trade bloc countries contracted by 13.7% to $1.962bn.

STATE DEBT AND TRANSITION BANKING

China in early December offered to let Kyrgyzstan defer a scheduled debt repayment on $1.8bn it owes to the Export-Import Bank of China amid the ongoing coronavirus crisis. Loans were taken out for projects linked to China's Belt and Road Initiative (BRI), which, among a vast amount of projects in various continents, is seeking to construct transit hubs across Central Asian countries for Chinese goods heading to Europe and vice versa.

In all, Kyrgyzstan has state debts of $4.8bn owed to China. On November 16, Kyrgyz Foreign Minister Ruslan Kazakbayev held a phone conversation with his Chinese counterpart, Wang Yi, in which he “drew attention to the importance of providing assistance in alleviating the burden of external debt on the country's budget.” Kazakbayev also pledged that Kyrgyzstan would protect Chinese businesses in the wake of the threats they faced during the recent political unrest.

In June last year, Kyrgyzstan secured a Paris Club agreement to suspend servicing of $11mn worth of debt until the end of the year. The creditor countries involved in that agreement were Denmark, France, Germany, Japan and South Korea, to whom Bishkek collectively owes more than $300mn.

Eyeing a boost to international trade, the Kyrgyz government has reorganised the open joint-stock company RSK Bank into an export-import bank. “We have included in the plan the creation of an export-import bank based on a commercial bank with state shares to introduce mechanisms such as factoring, consulting support and so on,” the then PM Kubatbek Boronov said, unveiling the move in late August.

Data graphs from EBRD on investment projects in Kyrgyzstan.

Bishkek will also continue to look to development banks including the ADB, European Bank for Reconstruction and Development (EBRD) and Eurasian Development Bank (EDB) for support. The EBRD, among other objectives, seeks to back small and medium-sized enterprises (SMEs) in Kyrgyzstan. SMEs account for approximately 40% of its economy.

The EDB, majority-owned by Russia and Kazakhstan, said in early January that it plans to borrow the equivalent of up to $1bn in 2021 to finance its projects and is mulling green bonds as an option for diversifying its funding sources. The lender raised $537mn in dollars-equivalent in 2020.

OTHER MATTERS

Management of KAZ Minerals, which mines copper and gold in Kyrgyzstan, is facing substantial resistance from shareholders to its proposed GBP3bn ($4,07bn) all-cash buyout offer to take the company private. They see the offer for the Kazakh company as an under-valuation. The company is developing the Bozymchak copper-gold mine in Kyrgyzstan. During the overthrow of the government in the country last year, Kazakhstan evacuated at least 500 Kazakh citizens that work in mines in Kyrgyzstan, including employees of KAZ Minerals from Bozymchak.

In late November, Kyrgyzstan’s agriculture ministry introduced a temporary ban on livestock exports due to a surge in meat prices on the local market amid the contracting economy weakened by the pandemic crisis. Agriculture Minister Tilek Toktogaziyev said beef shortages were caused by high export levels, which led to a 25% increase in prices to $5.90 per kilogram on the domestic market.

Kyrgyzstan has sometimes difficult relations with giant neighbour China (Image source: CIA World Factbook).

Kyrgyz officials are trying to build economic relations with China against a backdrop that includes last year’s decision to scrap a Chinese logistics centre investment by the Kyrgyz-Chinese At-Bashi Free Economic Zone Joint Venture in eastern Kyrgyzstan after mass protests from locals distrustful over how China might roll out BRI projects and angered by treatment of ethnic-Kyrgyz minorities in China’s Xinjiang region.

Iran last year launched the first export of goods via roads to Central Asia through the Kyrgyzstan, Tajikistan, Afghanistan and Iran Corridor (KTAI). If Iran’s fortunes improve with the advent of the Joe Biden administration in the US, landlocked Kyrgyzstan, like other Central Asian nations, might up its interest in making use of sole Iranian oceanic port Chabahar on the Gulf of Oman in international trade.

Kyrgyzstan, Iran and Tajikistan were among 19 countries for which the inaugural edition of the Ecological Threat Register (ETR), released last September by the Institute for Economics & Peace (IEP), brought particularly ominous news. The trio were ranked in a group of countries, of 157 assessed, and deemed the most fragile with high exposure to ecological threats and the highest risk of future collapse from environmental disasters in the decades ahead.

Features

BEYOND THE BOSPORUS: Investigators feel collar of former Turkish central bank deputy governor

Regime gangs continue to hustle for gains. Some Erdoganist businessmen among the losers.

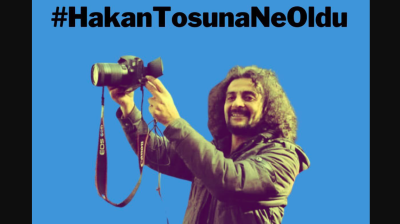

Journalist beaten to death in Istanbul as security conditions in Turkey rapidly deteriorate

Publisher, meanwhile, is shot in leg. Reporters regularly experience violence, judicial harassment and media lynching.

Agentic AI becomes South Korea’s next big tech battleground

As countries race to define their roles in the AI era, South Korea's tech giants are now embracing “agentic AI”, a next-generation form of AI that acts autonomously to complete goals, not just respond to commands.

Iran's capital Tehran showcases new "Virgin Mary" Metro station

Tehran's new Maryam metro station honours Virgin Mary with architecture blending Armenian and Iranian design elements in new push by Islamic Republic

_Cropped.jpg)